Food Price Monitoring and Analysis (FPMA) Bulletin #3, 10 April 2019

10/04/2019

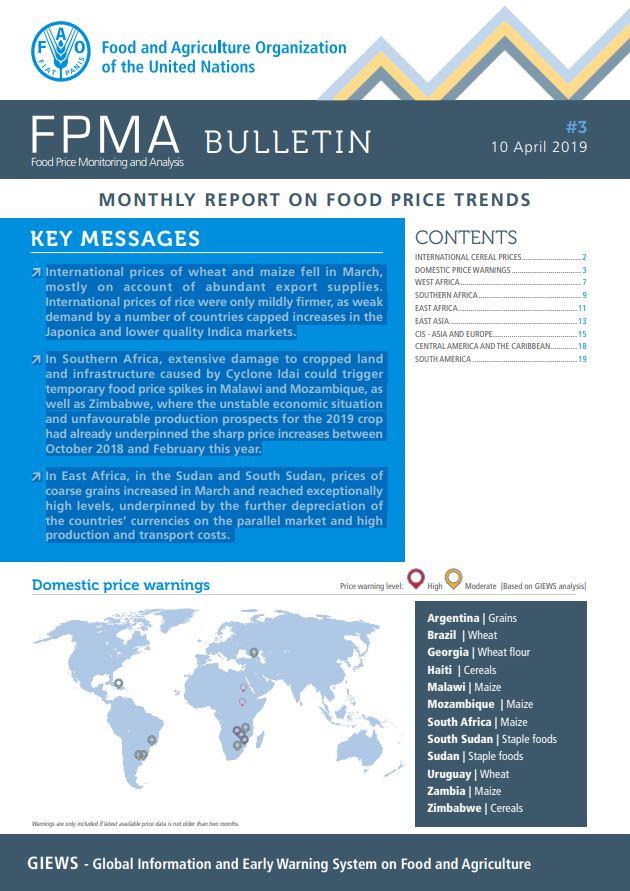

International prices of wheat and maize fell in March, mostly on account of abundant export supplies. International prices of rice were only mildly firmer, as weak demand by a number of countries capped increases in the Japonica and lower quality Indica markets. In Southern Africa, extensive damage to cropped land and infrastructure caused by Cyclone Idai could trigger temporary food price spikes in Malawi and Mozambique, as well as Zimbabwe, where the unstable economic situation and unfavourable production prospects for the 2019 crop had already underpinned the sharp price increases between October 2018 and February this year. In East Africa, in the Sudan and South Sudan, prices of coarse grains increased in March and reached exceptionally high levels, underpinned by the further depreciation of the countries’ currencies on the parallel market and high production and transport costs.

