Food Outlook – Biannual report on global food markets – June 2025

12/06/2025

FAO’s latest assessments indicate a relatively optimistic outlook for food commodity markets, with production and trade of all commodities, except sugar, anticipated to increase. However, this growth will have different impacts on stock recovery, influenced by the delicate balance between supply and demand. Global food commodity production remains vulnerable to weather conditions.

Dairy Market Review. Overview of global market developments in 2024

22/05/2025

The April 2025 issue of the dairy market review provides an overview of key developments in global milk production, dairy trade and prices during 2024. It shows that global milk production expanded in 2024, although at a slower pace than the previous year, sustained by significant output growth in Asia, Oceania and parts of Europe.

Dairy Market Review. Overview of global market developments in 2024

02/12/2024

The review finds that international dairy prices continued to strengthen since the beginning of 2024, led by butter prices. Moreover, global milk production is expected to moderately expand in 2024.

Food Outlook – Biannual Report on Global Food Markets - November 2024

14/11/2024

FAO’s latest assessments indicate differing trajectories across different commodities, with wheat, maize, and sugar production set to decline, while outputs of dairy, fisheries, meats, oilseeds, and rice are expected to increase, with implications for utilization, trade, and stock levels. However, global food production remains susceptible to shocks arising from weather conditions, geopolitical tensions, and policies.

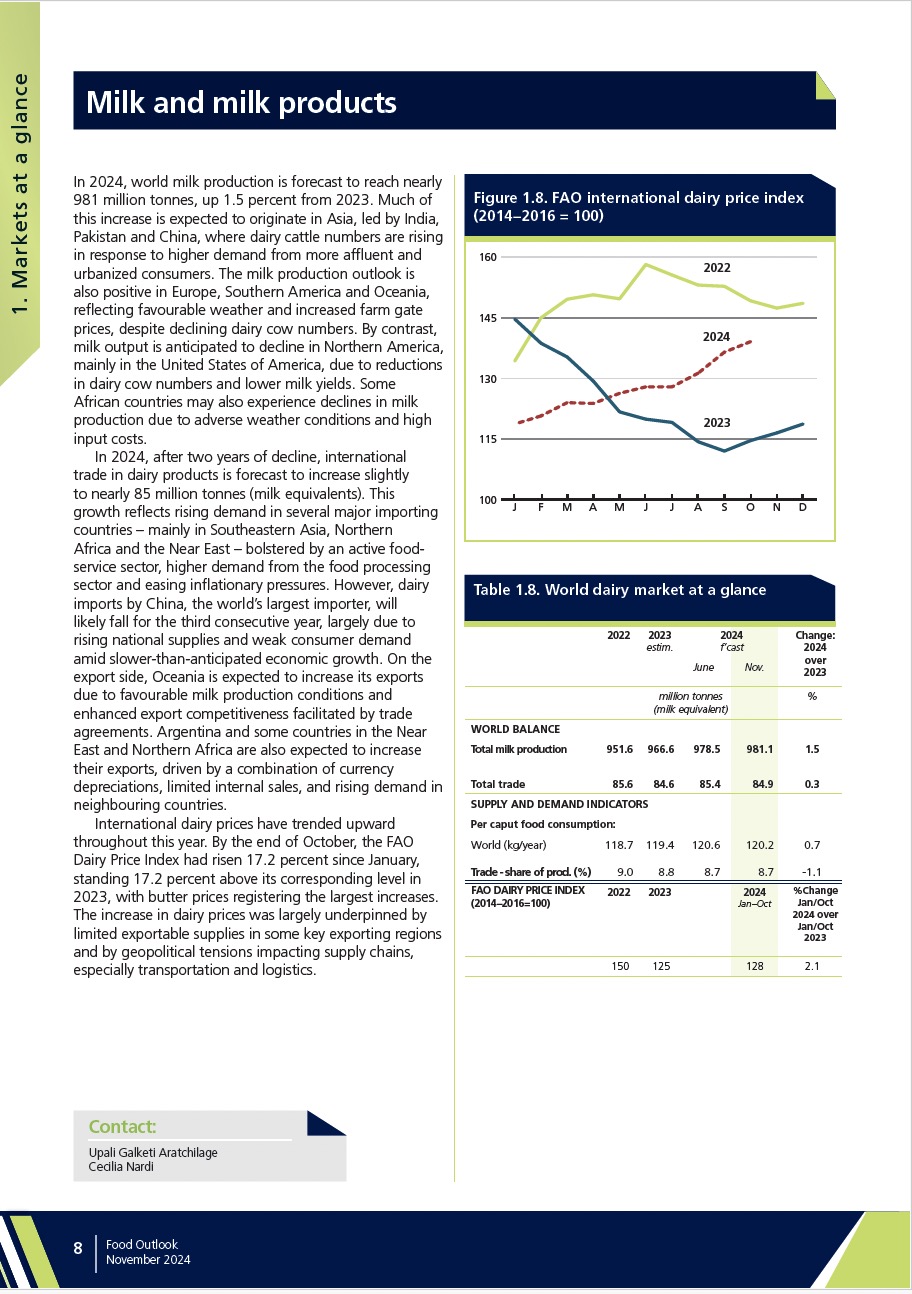

Milk and milk products (Market summary)

14/11/2024

This report provides an analysis of the most recent developments in the global milk market, including a short-term outlook

OECD-FAO Agricultural Outlook 2024-2033 - Chapter 7 (Dairy and dairy products)

06/07/2024

This chapter describes market developments and medium-term projections for world dairy markets for the period 2024-33. Projections cover consumption, production, trade and prices for milk, fresh dairy products, butter, cheese, skim milk powder and whole milk powder.

