Commodity in focus

Global production of tropical fruits has grown steadily over the past decade, predominantly in response to increasing demand in major producer areas. While tropical fruits play a small role in global agricultural trade in overall quantities, accounting for a mere 3 percent of world agricultural food products exports, their high average export unit value is well above USD 1 000 per tonne and places them as the third most valuable fruit group globally, behind bananas and apples. Trade in tropical fruits generates a substantial income for smallholder producers, as well as significant export earnings for many of the producing countries, thereby contributing to their food security.

Global trade in tropical fruits has expanded to unprecedented heights in recent years, reaching an estimated aggregate export volume of close to 11 million tonnes in 2023. Strong demand growth in key importing countries has led to ample investments in improving productivity and expanding production areas in supplying countries, notably for avocados.

Current releases

Major Tropical Fruits Market Review. Preliminary results 2024

24/12/2024

The Tropical Fruits Market Review Preliminary Results is issued on an annual basis to Members and Observers of the Sub-Group on Tropical Fruits of the...

Minor Tropical Fruits Global Trade Overview 2024

07/11/2024

This report provides a concise evaluation of the latest trends and developments in the global trade of minor tropical fruits as recorded under HS code...

More Publications

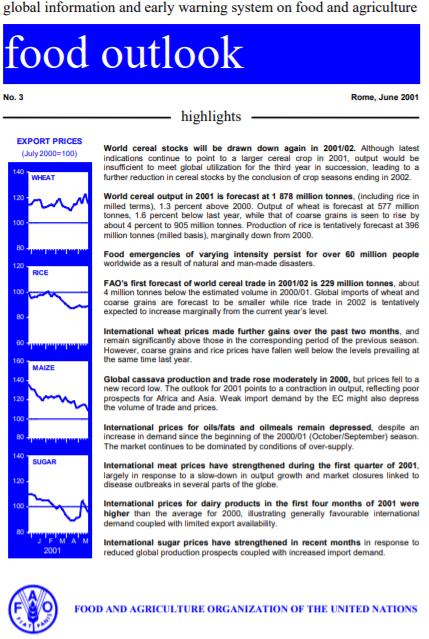

Food Outlook - June 2001

04/06/2001

World cereal stocks will be drawn down again in 2001/02. Although latest indications continue to point to a larger cereal crop in 2001, output would be insufficient to meet global utilization for the third year in succession, leading to a further reduction in cereal stocks by the conclusion of crop seasons ending in 2002. World cereal output in 2001 is forecast at 1 878 million tonnes, (including rice in milled terms), 1.3 percent above 2000. Output of wheat is forecast at 577 million tonnes, 1.6 percent below last year, while that of coarse grains is seen to rise by about 4 percent to 905 million tonnes. Production of rice is tentatively forecast at 396 million tonnes (milled basis), marginally down from 2000. Food emergencies of varying intensity persist for over 60 million people worldwide as a result of natural and man-made disasters. FAO’s first forecast of world cereal trade in 2001/02 is 229 million tonnes, about 4 million tonnes below the estimated volume in 2000/01. Global imports of wheat and coarse grains are forecast to be smaller while rice trade in 2002 is tentatively expected to increase marginally from the current year’s level. International wheat prices made further gains over the past two months, and remain significantly above those in the corresponding period of the previous season. However, coarse grains and rice prices have fallen well below the levels prevailing at the same time last year. Global cassava production and trade rose moderately in 2000, but prices fell to a new record low. The outlook for 2001 points to a contraction in output, reflecting poor prospects for Africa and Asia. Weak import demand by the EC might also depress the volume of trade and prices. International prices for oils/fats and oilmeals remain depressed, despite an increase in demand since the beginning of the 2000/01 (October/September) season. The market continues to be dominated by conditions of over-supply. International meat prices have strengthened during the first quarter of 2001, largely in response to a slow-down in output growth and market closures linked to disease outbreaks in several parts of the globe. International prices for dairy products in the first four months of 2001 were higher than the average for 2000, illustrating generally favourable international demand coupled with limited export availability. International sugar prices have strengthened in recent months in response to reduced global production prospects coupled with increased import demand.