Dairy Market Review - Overview of global dairy market developments - March 2018

29/03/2019

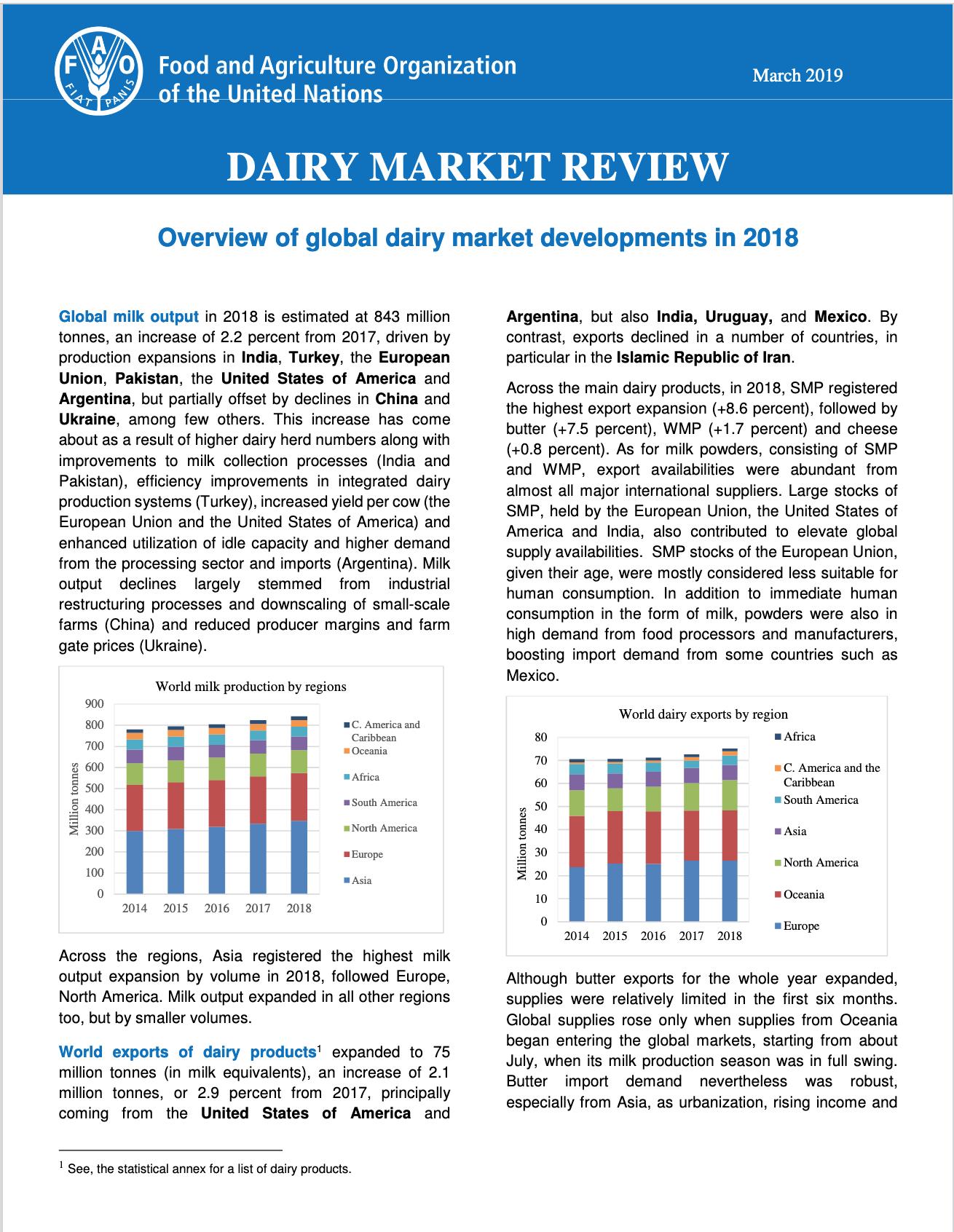

Global milk output in 2018 is estimated at 842 million tonnes, an increase of 2.2 percent from 2017, driven by production expansions in India, Turkey, the EU, Pakistan, the United States and Argentina, but partially offset by declines in China and Ukraine, among few others.

Crop Prospects and Food Situation - Quarterly Global Report, No. 1, March 2019

29/03/2019

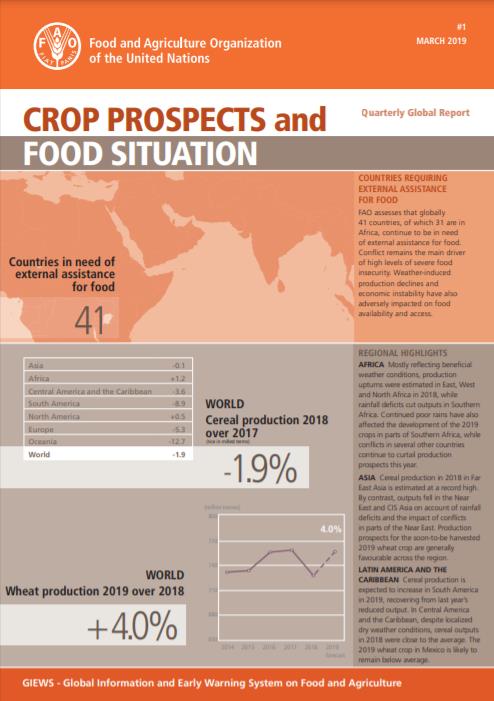

FAO assesses that globally 41 countries, of which 31 are in Africa, continue to be in need of external assistance for food. Conflict remains the main driver of high levels of severe food insecurity. Weather‑induced production declines and economic instability have also adversely impacted on food availability and access.