Food Outlook – Biannual Report on Global Food Markets - June 2024

13/06/2024

FAO’s latest forecasts point to increased production and higher stocks for several basic foodstuffs. However, global food production remains susceptible to shocks arising from weather conditions, geopolitical tensions, and policies. These factors could disrupt the delicate balance between supply and demand, impacting global food security.

Dairy Market Review. Overview of global market developments in 2023

23/04/2024

The April issue of the publication summarizes the salient trends and drivers of market developments in 2023. The review finds that international dairy prices weakened significantly in 2023. Additionally, global milk production expanded at a slightly faster pace in 2023 and international dairy trade contracted for the second consecutive year, albeit slower than the previous year.

Dairy Market Review - Emerging trends and outlook in 2023

15/12/2023

The review finds that high demand and tight supplies led prices of most dairy products to rebound since October. Furthermore, global milk production is forecast to expand at a faster pace in 2023 while world dairy trade may continue to contract in 2023, albeit less steeply than the previous year.

Food Outlook – Biannual Report on Global Food Markets - November 2023

09/11/2023

FAO's latest forecasts point to favourable production outlooks across most basic foodstuffs. However, global food production systems remain vulnerable to shocks, stemming from extreme weather events, and rising geopolitical tensions and policies, potentially tipping the delicate demand-supply balances, dampening prospects for international trade in food commodities and with implications for global food security.

Overview of market and policy developments in 2022

12/10/2023

The October issue of the publication summarizes the salient trends and drivers of market developments and significant public policy changes in 2022. The review finds that the international prices of most dairy products trended downward after reaching near-alltime highs in mid-2022. Additionally, world milk output expanded in 2022 at the slowest pace during the last two decades and international trade in dairy products contracted following nearly two decades of annual growth.

Food Outlook – Biannual Report on Global Food Markets - June 2023

15/06/2023

FAO’s latest forecasts point to increases in production and higher stocks across several basic foodstuffs. However, global food production systems remain vulnerable to shocks, stemming from weather conditions, geopolitical tensions and policies, potentially tipping the delicate demand-supply balances, with implications for global food security.

Food Outlook - June 2022

12/06/2023

In view of the soaring input prices,concerns about the weather, and increased market uncertainties stemming from the war in Ukraine, FAO’s latest forecasts point to a likely tightening of food markets in 2022.

Dairy Market Review – Emerging trends and outlook - December 2022

08/12/2022

The December issue of the publication summarizes the salient trends and market outlook in 2022. International dairy prices eased in recent months due to subdued import demand. Moreover, global milk production is forecast to expand slightly, sustained by growth in Asia. Meanwhile, world dairy trade may contract for the first time in two decades.

Food Outlook - November 2022

11/11/2022

FAO’s latest forecasts point to somewhat easing of market conditions for basic foodstuffs. However, increased climate variability, conflicts and geopolitical tensions, bleak economic prospects, soaring agricultural input costs and export restrictions continue to pose challenges to global food commodity market stability.

Dairy Market Review - Overview of market and policy developments - July 2021

29/07/2022

The July issue of the publication summarizes the salient trends and drivers of market developments and significant public policy changes in 2021. The review finds that the international dairy prices rose steeply in 2021, driven by tight global supplies and sustained demand. Additionally, world milk output expanded in 2021, albeit growing at the slowest rate seen since 2013 and global export trade expanded moderately, caused by tight supplies and high prices.

Dairy Market Review - Emerging trends and outlook - December 2021

29/12/2021

The December issue of the Dairy Market Review presents emerging trends and outlook of international meat prices, global meat production and trade in meat products. Tight global supplies and sustained import demand underpin rising global dairy prices. Global milk production is rising, with significant expansions expected in Asia and North America. World dairy trade in 2021 is likely to reach a new high amid a sharp increase in imports by China.

Dairy market review - Price and policy update - July 2021

16/07/2021

International dairy prices, measured by the FAO Dairy Price Index, fell slightly in June, ending 12-month of uninterrupted increases. At 119.9 points in June, the global dairy price index stood at 22 percent above its level one year ago. International quotations for all dairy products represented in the index fell in June, with butter registering the highest decline, underpinned by a faster decline in global import demand and a slight increase in inventories, especially in Europe.

Dairy Market Review - Overview of global dairy market developments in 2020 - April 2021

01/04/2021

Dairy Market Review: Overview of global dairy market developments in 2020, April 2021 The Dairy Market Review, April 2021 issue presents an overview of global dairy market developments in 2020, including trends in international milk product prices, world milk production and international trade in milk products. International dairy prices declined in 2020, mainly reflecting reduced import demand due to widespread economic downturns in importing countries. High export availabilities in exporting countries, caused by reduced internal sales and increased processing of less labour-intensive milk products, especially milk powders, also weighed on global milk prices. Despite many challenges to production due to the COVID-19 health crisis, world milk output rose in 2020, driven by increases in nearly all major regions. International trade in milk products also increased, driven by increased imports by a few countries in Asia and the Middle East.

Dairy Market Review - Emerging trends and outlook - December 2020

11/12/2020

The December issue of the FAO Dairy Market Review highlights the emerging trends and outlook. It indicates that international dairy prices are rebounding slowly, but remain below their pre-pandemic levels. Considering the overall dairy product price movements from January to November, only cheese quotations registered an increase, reflecting persistent and robust import demand from Asia and internal demand in Europe. Despite COVID-19-related market disruptions, world milk production is rising, mostly in Asia, but also in Europe and North America. In the meantime, international trade in butter, cheese and whole milk powder could expand, but skim milk powder trade (SMP) may contract.