Featured publications

Journal; magazine; bulletin

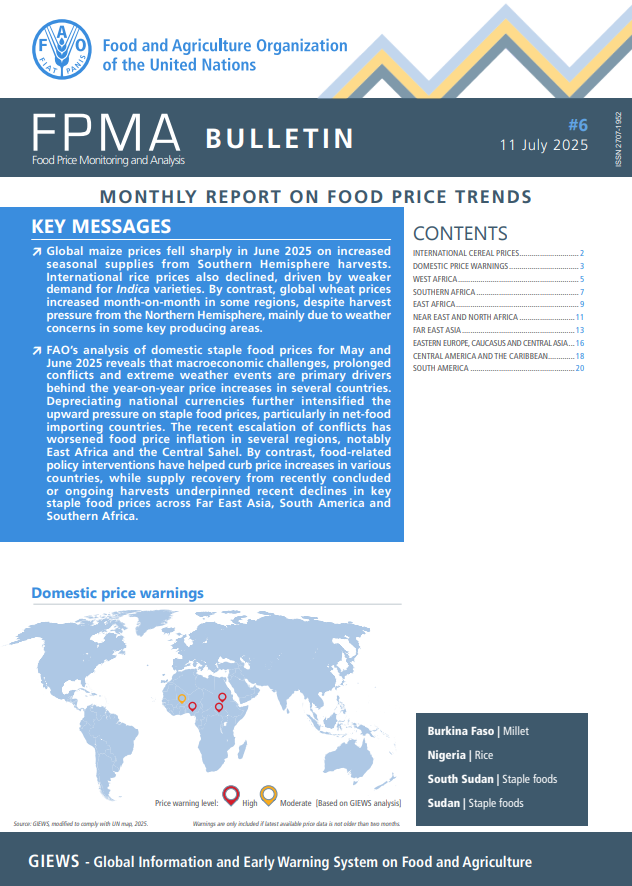

Food Price Monitoring and Analysis (FPMA) Bulletin #6, 11 July 2025 - Monthly report on food price trends

11/07/2025

Global maize prices fell sharply in June 2025 on increased seasonal supplies from Southern Hemisphere harvests. International rice prices also declined,...

Journal; magazine; bulletin

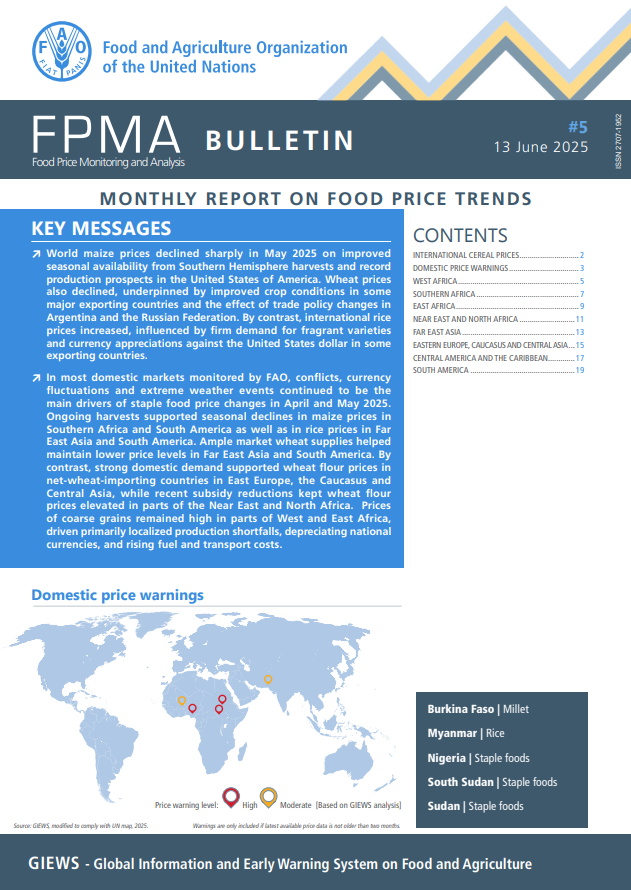

Food Price Monitoring and Analysis (FPMA) Bulletin #5, 13 June 2025 - Monthly report on food price trends

13/06/2025

World maize prices declined sharply in May 2025 on improved seasonal availability from Southern Hemisphere harvests and record production prospects...