Meat Market Review - Overview of global meat market developments, March 2019

22/03/2019

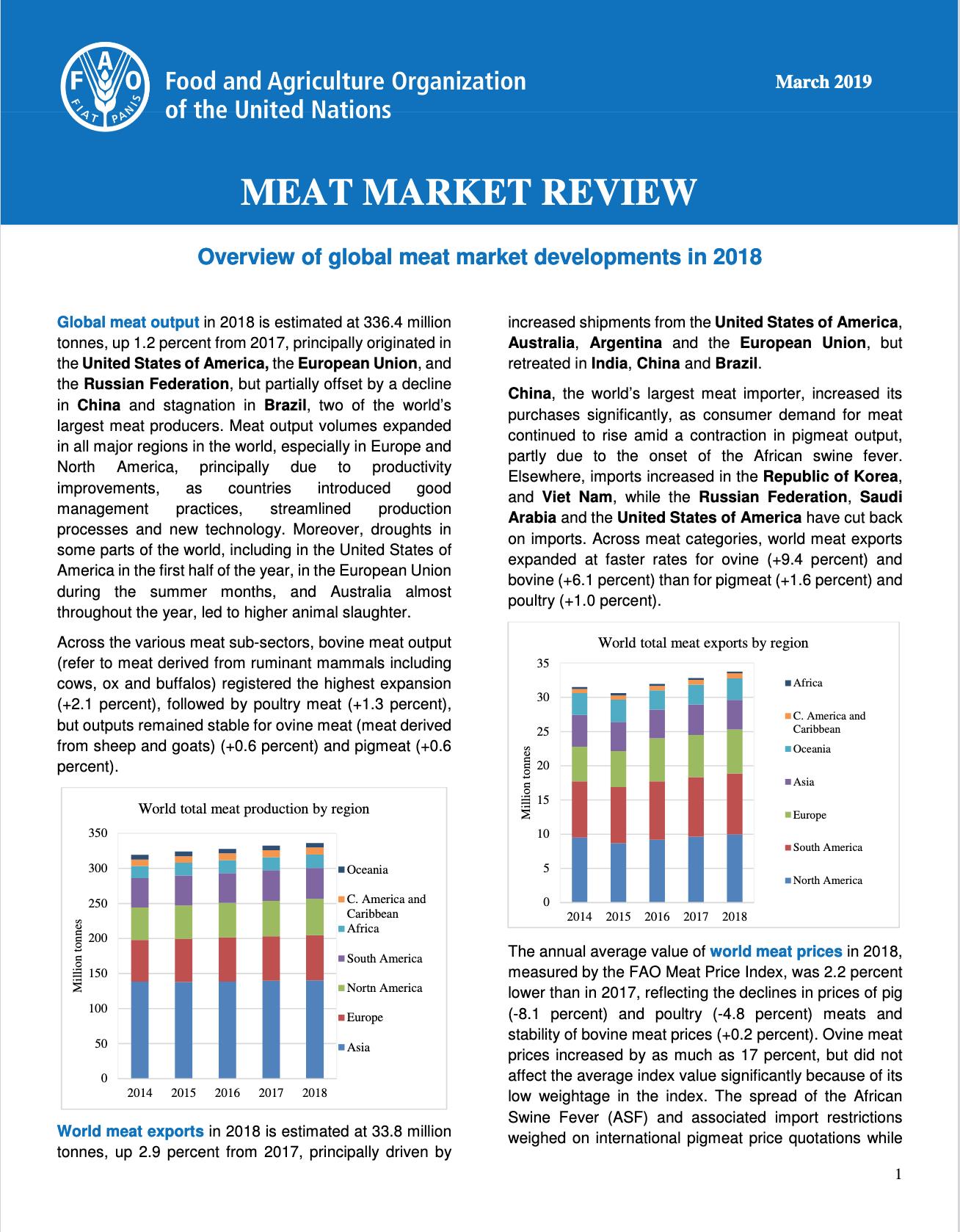

Global meat output in 2018 is estimated at 336.4 million tonnes, up 1.2 percent from 2017, principally originated in the United States, the EU, and the Russian Federation, but partially offset by a decline in China and stagnation in Brazil, two of the world’s largest meat producers. Meat output volumes expanded in all major regions in the world, especially in Europe and North America. Productivity improvements, as countries introduced better management practices, more streamlined production systems and new technology, were largely behind the output expansion. Moreover, droughts in some parts of the world, including in the United States in the first half of the year, in the EU during the summer months, and Australia almost throughout the year, led to higher animal slaughter. Across the various meat sub-sectors, bovine meat output (refer to meat derived from ruminant mammals including cows, ox and buffalos) registered the highest expansion (+2.1 percent), followed by poultry meat (+1.3 percent), but remained stable for ovine meat (meat derived from sheep and goats) (+0.6 percent) and pigmeat (+0.6 percent). World meat exports in 2018 is estimated at 33.8 million tonnes, up 2.9 percent from 2017, principally driven by increased shipments from the United States, Australia, Argentina and the EU, but retreated in India, China and Brazil. China, the world’s largest meat importer, increased its purchases significantly, as consumer demand for meat continued to rise amid a contraction in pigmeat output, partly due to the onset of the African swine fever. Elsewhere, imports increased in the Republic of Korea, and Viet Nam, while the Russian Federation, Saudi Arabia and the United States have cut back on imports. Across meat categories, world meat exports expanded at faster rates for ovine (+9.4 percent) and bovine (+6.1 percent) than for pigmeat (+1.6 percent) and poultry (+1.0 percent). The annual average value of world meat prices in 2018, measured by the FAO Meat Price Index, was 2.2 percent lower than in 2017, reflecting the declines in prices of pig (-8.1 percent) and poultry (-4.8 percent) meats and stability of bovine meat prices (+0.2 percent). Ovine meat prices increased by as much as 17 percent, but did not affect the average index value significantly because of its low weightage in the index. The spread of the African Swine Fever (ASF) and associated import restrictions weighed on international pigmeat price quotations while generally sluggish poultry import demand caused its prices to weaken. Abundant export supplies and robust demand from across the world characterized the global bovine market, keeping its prices stable. Price strength of ovine meat during the whole year was a result of strong import demand, combined with limited supplies from Oceania.

Special Report - FAO/WFP Crop and Food Security Assessment Mission to the Republic of South Sudan

15/03/2019

An FAO/WFP Crop and Food Security Assessment Mission (CFSAM) visited South Sudan from 3 to 13 December 2018 to estimate the cereal production during 2018 and assess the overall food security situation in the country. The CFSAM reviewed the findings of several Crop Assessment Missions conducted from May to December 2018 at planting and harvest time in different agro-ecological zones of the country. As during the past four years, all the missions were carried out by a Task Force Team that comprised staff from the Ministry of Agriculture and Food Security (MAFS), the National Bureau of Statistics (NBS), FAO and the respective State Ministries of Agriculture. Task Force Team members have been trained during the past years to conduct rapid assessments using established CFSAM protocols and techniques, including walking transects, scoring standing crops according to the PET yield levels and livestock body conditions, perform key informant interviews and farmer case studies. Between 2016 and 2018, in the framework of the concluded FAO/AFIS Project and the ongoing FAO-EU Project “Strengthening the resilience of pastoral and agro-pastoral communities in South Sudan’s cross border areas with Sudan, Ethiopia, Kenya and Uganda” (OSRO/SSD/703/EU), 54 County Crop Monitoring Committees (CCMCs) have been established with the aim to improve the local capacity to collect reliable and accurate data. All assessment and training activities have been financially supported by the European Union through the FAO South Sudan office.

Special Report - FAO Crop and Food Supply Assessment Mission to The Sudan - 14 March 2019

14/03/2019

Between 26 November and 14 December 2018, assisted by the Food and Agriculture Organization of the United Nations (FAO), the Ministry of Agriculture and Forestry (MoAF) carried out its annual Assessment Mission to determine the crop production and the food supply situation throughout the 18 states of the country. The Mission consisted of six core teams comprising members from the MoAF, the Food Security Technical Secretariat (FSTS) of the MoAF, the Ministry of Animal Resources (MoAR), the Humanitarian Aid Commission (HAC), the Strategic Reserve Corporation (SRC), FAO, FEWS NET, WFP and USAID.

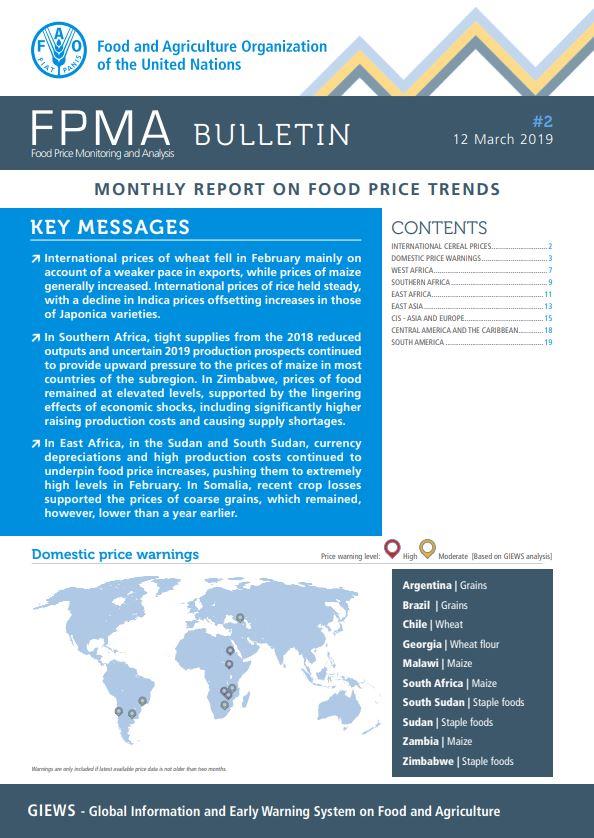

Food Price Monitoring and Analysis (FPMA) Bulletin #2, 12 March 2019

12/03/2019

International prices of wheat fell in February mainly on account of a weaker pace in exports, while prices of maize generally increased. International prices of rice held steady, with a decline in Indica prices offsetting increases in those of Japonica varieties. In Southern Africa, tight supplies from the 2018 reduced outputs and uncertain 2019 production prospects continued to provide upward pressure to the prices of maize in most countries of the subregion. In Zimbabwe, prices of food remained at elevated levels, supported by the lingering effects of economic shocks, including significantly higher raising production costs and causing supply shortages. In East Africa, in the Sudan and South Sudan, currency depreciations and high production costs continued to underpin food price increases, pushing them to extremely high levels in February. In Somalia, recent crop losses supported the prices of coarse grains, which remained, however, lower than a year earlier.

Major tropical fruits - Market Review 2018

09/03/2019

A comprehensive analysis of production, trade, and prices of major tropical fruits.

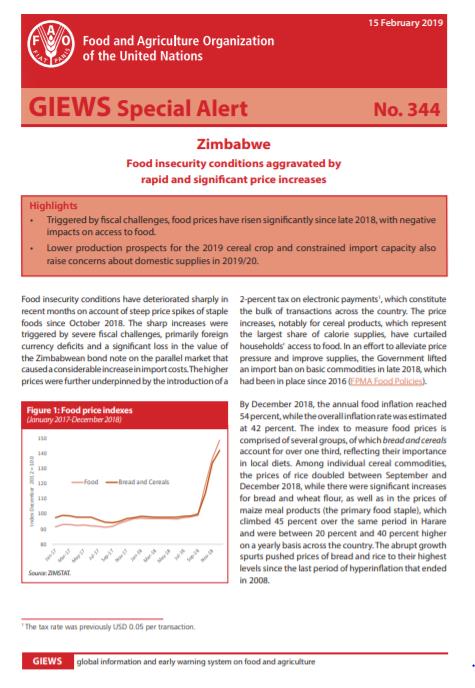

GIEWS Special Alert No. 344 - Zimbabwe, 15 February 2019

15/02/2019

Triggered by fiscal challenges, food prices have risen significantly since late 2018, with negative impacts on access to food. Lower production prospects for the 2019 cereal crop and constrained import capacity also raise concerns about domestic supplies in 2019/20.

Food Price Monitoring and Analysis (FPMA) Bulletin #1, 12 February 2019

12/02/2019

International prices of wheat remained firm in January due to tightening export supplies and robust world demand, while concerns over the impact of adverse weather on crops in South America underpinned maize export price quotations. International prices of rice also rose, mainly due to reviving Asian demand for Japonica rice. In East Africa, in the Sudan and South Sudan, the weak national currencies provided upward support to the prices of staple foods and kept them at levels well above those a year earlier. High production and transport costs also contributed to the higher level of prices. In Southern Africa, seasonal price increases of maize were amplified in several countries by the reduced 2018 production outturns, while in Zimbabwe, a drop in the value of the country’s currency and a shortage of foreign exchange were the main drivers of the surge in food prices late last year.