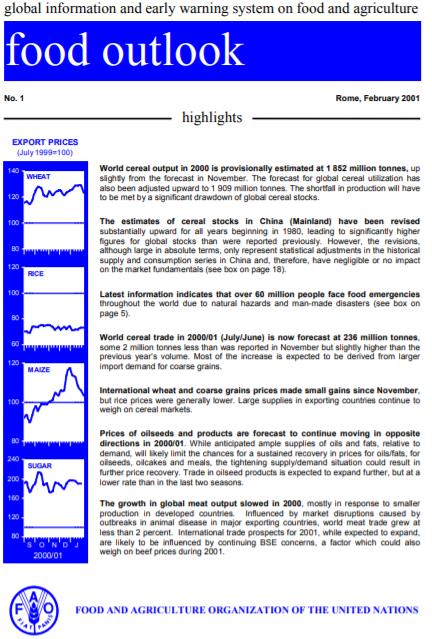

Food Outlook - February 2001

05/02/2001

World cereal output in 2000 is provisionally estimated at 1 852 million tonnes, up slightly from the forecast in November. The forecast for global cereal utilization has also been adjusted upward to 1 909 million tonnes. The shortfall in production will have to be met by a significant drawdown of global cereal stocks. The estimates of cereal stocks in China (Mainland) have been revised substantially upward for all years beginning in 1980, leading to significantly higher figures for global stocks than were reported previously. However, the revisions, although large in absolute terms, only represent statistical adjustments in the historical supply and consumption series in China and, therefore, have negligible or no impact on the market fundamentals. Latest information indicates that over 60 million people face food emergencies throughout the world due to natural hazards and man-made disasters. World cereal trade in 2000/01 (July/June) is now forecast at 236 million tonnes, some 2 million tonnes less than was reported in November but slightly higher than the previous year’s volume. Most of the increase is expected to be derived from larger import demand for coarse grains. International wheat and coarse grains prices made small gains since November, but rice prices were generally lower. Large supplies in exporting countries continue to weigh on cereal markets. Prices of oilseeds and products are forecast to continue moving in opposite directions in 2000/01. While anticipated ample supplies of oils and fats, relative to demand, will likely limit the chances for a sustained recovery in prices for oils/fats, for oilseeds, oilcakes and meals, the tightening supply/demand situation could result in further price recovery. Trade in oilseed products is expected to expand further, but at a lower rate than in the last two seasons. The growth in global meat output slowed in 2000, mostly in response to smaller production in developed countries. Influenced by market disruptions caused by outbreaks in animal disease in major exporting countries, world meat trade grew at less than 2 percent. International trade prospects for 2001, while expected to expand, are likely to be influenced by continuing BSE concerns, a factor which could also weigh on beef prices during 2001.

| With around 2 700 species, tropical fruits are not only a source of nutrition, but also of income generation for farmers who produce them for export. | |

| In global commodity trade, tropical fruits constitute a comparatively new group and since 1970, they have emerged as significant in the international marketplace. | |

| Export volumes of fresh tropical fruits display the fastest average annual growth rates among internationally traded food commodities. | |

| Advances in transportation, trade agreements and shifting consumer preferences in favour of these fruits led to trade growth. | |

| Tropical fruits are highly perishable during production and distribution, and so environmental challenges are among the key obstacles to sustaining production and ensuring that international markets are supplied. | |

| Increasingly, erratic weather events are a particularly acute challenge to growing tropical fruits because the vast majority are produced on smallholder farms of less than 5 ha where cultivation is highly dependent on rainfall. |

| An estimated 99 percent of tropical fruit production originates in

developing countries, predominantly in Asia and Latin America and a

smaller share in Africa. |

| In most producing zones, tropical fruits continue to be cultivated at the subsistence rather than the commercial level. |

| The combined exports of the four major tropical fruits represent only 5 percent of total production volume, and the remainder is consumed or otherwise utilized domestically. |

Dashboards

Related links

- Global Trade in Bananas

- FAO Intergovernmental Group on Bananas and Tropical Fruits

- International Year of Fruits and Vegetables (IYFV)

- Committee on Commodity Problems (CCP)

- Global Commodity Markets

- Responsible Business Conduct (RBC) in Agriculture

- OECD-FAO Guidance for Responsible Agricultural Supply Chains

- World Banana Forum

- TR4 Global Network

For general inquiries, contact: