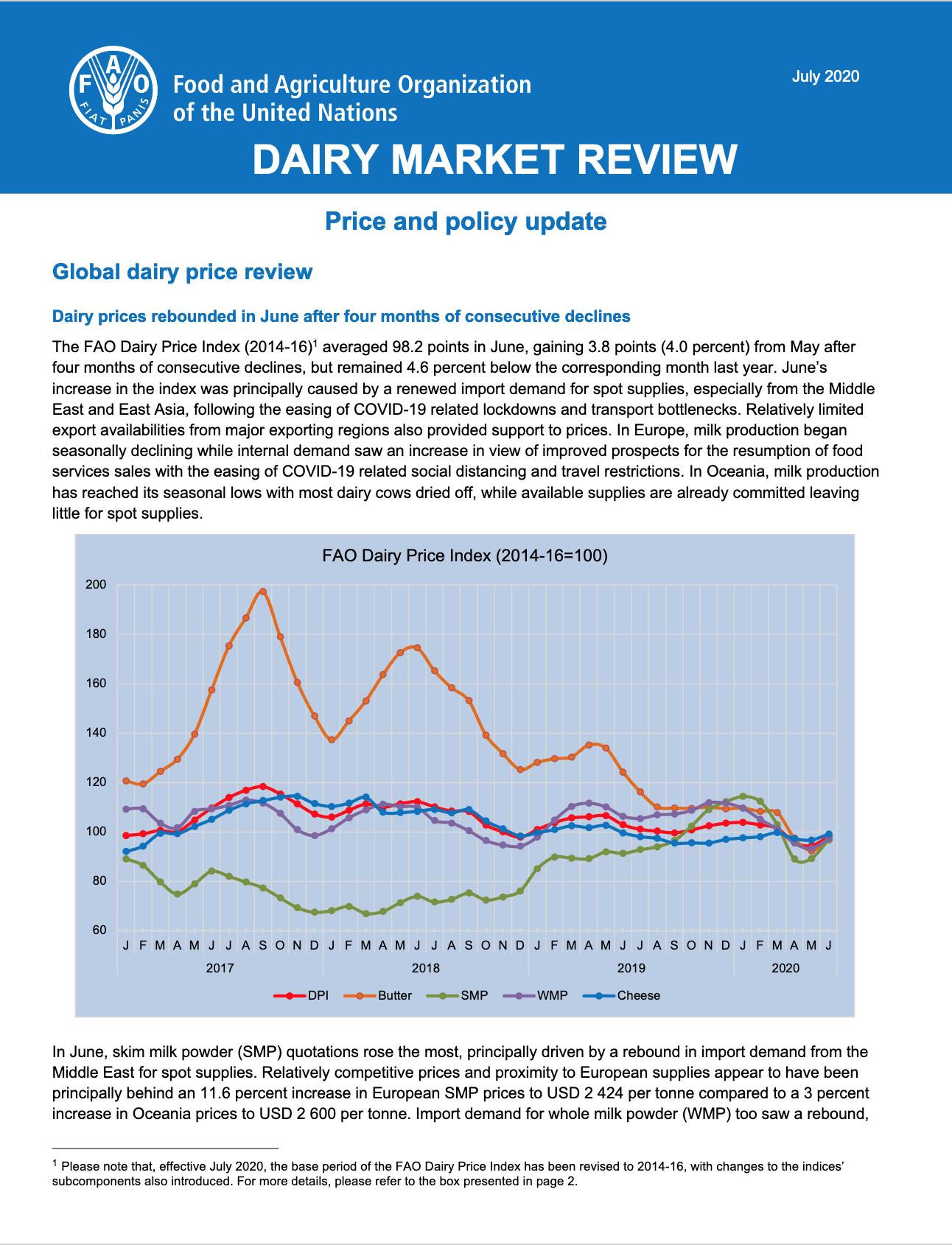

Dairy market review: Price and policy update - July 2020

03/02/2020

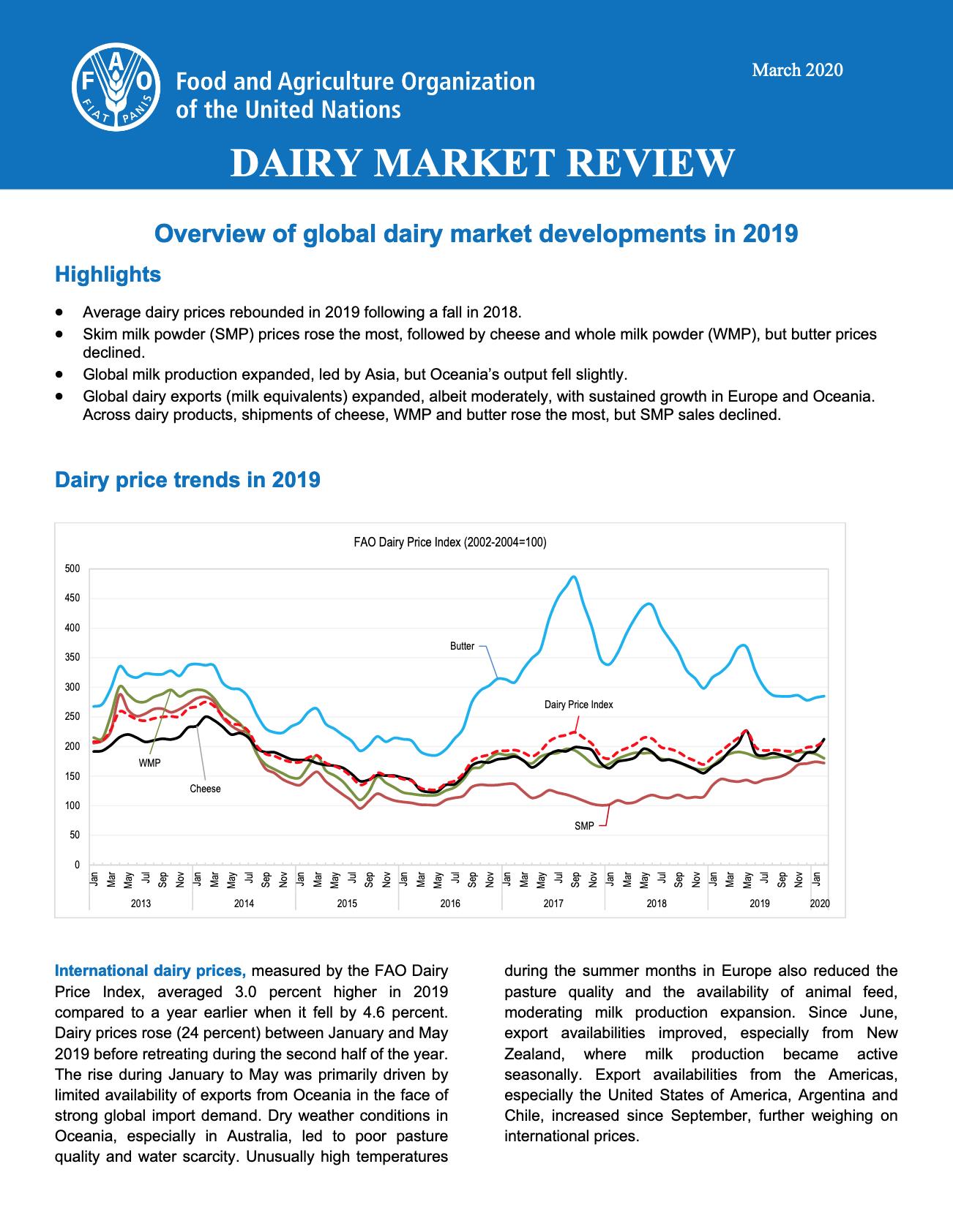

International dairy prices in June, measured by the FAO Dairy Price Index, were down by 5.7 points (5.4 percent) from January 2020, with skim milk powder (SMP) registering the sharpest fall (-15.3 percent), followed by butter (11.8 percent), whole milk powder (WMP) (-11.2 percent), while cheese prices rose (+1.6 percent).