Journal; magazine; bulletin

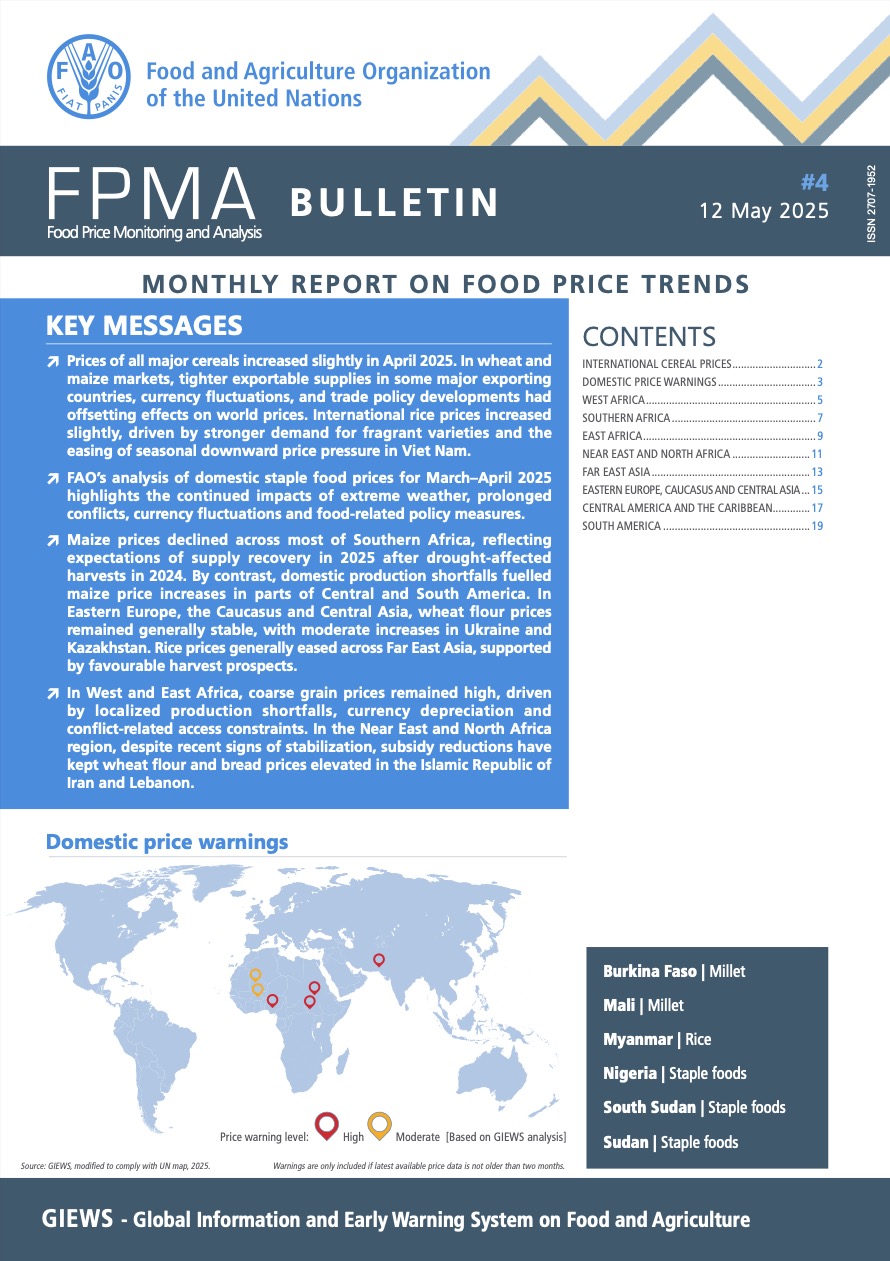

Food Price Monitoring and Analysis (FPMA) Bulletin #4, 12 May 2025 - Monthly report on food price trends

12/05/2025

Prices of all major cereals increased slightly in April 2025. Tighter exportable surpluses in some major exporters, currency movements and trade policy...

