No. 21 WTO Agreement on Agriculture: Export Competition after the Nairobi Ministerial Conference

08/03/2017

The Ministerial Decision on Export Competition introduced prohibitions to agricultural export subsidies. It foresees the elimination of export subsidies in different timeframes for developed and developing countries. Specific exceptions have been agreed upon for some products and for particular developed and developing members. The Decision also covers the other three elements (namely Export Credits and Guarantees,

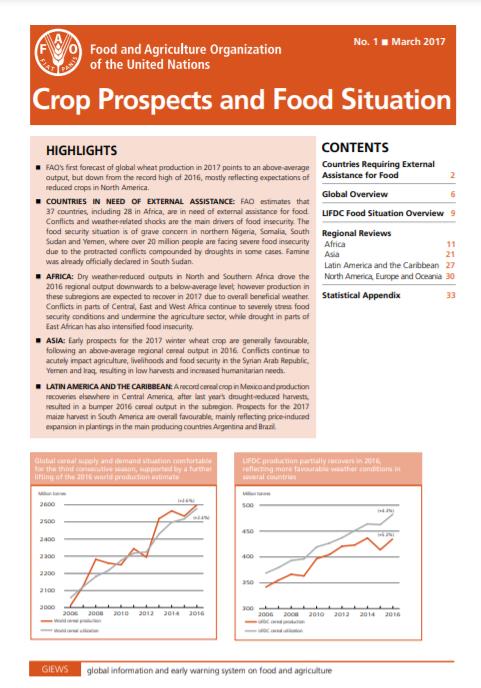

Crop Prospects and Food Situation - Quarterly Global Report, No. 1, March 2017

02/03/2017

FAO’s first forecast of global wheat production in 2017 points to an above-average output, but down from the record high of 2016, mostly reflecting expectations of reduced crops in North America. COUNTRIES IN NEED OF EXTERNAL ASSISTANCE: FAO estimates that 37 countries, including 28 in Africa, are in need of external assistance for food. Conflicts and weather-related shocks are the main drivers of food insecurity.

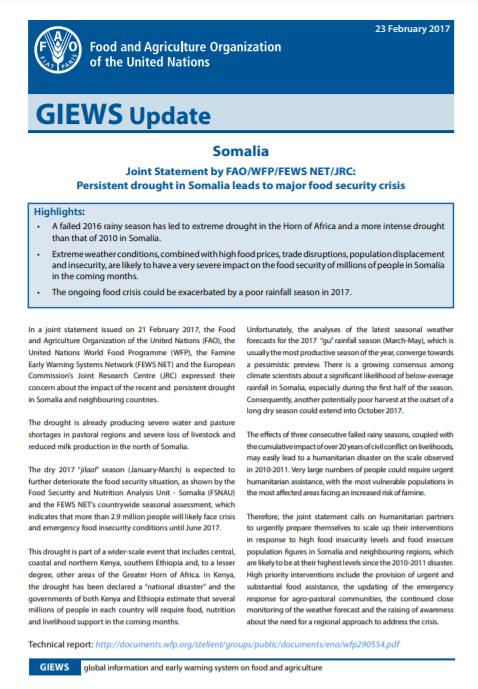

GIEWS Update - Somalia, 23 February 2017

23/02/2017

A failed 2016 rainy season has led to extreme drought in the Horn of Africa and a more intense drought than that of 2010 in Somalia. Extreme weather conditions, combined with high food prices, trade disruptions, population displacement and insecurity, are likely to have a very severe impact on the food security of millions of people in Somalia in the coming months. The ongoing food crisis could be exacerbated by a poor rainfall season in 2017.