Dairy Market Review - Overview of global dairy market developments - March 2018

29/03/2019

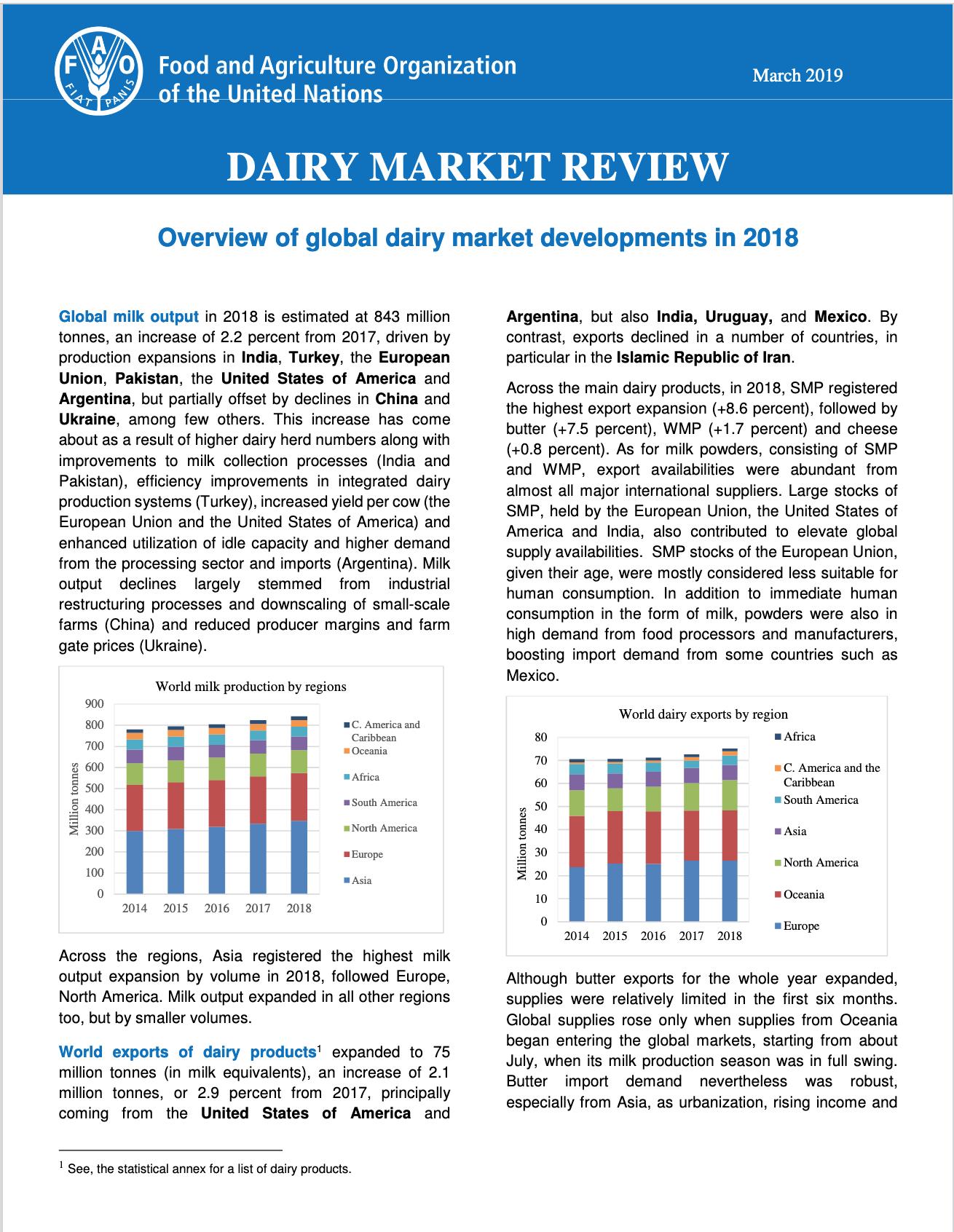

Global milk output in 2018 is estimated at 842 million tonnes, an increase of 2.2 percent from 2017, driven by production expansions in India, Turkey, the EU, Pakistan, the United States and Argentina, but partially offset by declines in China and Ukraine, among few others.