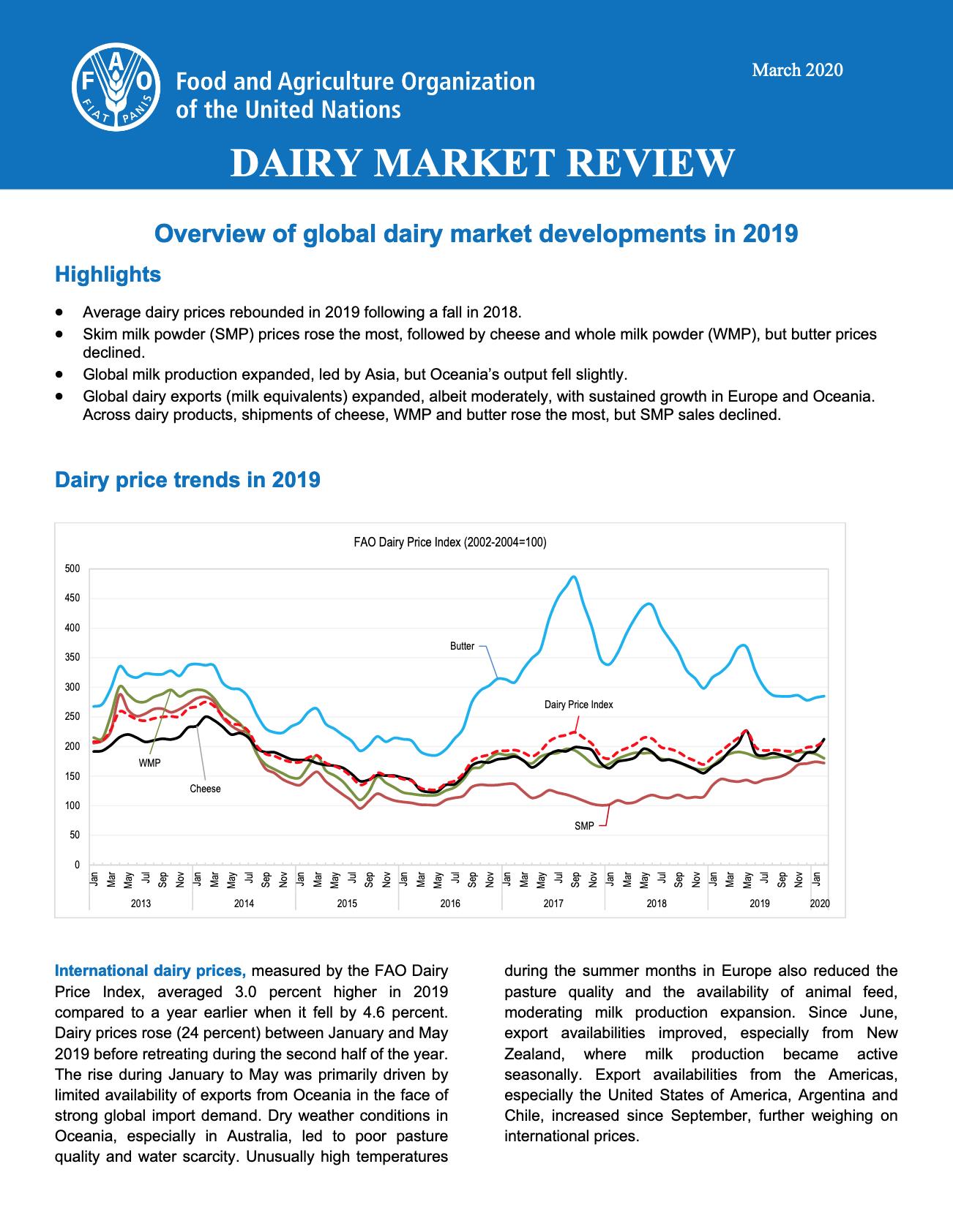

Dairy Market Review - Overview of global dairy market developments in 2019

03/02/2019

This publication provides an update on production, trade and price movements of milk, and milk products (butter, cheese, skim milk powder and whole milk powder). It aims to provide a clear snapshot view of key changes and underlying determinants of world dairy markets. It is the only publication that covers dairy market developments in the entire world that is also updated regularly; it supports the division’s objective in providing market information relevant for policy makers, helping them in the process to take data-based policy decisions. • Average dairy prices rebounded in 2019 following a fall in 2018. • Skim milk powder (SMP) prices rose the most, followed by cheese and whole milk powder (WMP), but butter prices declined. • Global milk production expanded, led by Asia, but Oceania’s output fell slightly. • Global dairy exports (milk equivalents) expanded, albeit moderately, with sustained growth in Europe and Oceania. Across dairy products, shipments of cheese, WMP and butter rose the most, but SMP sales declined.

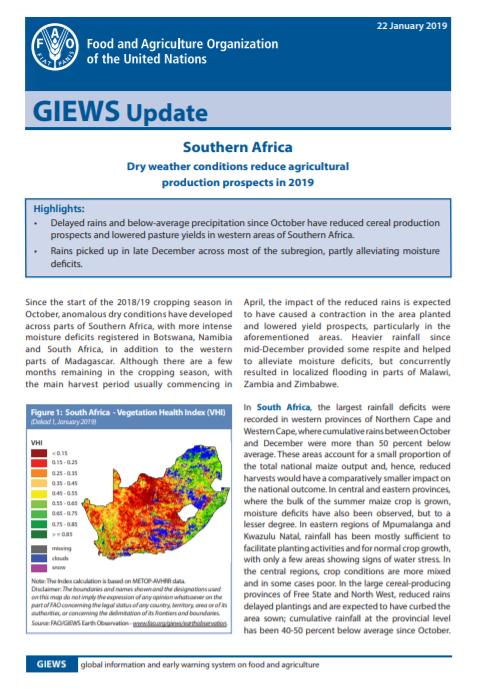

GIEWS Update - Southern Africa, 22 January 2019

22/01/2019

Delayed rains and below-average precipitation since October have reduced cereal production prospects and lowered pasture yields in western areas of Southern Africa. Rains picked up in late December across most of the subregion, partly alleviating moisture deficits.

Oilcrops complex: policy changes and industry measures - Annual compendium - 2017

25/12/2018

The 2017 compendium offers an overview of salient government policies and related private sector measures concerning global and national markets for oilcrops and derived products. Its purpose is to facilitate the work of policy makers, market experts, analysts and other interested stakeholders by providing a short, concise overview of policy developments relevant to the sector. Detailed news items are presented in tabular form (in English only), preceeded by a brief discussion of the key policy trends observed in the year under review.