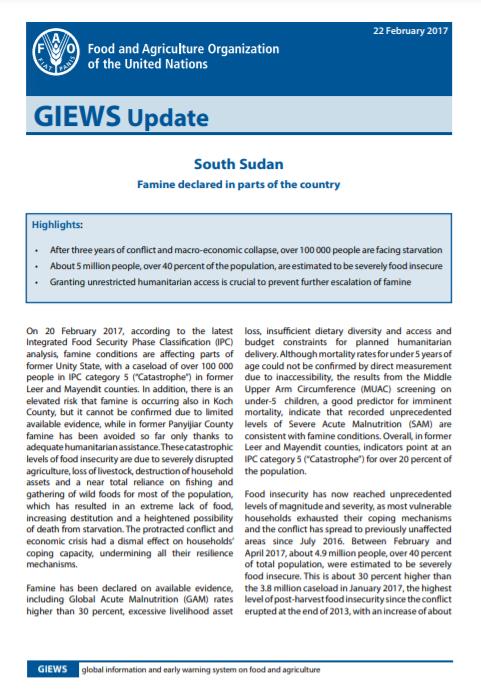

GIEWS Update - South Sudan, 22 February 2017

22/02/2017

After three years of conflict and macro-economic collapse, over 100 000 people are facing starvation. About 5 million people, over 40 percent of the population, are estimated to be severely food insecure. Granting unrestricted humanitarian access is crucial to prevent further escalation of famine.

No. 20 How can governance be improved for trade and food security?

14/02/2017

This policy brief provides an overview of the different food security objectives that underlie the use of trade and related policy measures, based on Chapter 3 of the State of Commodity Markets (SOCO) 2016.

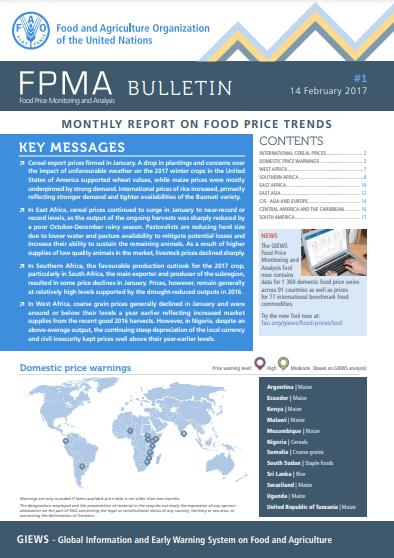

Food Price Monitoring and Analysis (FPMA) Bulletin #1, 14 February 2017

14/02/2017

Cereal export prices firmed in January. A drop in plantings and concerns over the impact of unfavourable weather on the 2017 winter crops in the United States of America supported wheat values, while maize prices were mostly underpinned by strong demand. International prices of rice increased, primarily reflecting stronger demand and tighter availabilities of the Basmati variety. In East Africa, cereal prices continued to surge in January to near-record or record levels, as the output of the ongoing harvests was sharply reduced by a poor October-December rainy season. Pastoralists are reducing herd size due to lower water and pasture availability to mitigate potential losses and increase their ability to sustain the remaining animals. As a result of higher supplies of low quality animals in the market, livestock prices declined sharply. In Southern Africa, the favourable production outlook for the 2017 crop, particularly in South Africa, the main exporter and producer of the subregion, resulted in some price declines in January. Prices, however, remain generally at relatively high levels supported by the drought-reduced outputs in 2016. In West Africa, coarse grain prices generally declined in January and were around or below their levels a year earlier reflecting increased market supplies from the recent good 2016 harvests. However, in Nigeria, despite an above-average output, the continuing steep depreciation of the local currency and civil insecurity kept prices well above their year-earlier levels.

Assessing volatility patterns in food crops

01/02/2017

Prices of food crops, which depend on unpredictable factors like the weather, are naturally volatile. However, in recent years we have experienced bouts of extreme food price volatility. These can be a thread to world food security. Especially in developing countries, where households spend a large share of income on food items and about two billion people live off small farms, while often not having access to credit, savings, or storage facilities, large price fluctuations can have devastating and long-term repercussions. In order to be able to anticipate, prepare for, or even mitigate abnormally high price volatility, it is essential to better understand how the many factors suspected to affect volatility exert their impact. Which are the most relevant factors? Is the influence gradual? Or do we, for example, find evidence for the conjecture of a critical stocks-to-use threshold below which volatility increases drastically? We look at three basic food commodities to investigate these questions – wheat, maize, and soybeans. We formulate an exponential ARCH model with additional exogenous covariates and use component-wise gradient boosting to both select variables and estimate the model. While certain factors, e.g. the stocks-to-use ratio, turn out to be important for all three commodities, which variables are informative generally varies by crop. Their influence typically being non-linear, we quantify critical thresholds associated with changes in volatility levels.

What did we learn from the bout of high and volatile food commodity prices (2007-2013)?