Journal; magazine; bulletin

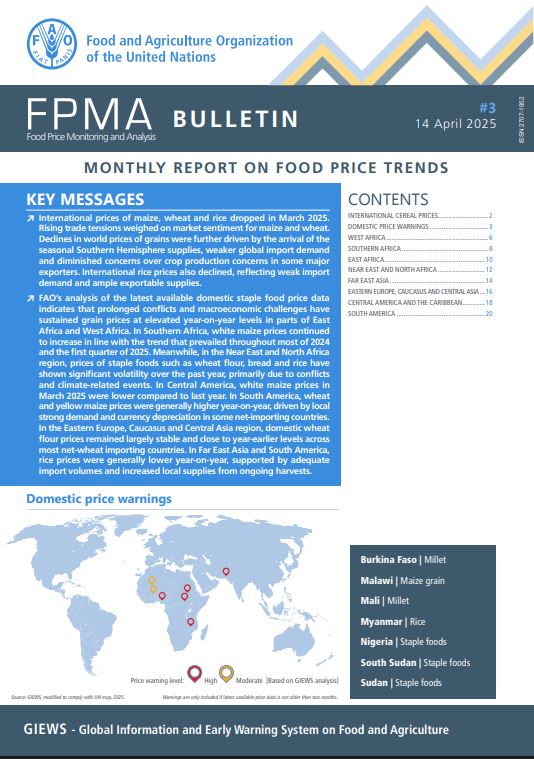

Food Price Monitoring and Analysis (FPMA) Bulletin #3, 14 April 2025 - Monthly report on food price trends

14/04/2025

International prices of maize, wheat and rice dropped in March 2025. Rising trade tensions weighed on market sentiment for maize and wheat. Declines...

Publications

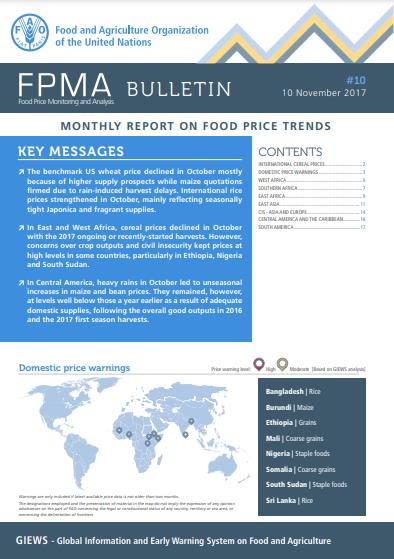

Food Price Monitoring and Analysis (FPMA) Bulletin #10, 10 November 2017

10/11/2017

The benchmark US wheat price declined in October mostly because of higher supply prospects while maize quotations firmed due to rain-induced harvest delays. International rice prices strengthened in October, mainly reflecting seasonally tight Japonica and fragrant supplies. In East and West Africa, cereal prices declined in October with the 2017 ongoing or recently-started harvests. However, concerns over crop outputs and civil insecurity kept prices at high levels in some countries, particularly in Ethiopia, Nigeria and South Sudan. In Central America, heavy rains in October led to unseasonal increases in maize and bean prices. They remained, however, at levels well below those a year earlier as a result of adequate domestic supplies, following the overall good outputs in 2016 and the 2017 first season harvests.

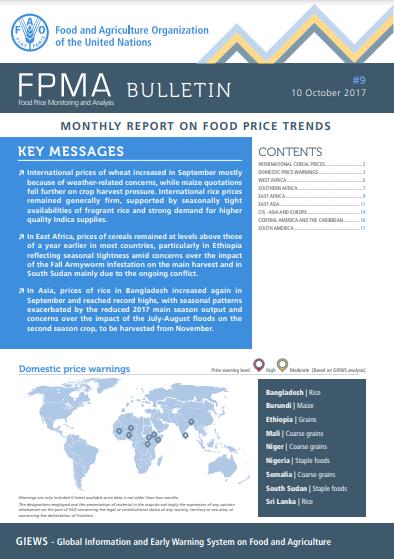

Food Price Monitoring and Analysis (FPMA) Bulletin #9, 10 October 2017

10/10/2017

International prices of wheat increased in September mostly because of weather-related concerns, while maize quotations fell further on crop harvest pressure. International rice prices remained generally firm, supported by seasonally tight availabilities of fragrant rice and strong demand for higher quality Indica supplies. In East Africa, prices of cereals remained at levels above those of a year earlier in most countries, particularly in Ethiopia reflecting seasonal tightness amid concerns over the impact of the Fall Armyworm infestation on the main harvest and in South Sudan mainly due to the ongoing conflict. In Asia, prices of rice in Bangladesh increased again in September and reached record highs, with seasonal patterns exacerbated by the reduced 2017 main season output and concerns over the impact of the July-August floods on the second season crop, to be harvested from November.