Dairy Market Review - Overview of global dairy market developments in 2019

03/02/2019

This publication provides an update on production, trade and price movements of milk, and milk products (butter, cheese, skim milk powder and whole milk powder). It aims to provide a clear snapshot view of key changes and underlying determinants of world dairy markets. It is the only publication that covers dairy market developments in the entire world that is also updated regularly; it supports the division’s objective in providing market information relevant for policy makers, helping them in the process to take data-based policy decisions. • Average dairy prices rebounded in 2019 following a fall in 2018. • Skim milk powder (SMP) prices rose the most, followed by cheese and whole milk powder (WMP), but butter prices declined. • Global milk production expanded, led by Asia, but Oceania’s output fell slightly. • Global dairy exports (milk equivalents) expanded, albeit moderately, with sustained growth in Europe and Oceania. Across dairy products, shipments of cheese, WMP and butter rose the most, but SMP sales declined.

Dairy Market Review - December 2018

12/07/2018

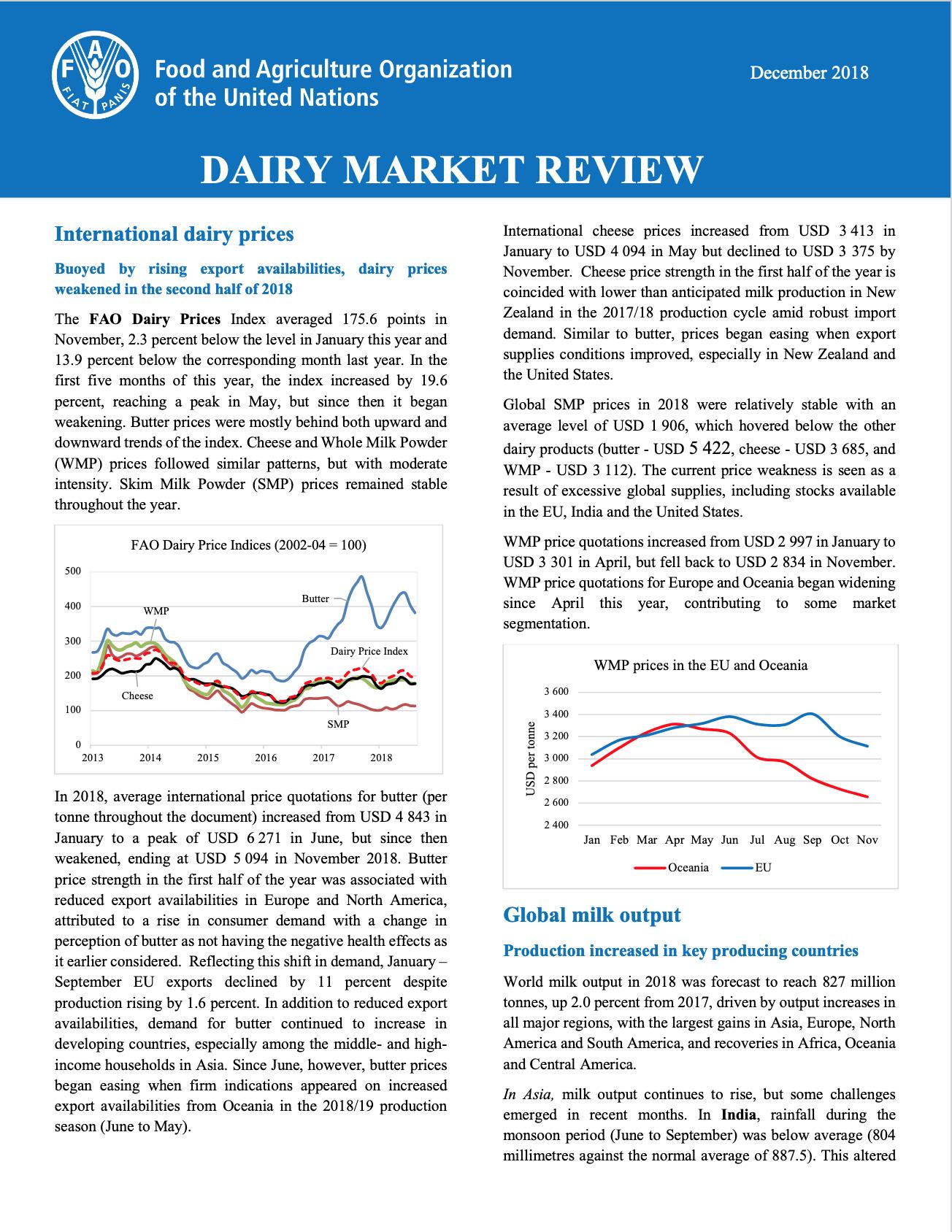

Buoyed by rising export availabilities, dairy prices weakened in the second half of 2018. Milk production increased in key producing countries, including New Zealand in the 2018/19 production cycle. Aided by high production in some regions, global butter supplies improved in recent months, while cheese trade expanded in 2018 at a slow pace than in 2017. Trade in Skim Milk Powder (SMP) and Whole Milk Powder (WMP) expanded on ample supplies and competitive prices.