01/01/2017

This research paper looks at the crisis in international agricultural markets during the last decade and draws out some lessons. Although crop prices continue to be volatile, the bout of high prices/high volatility ended by 2015. The initial rapid rise of prices was not predicted, and surprised both market players and the international community more broadly. Considerable policy attention was focused on the crisis – by the UN broadly, by FAO and its members, by G20 heads, agricultural groups, an d national governments.

Oilseeds, Oils & Meals. Monthly Price and Policy Update No. 90, January 2017

01/01/2017

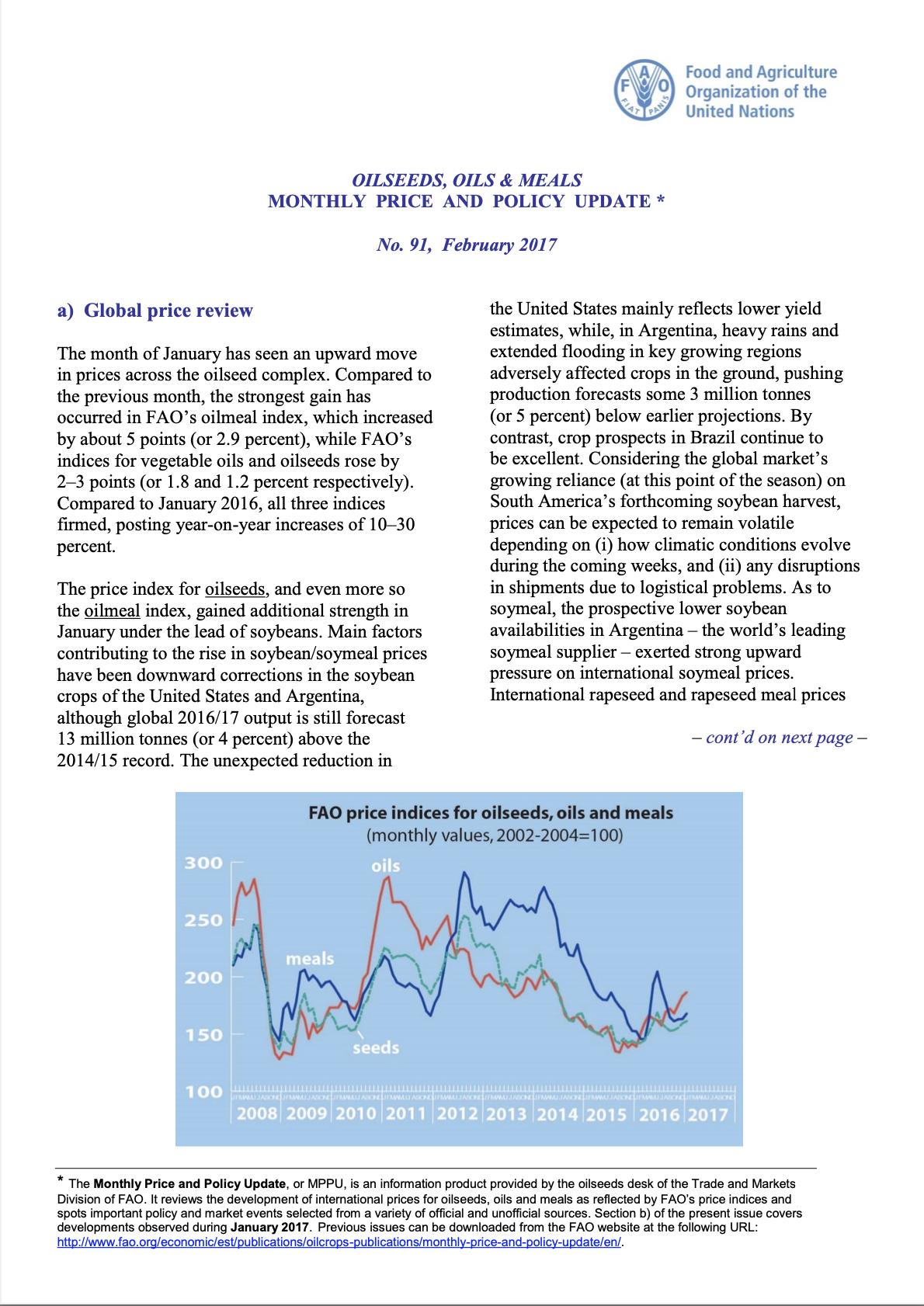

he month of August saw a rise in all threeFAO price indices trailing the oilseed complex. The oilseeds index increased for a third consecutive month, rising by 0.6 points (or 0.6 percent) and marking the highest level since January 2020. The price indices for oilmeals and vegetable oils posted more significant gains of, respectively, 3.7 and 5.5 points (or 4.6 and 5.9 percent). While all three indices fared above their year-earlier levels, the vegetable oils index stood out with its 19 percent year-on-year gain.