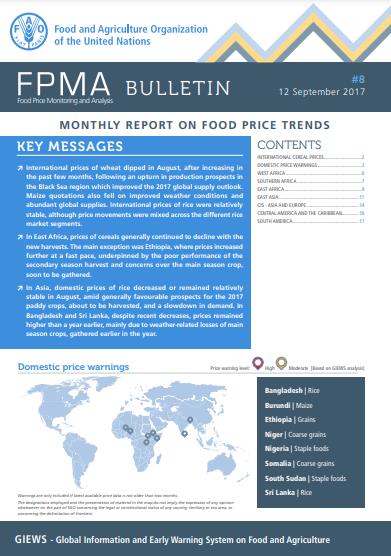

Food Price Monitoring and Analysis (FPMA) Bulletin #8, 12 September 2017

12/09/2017

International prices of wheat dipped in August, after increasing in the past few months, following an upturn in production prospects in the Black Sea region which improved the 2017 global supply outlook. Maize quotations also fell on improved weather conditions and abundant global supplies. International prices of rice were relatively stable, although price movements were mixed across the different rice market segments. In East Africa, prices of cereals generally continued to decline with the new harvests. The main exception was Ethiopia, where prices increased further at a fast pace, underpinned by the poor performance of the secondary season harvest and concerns over the main season crop, soon to be gathered. In Asia, domestic prices of rice decreased or remained relatively stable in August, amid generally favourable prospects for the 2017 paddy crops, about to be harvested, and a slowdown in demand. In Bangladesh and Sri Lanka, despite recent decreases, prices remained higher than a year earlier, mainly due to weather-related losses of main season crops, gathered earlier in the year.

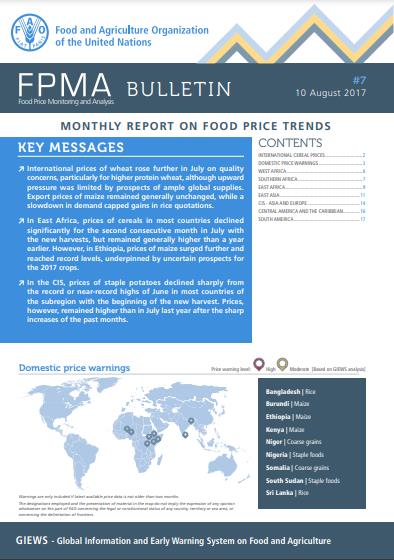

Food Price Monitoring and Analysis (FPMA) Bulletin #7, 10 August 2017

10/08/2017

International prices of wheat rose further in July on quality concerns, particularly for higher protein wheat, although upward pressure was limited by prospects of ample global supplies. Export prices of maize remained generally unchanged, while a slowdown in demand capped gains in rice quotations. In East Africa, prices of cereals in most countries declined significantly for the second consecutive month in July with the new harvests, but remained generally higher than a year earlier. However, in Ethiopia, prices of maize surged further and reached record levels, underpinned by uncertain prospects for the 2017 crops. In the CIS, prices of staple potatoes declined sharply from the record or near-record highs of June in most countries of the subregion with the beginning of the new harvest. Prices, however, remained higher than in July last year after the sharp increases of the past months.