Rapport Spécial - Mission FAO/PAM d'évaluation des récoltes et de la sécurité alimentaire à Madagascar - 21 décembre 2018

21/12/2018

Une mission conjointe FAO/PAM d'évaluation des récoltes et de la sécurité alimentaire (CFSAM) s'est rendue à Madagascar à la demande du Gouvernement malgache, en raison de préoccupations quant à l'impact d'une vague prolongée de sécheresse dans les régions du sud et d’inondations localisées dans les régions centrales. La Mission s’est rendue dans le pays du 30 juillet au 11 août afin de s’enquérir des facteurs ayant eu une incidence sur la production agricole, d'établir des estimations de la production céréalière nationale et d’évaluer la situation globale de la sécurité alimentaire et nutritionnelle. La Mission a bénéficié de l'appui technique et logistique du Service des statistiques agricoles du Ministère de l'agriculture et de l'élevage.

Использование инструментов ВТО в интересах агробизнеса

12/12/2018

Данное руководство информирует агробизнес о широком наборе инструментов ВТО, которые могут быть использованы для улучшения доступа к сельскохозяйственным рынкам. Даже малый и средний бизнес может легко и непосредственно использовать некоторые из этих инструментов, в частности, инструменты прозрачности. Бизнес-ассоциации и национальные сельскохозяйственные производители могут сотрудничать и общаться с правительствами при применении таких инструментов, как меры торговой защиты. Данное руководство предоставляет агробизнесу практический инструментарий для развития своего внешнеторгового потенциала. Инструменты транспарентности в этих соглашениях полезны для агробизнеса в исследованиях и анализе экспортных рынков, поскольку они дают доступ к информации об изменениях регулирования импорта в отношении конкретных товаров и продуктов. Инструменты и процедуры торговой защиты используются для защиты производителей от недобросовестной торговой практики, такой как демпинг или субсидии. Инструменты упрощения процедур торговли значительно улучшают административные и таможенные процедуры для ускорения перемещения, освобождения товаров и сокращения затрат времени и затрат для импортеров. Данная публикация подготовлена в рамках Региональной инициативы ФАО в Европе и Центральной Азии “Развитие агропродовольственной торговли и доступа к международным рынкам”.

Food Price Monitoring and Analysis (FPMA) Bulletin #10, 10 December 2018

10/12/2018

International prices of wheat and maize remained under downward pressure in November, mostly on account of large nearby supplies. For rice, new crop arrivals continued to weigh on export price quotations. In East Africa, in the Sudan, a further sharp devaluation of the currency triggered a marked increase in the prices of grains, which reached record to near-record highs despite the ongoing harvest. In Southern Africa, in Zimbabwe, a drop in the value of the country’s currency, as well as a shortage of foreign exchange, curbed imports and underpinned the increases in cereal prices. Elsewhere in the subregion, reduced 2018 harvests pushed the prices of maize to levels above those recorded a year earlier in several countries.

Crop Prospects and Food Situation - Quarterly Global Report, No. 4, December 2018

07/12/2018

FAO assesses that globally 40 countries, of which 31 in Africa, continue to be in need of external assistance for food. The impact of conflicts continues to be the main cause of the high level of severe food insecurity. Weather-induced production declines have also negatively impacted food availability.

Food Price Monitoring and Analysis (FPMA) Bulletin #9, 9 November 2018

09/11/2018

International prices of wheat in October were supported by concerns over a tighter global supply outlook, while those of maize in the United States of America rose, mostly supported by large sales for export. By contrast, export prices of rice were generally weaker on account of harvest pressure, export competition and currency movements. In Asia, in the Philippines, the start of the 2018 main season harvest halted the upward trend of rice prices of the past several months on the backdrop of low public inventories and increased fuel costs. Prices, however, remained at record or near-record highs, well above their levels in October 2017. In Central America, prices of white maize dropped markedly in October, mainly as a result of improved market availabilities from the 2018 main season harvest. Prices, however, remained well above their year-earlier values in most countries, particularly in Nicaragua, following the sustained increases since the beginning of 2018.

Pilot project on the implementation of the OECD-FAO Guidance for Responsible Agricultural Supply Chains : Baseline Report

29/10/2018

This report provides background information on the OECD-FAO Guidance for Responsible Agricultural Supply Chains (hereafter OECD-FAO Guidance) and the pilot project for testing the practical application of the OECD-FAO Guidance. The report lays out the main challenges and opportunities companies may face when carrying out risk-based due diligence, and summarises the key recommendations stemming from the baseline analysis for both participants and the OECD and FAO.