Banana market review 2015 - 2016

01/01/2017

The Banana Market Review, issued once a year, contains information and analysis on global banana trade, including imports, exports, prices and policy changes. Information and data comes from various sources, including FAO member nations, traders and the world press.

Обзор текущей сельскохозяйственной торговой политики в постсоветских странах 2015-16

01/01/2017

Данный обзор является вторым выпуском в серии публикаций, посвященных анализу последних изменений в сельскохозяйственной торговле и развитию торговой политики в постсоветских странах. Как и предыдущая публикация, он подготовлен в рамках Региональной инициативы ФАО в Европе и Центральной Азии «Развитие агропродовольственной торговли и доступа к международным рынкам». Инициатива содействует налаживанию диалога по многосторонним и региональным торговым соглашениям и способствует формированию и реал изации аграрной торговой политики на уровне стран. Данная публикация является результатом работы Группы экспертов по вопросам сельскохозяйственной торговли в Европе и Центральной Азии, созданной в 2014 году при поддержке ФАО.

Citrus fruit fresh and processed - Statistical Bulletin 2016

01/01/2017

FAO SO4 sets up a FAO ambitious goal to improve market transparency and poverty reduction. The annual citrus bulletin, compiled based on the production and trade survey provided by the member nations, provides unique information on market developments, which contributes to greater market transparency and is widely used by the member governments and citrus growers for decision-making. In particular, given the unique source of information and scope of data coverage, the bulletin is the solo comp rehensive information source over the citrus market world.

GIEWS Special Alert No. 337 - East Africa, 20 December 2016

20/12/2016

Widespread drought severely affects crops and rangelands in East Africa and food insecurity is expected to significantly deteriorate by early 2017 Major areas of concern are central and southern Somalia, South-Eastern Ethiopia, northern and eastern Kenya, northern and eastern United Republic of Tanzania and South-Eastern Uganda Sharply increasing prices of cereals and livestock products constrain food access for large numbers of households Recurrent climatic shocks have undermined household resi lience and urgent support to agriculture is needed.

Food Price Monitoring and Analysis (FPMA) Bulletin #11, 9 December 2016

09/12/2016

International wheat prices showed mixed trends in November but remained below their year-earlier levels on account of ample global supplies. Those of maize were relatively stable with the downward pressure from expectations of bumper crops offset by strong import demand. New crop arrivals and sluggish demand kept quotations of rice generally under pressure. In East Africa, cereal prices increased in most countries and were at levels well above those a year earlier due to localized production shortfalls and uncertain prospects for current crops in some areas. In South Sudan, the further sharp depreciation of the local currency underpinned staple food prices, which increased in November after some declines in the past months. In West Africa, adequate supplies from the good 2016 harvests and carryover stocks from last year’s production led to further price declines in most countries of the subregion. In Nigeria, however, the weak local currency and persisting civil insecurity limited the decline and kept prices at record or near-record highs.

Cereal supply and demand balances for sub-Saharan African countries No.4, December 2016

08/12/2016

Statistical report presenting cereal supply and demand balance for current year in sub-Saharan African countries. This report is based on information available as of November 2016.

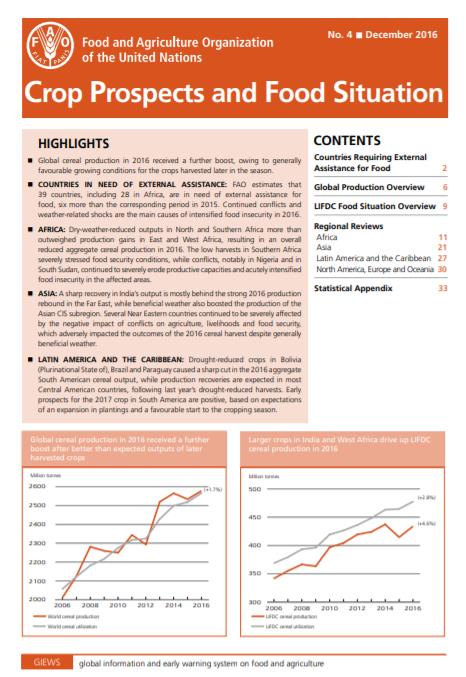

Crop Prospects and Food Situation - Quarterly Global Report, No. 4, December 2016

08/12/2016

The report provides a review of the food situation by geographic region, a section dedicated to the LIFDCs and a list of countries requiring external assistance for food.