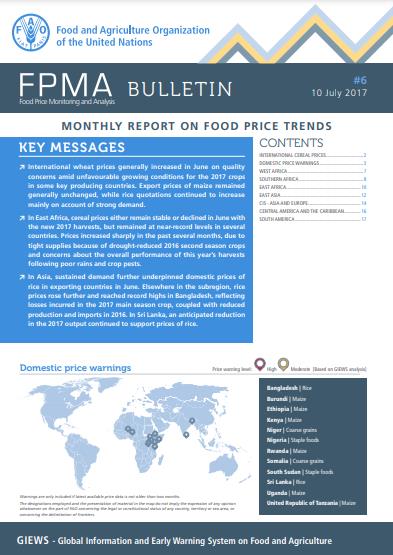

Food Price Monitoring and Analysis (FPMA) Bulletin #6, 10 July 2017

10/07/2017

International wheat prices generally increased in June on quality concerns amid unfavourable growing conditions for the 2017 crops in some key producing countries. Export prices of maize remained generally unchanged, while rice quotations continued to increase mainly on account of strong demand. In East Africa, cereal prices either remain stable or declined in June with the new 2017 harvests, but remained at near-record levels in several countries. Prices increased sharply in the past several months, due to tight supplies because of drought-reduced 2016 second season crops and concerns about the overall performance of this year’s harvests following poor rains and crop pests. In Asia, sustained demand further underpinned domestic prices of rice in exporting countries in June. Elsewhere in the subregion, rice prices rose further and reached record highs in Bangladesh, reflecting losses incurred in the 2017 main season crop, coupled with reduced production and imports in 2016. In Sri Lanka, an anticipated reduction in the 2017 output continued to support prices of rice.

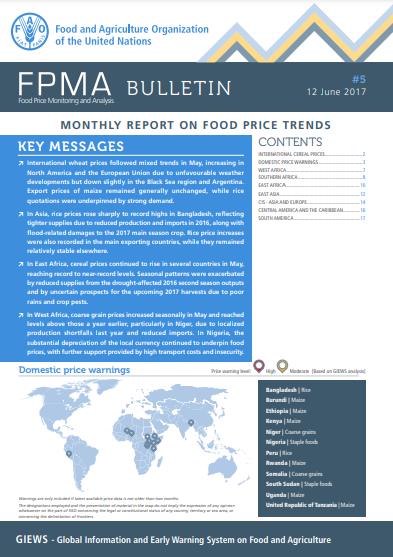

Food Price Monitoring and Analysis (FPMA) Bulletin #5, 12 June 2017

12/06/2017

International wheat prices followed mixed trends in May, increasing in North America and the European Union due to unfavourable weather developments but down slightly in the Black Sea region and Argentina. Export prices of maize remained generally unchanged, while rice quotations were underpinned by strong demand. In Asia, rice prices rose sharply to record highs in Bangladesh, reflecting tighter supplies due to reduced production and imports in 2016, along with flood‑related damages to the 2017 main season crop. Rice price increases were also recorded in the main exporting countries, while they remained relatively stable elsewhere. In East Africa, cereal prices continued to rise in several countries in May, reaching record to near-record levels. Seasonal patterns were exacerbated by reduced supplies from the drought-affected 2016 second season outputs and by uncertain prospects for the upcoming 2017 harvests due to poor rains and crop pests. In West Africa, coarse grain prices increased seasonally in May and reached levels above those a year earlier, particularly in Niger, due to localized production shortfalls last year and reduced imports. In Nigeria, the substantial depreciation of the local currency continued to underpin food prices, with further support provided by high transport costs and insecurity.

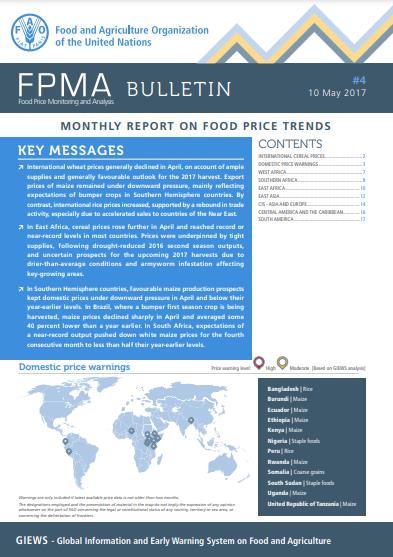

Food Price Monitoring and Analysis (FPMA) Bulletin #4, 10 May 2017

10/05/2017

International wheat prices generally declined in April, on account of ample supplies and generally favourable outlook for the 2017 harvest. Export prices of maize remained under downward pressure, mainly reflecting expectations of bumper crops in Southern Hemisphere countries. By contrast, international rice prices increased, supported by a rebound in trade activity, especially due to accelerated sales to countries of the Near East. In East Africa, cereal prices rose further in April and reached record or near‑record levels in most countries. Prices were underpinned by tight supplies, following drought-reduced 2016 second season outputs, and uncertain prospects for the upcoming 2017 harvests due to drier‑than‑average conditions and armyworm infestation affecting key‑growing areas. In Southern Hemisphere countries, favourable maize production prospects kept domestic prices under downward pressure in April and below their year-earlier levels. In Brazil, where a bumper first season crop is being harvested, maize prices declined sharply in April and averaged some 40 percent lower than a year earlier. In South Africa, expectations of a near‑record output pushed down white maize prices for the fourth consecutive month to less than half their year-earlier levels.