Dairy Market Review - October 2018

11/06/2018

World milk output is forecast to reach nearly 828 million tonnes in 2018, up 2.1 percent from 2017. This year, milk outputs are anticipated to increase in all major regions, with the largest increase is anticipated in Asia, followed by Europe, North America, and South America. Africa, Oceania and Central America are anticipated to recover from downturns experienced in 2017. In 2018, World dairy exports are forecast to reach 75 million tonnes, up 2.7 percent from the revised export figures for 2017. In 2018, much of the expanded global exports is expected to originate in the Americas and Oceania; stable in Europe and Africa; but to decline in Asia. The FAO Dairy Prices Index averaged 191.5 in September 2018, 6.4 percent higher than the level in January this year. At this level, the index is 14.6 percent below the corresponding month last year, and 30.5 percent below that of the peak it reached in February 2014.

No. 11 Dairy: Measuring the impact of reform

06/12/2005

Determining the impact of reforms to dairy sector policies is problematic and controversial. The extent and pervasiveness of intervention in the sector, and the resulting distortions to the international market, would suggest that liberalization could potentially lead to large gains, and indeed these are consistently reflected in most model-based analyses. The size of impacts has long been thought of as the key reason why dairy reforms and trade discussions have been so difficult. However, there are reasons for questioning estimates of the likely magnitudes of such impacts across different importing and exporting countries.

Food Outlook - October 2002

02/10/2002

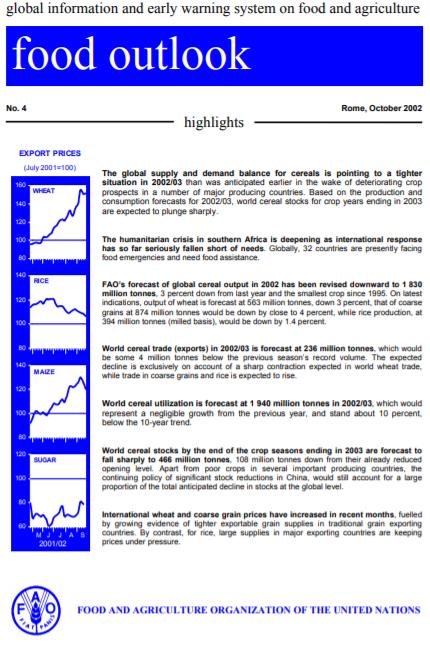

The global supply and demand balance for cereals is pointing to a tighter situation in 2002/03 than was anticipated earlier in the wake of deteriorating crop prospects in a number of major producing countries. Based on the production and consumption forecasts for 2002/03, world cereal stocks for crop years ending in 2003 are expected to plunge sharply. The humanitarian crisis in southern Africa is deepening as international response has so far seriously fallen short of needs. Globally, 32 countries are presently facing food emergencies and need food assistance. FAO’s forecast of global cereal output in 2002 has been revised downward to 1 830 million tonnes, 3 percent down from last year and the smallest crop since 1995. On latest indications, output of wheat is forecast at 563 million tonnes, down 3 percent, that of coarse grains at 874 million tonnes would be down by close to 4 percent, while rice production, at 394 million tonnes (milled basis), would be down by 1.4 percent. World cereal trade (exports) in 2002/03 is forecast at 236 million tonnes, which would be some 4 million tonnes below the previous season’s record volume. The expected decline is exclusively on account of a sharp contraction expected in world wheat trade, while trade in coarse grains and rice is expected to rise. World cereal utilization is forecast at 1 940 million tonnes in 2002/03, which would represent a negligible growth from the previous year, and stand about 10 percent, below the 10-year trend. World cereal stocks by the end of the crop seasons ending in 2003 are forecast to fall sharply to 466 million tonnes, 108 million tonnes down from their already reduced opening level. Apart from poor crops in several important producing countries, the continuing policy of significant stock reductions in China, would still account for a large proportion of the total anticipated decline in stocks at the global level. International wheat and coarse grain prices have increased in recent months, fuelled by growing evidence of tighter exportable grain supplies in traditional grain exporting countries. By contrast, for rice, large supplies in major exporting countries are keeping prices under pressure. FOOD AND AGRICULTUR

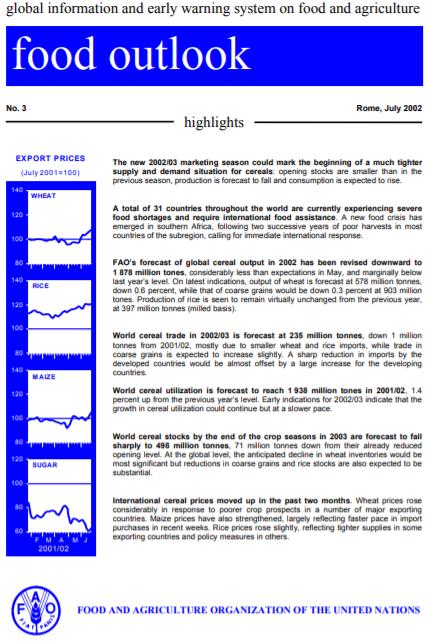

Food Outlook - July 2002

02/07/2002

The new 2002/03 marketing season could mark the beginning of a much tighter supply and demand situation for cereals: opening stocks are smaller than in the previous season, production is forecast to fall and consumption is expected to rise. A total of 31 countries throughout the world are currently experiencing severe food shortages and require international food assistance. A new food crisis has emerged in southern Africa, following two successive years of poor harvests in most countries of the subregion, calling for immediate international response. FAO’s forecast of global cereal output in 2002 has been revised downward to 1 878 million tones, considerably less than expectations in May, and marginally below last year’s level. On latest indications, output of wheat is forecast at 578 million tonnes, down 0.6 percent, while that of coarse grains would be down 0.3 percent at 903 million tones. Production of rice is seen to remain virtually unchanged from the previous year, at 397 million tonnes (milled basis). World cereal trade in 2002/03 is forecast at 235 million tonnes, down 1 million tonnes from 2001/02, mostly due to smaller wheat and rice imports, while trade in coarse grains is expected to increase slightly. A sharp reduction in imports by the developed countries would be almost offset by a large increase for the developing countries. World cereal utilization is forecast to reach 1 938 million tones in 2001/02, 1.4 percent up from the previous year’s level. Early indications for 2002/03 indicate that the growth in cereal utilization could continue but at a slower pace. World cereal stocks by the end of the crop seasons in 2003 are forecast to fall sharply to 498 million tonnes, 71 million tonnes down from their already reduced opening level. At the global level, the anticipated decline in wheat inventories would be most significant but reductions in coarse grains and rice stocks are also expected to be substantial. International cereal prices moved up in the past two months. Wheat prices rose considerably in response to poorer crop prospects in a number of major exporting countries. Maize prices have also strengthened, largely reflecting faster pace in import purchases in recent weeks. Rice prices rose slightly, reflecting tighter supplies in some exporting countries and policy measures in others.