Special Report - FAO/WFP Crop and Food Security Assessment Mission to the Syrian Arab Republic - 14 November 2016

14/11/2016

A joint FAO/WFP Crop and Food Security Mission (CFSAM) visited the Syrian Arab Republic between 15 June and 1 July 2016 to estimate crop production and assess the overall food security situation.

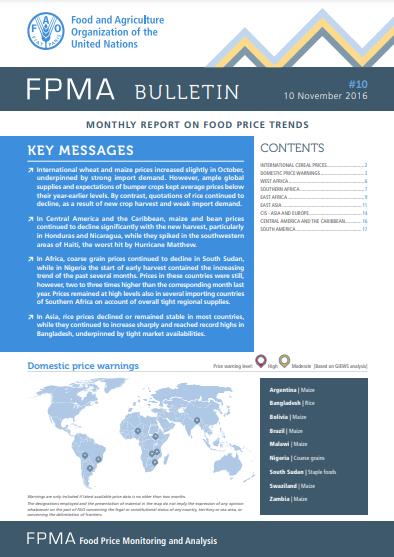

Food Price Monitoring and Analysis (FPMA) Bulletin #10, 10 November 2016

10/11/2016

International wheat and maize prices increased slightly in October, underpinned by strong import demand. However, ample global supplies and expectations of bumper crops kept average prices below their year-earlier levels. By contrast, quotations of rice continued to decline, as a result of new crop harvest and weak import demand. In Central America and the Caribbean, maize and bean prices continued to decline significantly with the new harvest, particularly in Honduras and Nicaragua, while they spiked in the southwestern areas of Haiti, the worst hit by Hurricane Matthew. In Africa, coarse grain prices continued to decline in South Sudan, while in Nigeria the start of early harvest contained the increasing trend of the past several months. Prices in these countries were still, however, two to three times higher than the corresponding month last year. Prices remained at high levels also in several importing countries of Southern Africa on account of overall tight regional supplies. In Asia, rice prices declined or remained stable in most countries, while they continued to increase sharply and reached record highs in Bangladesh, underpinned by tight market availabilities.

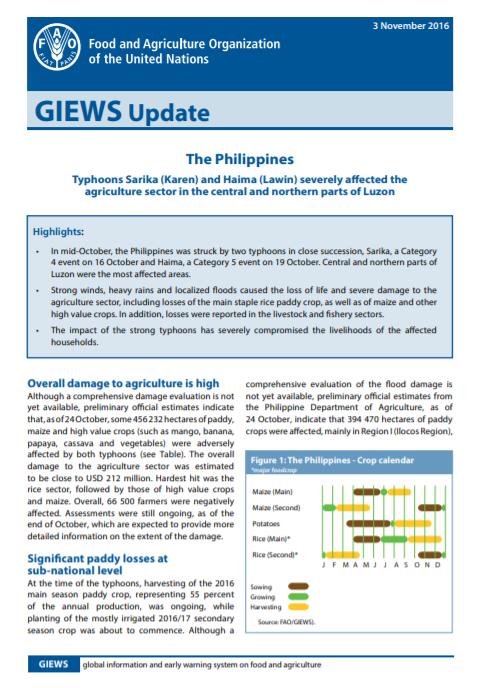

GIEWS Update - The Philippines, 3 November 2016

03/11/2016

In mid-October, the Philippines was struck by two typhoons in close succession, Sarika, a Category 4 event on 16 October and Haima, a Category 5 event on 19 October. Central and northern parts of Luzon were the most affected areas. Strong winds, heavy rains and localized floods caused the loss of life and severe damage to the agriculture sector, including losses of the main staple rice paddy crop, as well as of maize and other high value crops. In addition, losses were reported in the livestock and fishery sectors. The impact of the strong typhoons has severely compromised the livelihoods of the affected households.