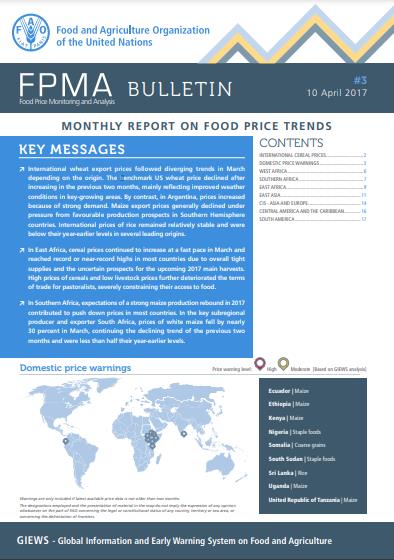

Food Price Monitoring and Analysis (FPMA) Bulletin #3, 10 April 2017

10/04/2017

International wheat export prices followed diverging trends in March depending on the origin. The benchmark US wheat price declined after increasing in the previous two months, mainly reflecting improved weather conditions in key-growing areas. By contrast, in Argentina, prices increased because of strong demand. Maize export prices generally declined under pressure from favourable production prospects in Southern Hemisphere countries. International prices of rice remained relatively stable and were below their year-earlier levels in several leading origins. In East Africa, cereal prices continued to increase at a fast pace in March and reached record or near-record highs in most countries due to overall tight supplies and the uncertain prospects for the upcoming 2017 main harvests. High prices of cereals and low livestock prices further deteriorated the terms of trade for pastoralists, severely constraining their access to food. In Southern Africa, expectations of a strong maize production rebound in 2017 contributed to push down prices in most countries. In the key subregional producer and exporter South Africa, prices of white maize fell by nearly 30 percent in March, continuing the declining trend of the previous two months and were less than half their year-earlier levels.

Food Price Monitoring and Analysis (FPMA) Bulletin #2, 10 March 2017

10/03/2017

International cereal export prices increased further in February. Wheat and maize quotations were mainly underpinned by strong demand but ample global supplies and generally favourable early prospects for 2017 crops limited the increase. International prices of rice also increased, mostly reflecting currency movements and expectations of stronger Basmati sales. In East Africa, cereal prices remained at record or near-record highs in February, underpinned by the sharply-reduced 2016/17 harvests following severe dry weather. Low water and pasture availability leading to the deterioration of livestock body conditions and destocking by farmers resulted in a sharp decline in livestock prices. In Nigeria, prices of staple foods, including cereals and tubers, rose sharply in January and reached record to near-record levels. The persistent depreciation of the local currency, soaring transport costs and civil insecurity more than offset the price downward effect from the 2016 above-average harvest.

Food Price Monitoring and Analysis (FPMA) Bulletin #1, 14 February 2017

14/02/2017

Cereal export prices firmed in January. A drop in plantings and concerns over the impact of unfavourable weather on the 2017 winter crops in the United States of America supported wheat values, while maize prices were mostly underpinned by strong demand. International prices of rice increased, primarily reflecting stronger demand and tighter availabilities of the Basmati variety. In East Africa, cereal prices continued to surge in January to near-record or record levels, as the output of the ongoing harvests was sharply reduced by a poor October-December rainy season. Pastoralists are reducing herd size due to lower water and pasture availability to mitigate potential losses and increase their ability to sustain the remaining animals. As a result of higher supplies of low quality animals in the market, livestock prices declined sharply. In Southern Africa, the favourable production outlook for the 2017 crop, particularly in South Africa, the main exporter and producer of the subregion, resulted in some price declines in January. Prices, however, remain generally at relatively high levels supported by the drought-reduced outputs in 2016. In West Africa, coarse grain prices generally declined in January and were around or below their levels a year earlier reflecting increased market supplies from the recent good 2016 harvests. However, in Nigeria, despite an above-average output, the continuing steep depreciation of the local currency and civil insecurity kept prices well above their year-earlier levels.