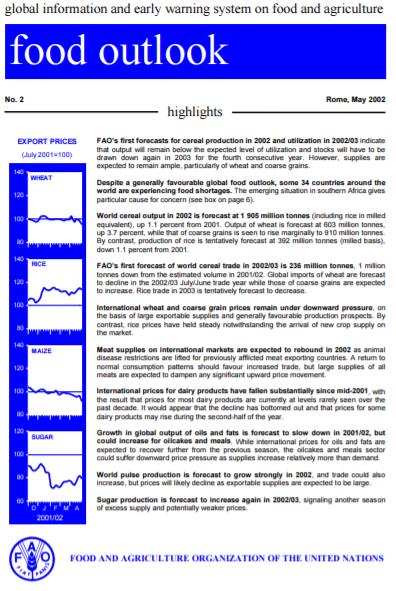

Food Outlook - May 2002

03/05/2002

FAO’s first forecasts for cereal production in 2002 and utilization in 2002/03 indicate that output will remain below the expected level of utilization and stocks will have to be drawn down again in 2003 for the fourth consecutive year. However, supplies are expected to remain ample, particularly of wheat and coarse grains. Despite a generally favourable global food outlook, some 34 countries around the world are experiencing food shortages. The emerging situation in southern Africa gives particular cause for concern. World cereal output in 2002 is forecast at 1 905 million tonnes (including rice in milled equivalent), up 1.1 percent from 2001. Output of wheat is forecast at 603 million tonnes, up 3.7 percent, while that of coarse grains is seen to rise marginally to 910 million tonnes. By contrast, production of rice is tentatively forecast at 392 million tonnes (milled basis), down 1.1 percent from 2001. FAO’s first forecast of world cereal trade in 2002/03 is 236 million tonnes, 1 million tonnes down from the estimated volume in 2001/02. Global imports of wheat are forecast to decline in the 2002/03 July/June trade year while those of coarse grains are expected to increase. Rice trade in 2003 is tentatively forecast to decrease. International wheat and coarse grain prices remain under downward pressure, on the basis of large exportable supplies and generally favourable production prospects. By contrast, rice prices have held steady notwithstanding the arrival of new crop supply on the market. Meat supplies on international markets are expected to rebound in 2002 as animal disease restrictions are lifted for previously afflicted meat exporting countries. A return to normal consumption patterns should favour increased trade, but large supplies of all meats are expected to dampen any significant upward price movement. International prices for dairy products have fallen substantially since mid-2001, with the result that prices for most dairy products are currently at levels rarely seen over the past decade. It would appear that the decline has bottomed out and that prices for some dairy products may rise during the second-half of the year. Growth in global output of oils and fats is forecast to slow down in 2001/02, but could increase for oilcakes and meals. While international prices for oils and fats are expected to recover further from the previous season, the oilcakes and meals sector could suffer downward price pressure as supplies increase relatively more than demand. World pulse production is forecast to grow strongly in 2002, and trade could also increase, but prices will likely decline as exportable supplies are expected to be large. Sugar production is forecast to increase again in 2002/03, signaling another season of excess supply and potentially weaker prices.