Meat Market Review: October 2018

22/10/2018

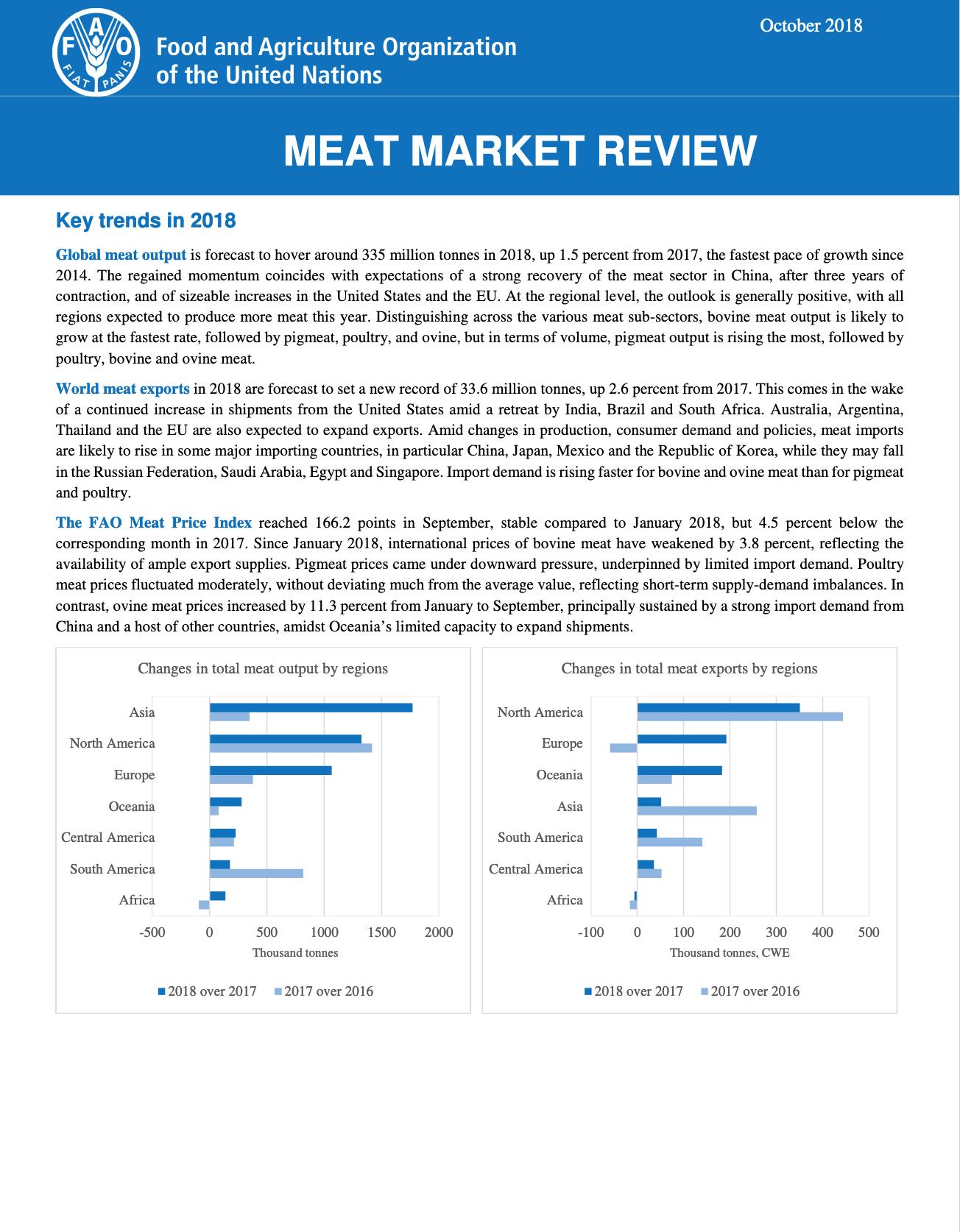

Global meat output is forecast to hover around 335 million tonnes in 2018, up 1.5 percent from 2017, the fastest pace of growth since 2014. The regained momentum coincides with expectations of a strong recovery of the meat sector in China, after three years of contraction, and of sizeable increases in the United States and the EU. At the regional level, the outlook is generally positive, with all regions expected to produce more meat this year. World meat exports in 2018 are forecast to set a new record of 33.6 million tonnes, up 2.6 percent from 2017. This comes in the wake of a continued increase in shipments from the United States amid a retreat by India, Brazil and South Africa. Australia, Argentina, Thailand and the EU are also expected to expand exports. Amid changes in production, consumer demand and policies, meat imports are likely to rise in some major importing countries, in particular China, Japan, Mexico and the Republic of Korea, while they may fall in the Russian Federation, Saudi Arabia, Egypt and Singapore. Import demand is rising faster for bovine and ovine meat than for pigmeat and poultry. The FAO Meat Price Index reached 166.2 points in September, stable compared to January 2018, but 4.5 percent below the corresponding month in 2017. Since January 2018, international prices of bovine meat have weakened by 3.8 percent, reflecting the availability of ample export supplies.