Food Price Monitoring and Analysis (FPMA) Bulletin #11, 9 December 2016

09/12/2016

International wheat prices showed mixed trends in November but remained below their year-earlier levels on account of ample global supplies. Those of maize were relatively stable with the downward pressure from expectations of bumper crops offset by strong import demand. New crop arrivals and sluggish demand kept quotations of rice generally under pressure. In East Africa, cereal prices increased in most countries and were at levels well above those a year earlier due to localized production shortfalls and uncertain prospects for current crops in some areas. In South Sudan, the further sharp depreciation of the local currency underpinned staple food prices, which increased in November after some declines in the past months. In West Africa, adequate supplies from the good 2016 harvests and carryover stocks from last year’s production led to further price declines in most countries of the subregion. In Nigeria, however, the weak local currency and persisting civil insecurity limited the decline and kept prices at record or near-record highs.

Food Price Monitoring and Analysis (FPMA) Bulletin #10, 10 November 2016

10/11/2016

International wheat and maize prices increased slightly in October, underpinned by strong import demand. However, ample global supplies and expectations of bumper crops kept average prices below their year-earlier levels. By contrast, quotations of rice continued to decline, as a result of new crop harvest and weak import demand. In Central America and the Caribbean, maize and bean prices continued to decline significantly with the new harvest, particularly in Honduras and Nicaragua, while they spiked in the southwestern areas of Haiti, the worst hit by Hurricane Matthew. In Africa, coarse grain prices continued to decline in South Sudan, while in Nigeria the start of early harvest contained the increasing trend of the past several months. Prices in these countries were still, however, two to three times higher than the corresponding month last year. Prices remained at high levels also in several importing countries of Southern Africa on account of overall tight regional supplies. In Asia, rice prices declined or remained stable in most countries, while they continued to increase sharply and reached record highs in Bangladesh, underpinned by tight market availabilities.

Food Price Monitoring and Analysis (FPMA) Bulletin #9, 10 October 2016

10/10/2016

Wheat and maize export quotations generally declined in September, remaining at multi-year lows on account of ample world supplies and expectations of bumper crops. Rice prices also declined on account of improved prospects for global supplies and weak demand for imports. In Africa, food prices continued to soar in Nigeria driven by the continuous sharp depreciation of the local currency and insecurity in some areas. In South Sudan, cereal prices declined in September with the new harvest, but remained at levels well above those a year earlier. In Central America, white maize prices declined significantly in September mostly reflecting improved supplies from the main de primera season harvest, which is anticipated to rebound from last year’s drought-reduced level.

Food Price Monitoring and Analysis (FPMA) Bulletin #8, 9 September 2016

09/09/2016

Ample supplies and improved production prospects kept cereal prices generally under downward pressure. Maize and rice quotations fell the most, while high quality wheat prices firmed on strong demand. In Africa, food prices in South Sudan declined in August although they remained high, while in Nigeria the weak currency continued to underpin prices. In Southern Africa, decreasing maize quotations in South Africa eased prices in importing countries. In Asia, domestic prices of rice weakened in the main exporting countries in August, particularly in Thailand, amid mostly favourable prospects for the 2016 paddy crops and overall sluggish export demand. In South America, domestic prices of yellow maize in Argentina fell significantly from their record highs as a result of ample supplies from the recently-completed 2016 harvest, while they generally increased elsewhere due to an anticipated decline in this year’s outputs.

Food Price Monitoring and Analysis (FPMA) Bulletin #7, 10 August 2016

10/08/2016

International grain prices declined significantly in July, with those of wheat weighed down by seasonal harvest pressure and maize quotations falling on account of generally favourable weather for developing crops. Prices of rice showed mixed trends in Asian origins, while they increased in main exporting countries of South America. In Africa, food prices soared in July in South Sudan driven by the recent upsurge in insecurity. In Nigeria, the weak local currency continued to exert upward pressure on cereal prices, while in Malawi maize prices rose steeply for the second consecutive month mainly as a result of the sharply drought-reduced 2016 harvest. In South America, the increasing trend in yellow maize prices of the past several months halted under downward pressure from the ongoing 2016 harvests in the main maize producing countries, Argentina and Brazil, although prices remain at high levels. Elsewhere in the subregion, prices generally increased as a result of the reduced maize harvests expected this year.