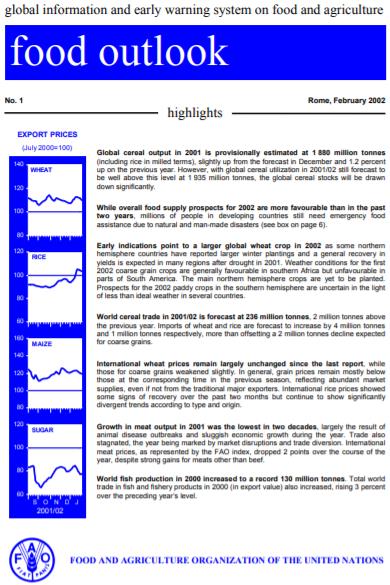

Food Outlook - February 2002

04/02/2002

Global cereal output in 2001 is provisionally estimated at 1 880 million tonnes (including rice in milled terms), slightly up from the forecast in December and 1.2 percent up on the previous year. However, with global cereal utilization in 2001/02 still forecast to be well above this level at 1 935 million tonnes, the global cereal stocks will be drawn down significantly.

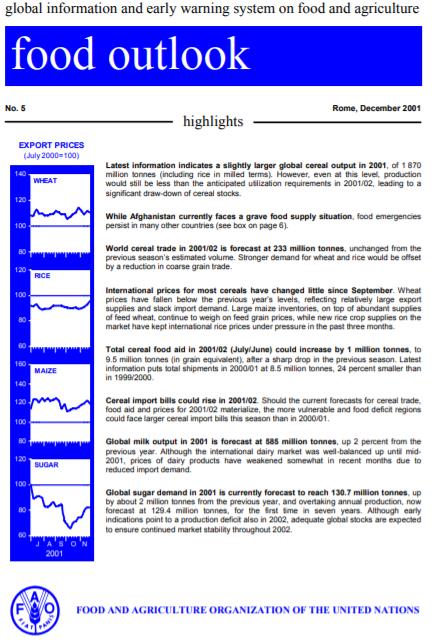

Food Outlook - December 2001

03/12/2001

Latest information indicates a slightly larger global cereal output in 2001, of 1 870 million tonnes (including rice in milled terms). However, even at this level, production would still be less than the anticipated utilization requirements in 2001/02, leading to a significant draw-down of cereal stocks. While Afghanistan currently faces a grave food supply situation, food emergencies persist in many other countries. World cereal trade in 2001/02 is forecast at 233 million tonnes, unchanged from the previous season’s estimated volume. Stronger demand for wheat and rice would be offset by a reduction in coarse grain trade. International prices for most cereals have changed little since September. Wheat prices have fallen below the previous year’s levels, reflecting relatively large export supplies and slack import demand. Large maize inventories, on top of abundant supplies of feed wheat, continue to weigh on feed grain prices, while new rice crop supplies on the market have kept international rice prices under pressure in the past three months. Total cereal food aid in 2001/02 (July/June) could increase by 1 million tonnes, to 9.5 million tonnes (in grain equivalent), after a sharp drop in the previous season. Latest information puts total shipments in 2000/01 at 8.5 million tonnes, 24 percent smaller than in 1999/2000. Cereal import bills could rise in 2001/02. Should the current forecasts for cereal trade, food aid and prices for 2001/02 materialize, the more vulnerable and food deficit regions could face larger cereal import bills this season than in 2000/01. Global milk output in 2001 is forecast at 585 million tonnes, up 2 percent from the previous year. Although the international dairy market was well-balanced up until mid2001, prices of dairy products have weakened somewhat in recent months due to reduced import demand. Global sugar demand in 2001 is currently forecast to reach 130.7 million tonnes, up by about 2 million tonnes from the previous year, and overtaking annual production, now forecast at 129.4 million tonnes, for the first time in seven years. Although early indications point to a production deficit also in 2002, adequate global stocks are expected to ensure continued market stability throughout 2002.