Food Price Monitoring and Analysis (FPMA) Bulletin #6, 11 July 2016

11/07/2016

International wheat prices rose in June but remained below last year’s level on account of good supply prospects. Maize prices increased as a result of fast shrinking export supplies in South America and in the Black Sea region. Tight availabilities continued to lend support to rice quotations in most Asian origins, but gains were contained by subdued demand. In Africa, cereal prices rose sharply in South Sudan underpinned by high inflation and insecurity, and in Nigeria mostly due to the depreciation of the local currency. In South Africa, domestic prices of yellow maize increased further and were nearly 50 percent higher than in June last year as a result of tight domestic availabilities and currency weakness. In South America, prices of yellow maize increased and were well above their year-earlier levels in most countries of the subregion, particularly in Argentina and Brazil, underpinned by a strong pace of exports and a 2016 reduced output, respectively.

Food Price Monitoring and Analysis (FPMA) Bulletin #5, 9 June 2016

09/06/2016

International wheat prices remained below their levels of May last year, while those of maize continued to rise and exceeded their year‑earlier levels, supported by strong import demand and concerns about crop conditions in South America. Rice prices rebounded in May. In Asia, shortfalls in 2015 secondary crop outputs, due to adverse weather, continued to put upward pressure on domestic prices of rice in exporting countries, particularly in Thailand, where prices rose sharply in May to levels well above those of a year earlier. Domestic prices of maize in key subregional producing and exporting countries increased and reached record or near-record highs in May. In Argentina and Brazil, the rising maize prices were mainly underpinned by robust export demand and a tighter supply outlook, respectively. In Ukraine, prices were mostly supported by strong exports, while in South Africa, maize prices rebounded in May and were at new-record highs due to the depreciation of the country’s currency and tight domestic availabilities.

Food Price Monitoring and Analysis (FPMA) Bulletin #4, 10 May 2016

10/05/2016

International prices of wheat showed mixed trends in April, but remained lower than a year earlier mostly reflecting good prospects for 2016 production. By contrast, maize export quotations generally increased, supported by solid export demand and concerns about 2016 production prospects in South America. In Asia, rice prices increased in exporting countries in April amid expectations of reduced 2015 secondary crops, due to dry weather associated with the El Niño phenomenon. In South Africa, prices of white maize continued to decline from the record levels of February with the ongoing harvest but were still high year‑on‑year, underpinned by tight supplies and poor crop prospects. In Nigeria, the currency weakness triggered further increases in domestic coarse grain prices, with those of sorghum at record highs. Steep price increases were also recorded in South Sudan. In Argentina, strong exports, supported by the weak local currency and the recent elimination of export taxes, underpinned prices of maize which were at record highs in April and pushed prices of wheat to double their year-earlier levels. Similarly, in Brazil, maize prices were mainly underpinned by rising exports but also sustained domestic demand from the feed industry.

Food Price Monitoring and Analysis (FPMA) Bulletin #3, 11 April 2016

11/04/2016

Prospects for continuing large global supplies kept international prices of wheat and maize under downward pressure in March. Export prices of rice in Asia generally firmed, but they were still down in March compared to the same period last year. In East Africa, coarse grain prices rose further in March, sustaining the already high levels, particularly in South Sudan. In Southern Africa, despite some declines in South Africa, prices remained well above their year-earlier values, reflecting tight supplies and poor 2016 production prospects. In West Africa, in Nigeria, sharp price increases continued mainly due to the depreciation of the national currency. In South America, currency weakness in several countries maintained upward pressure on cereal prices, which remained at relatively high levels, particularly in Argentina and Brazil. In Colombia, the depreciation of the national currency coupled with this year’s unfavourable production outlook pushed prices of rice to record highs in March.

Food Price Monitoring and Analysis (FPMA) Bulletin #2, 10 March 2016

10/03/2016

International wheat prices declined in February as a result of reduced trade activity, while maize quotations were firmer on stronger demand. International prices of rice followed mixed trends depending on the origin. Overall, cereal quotations remained lower than in the corresponding period last year. In Southern Africa, maize prices continued to increase in February, although at a slower rate, and were at record highs. Prices increased also in several East African countries, reaching levels well above those of a year earlier, mainly supported by reduced domestic availabilities. In West Africa, coarse grain prices rose steeply in Nigeria in January. In South America, cereal prices in February increased sharply in several countries of the subregion. Most notably, prices were at record highs or well above those of a year earlier in Argentina, Brazil and Colombia mainly due to the depreciation of the national currencies.