Latest publications

Book (series)

Food Outlook – Biannual Report on Global Food Markets - November 2024

14/11/2024

FAO’s latest assessments indicate differing trajectories across different commodities, with wheat, maize, and sugar production set to decline, while...

Book (series)

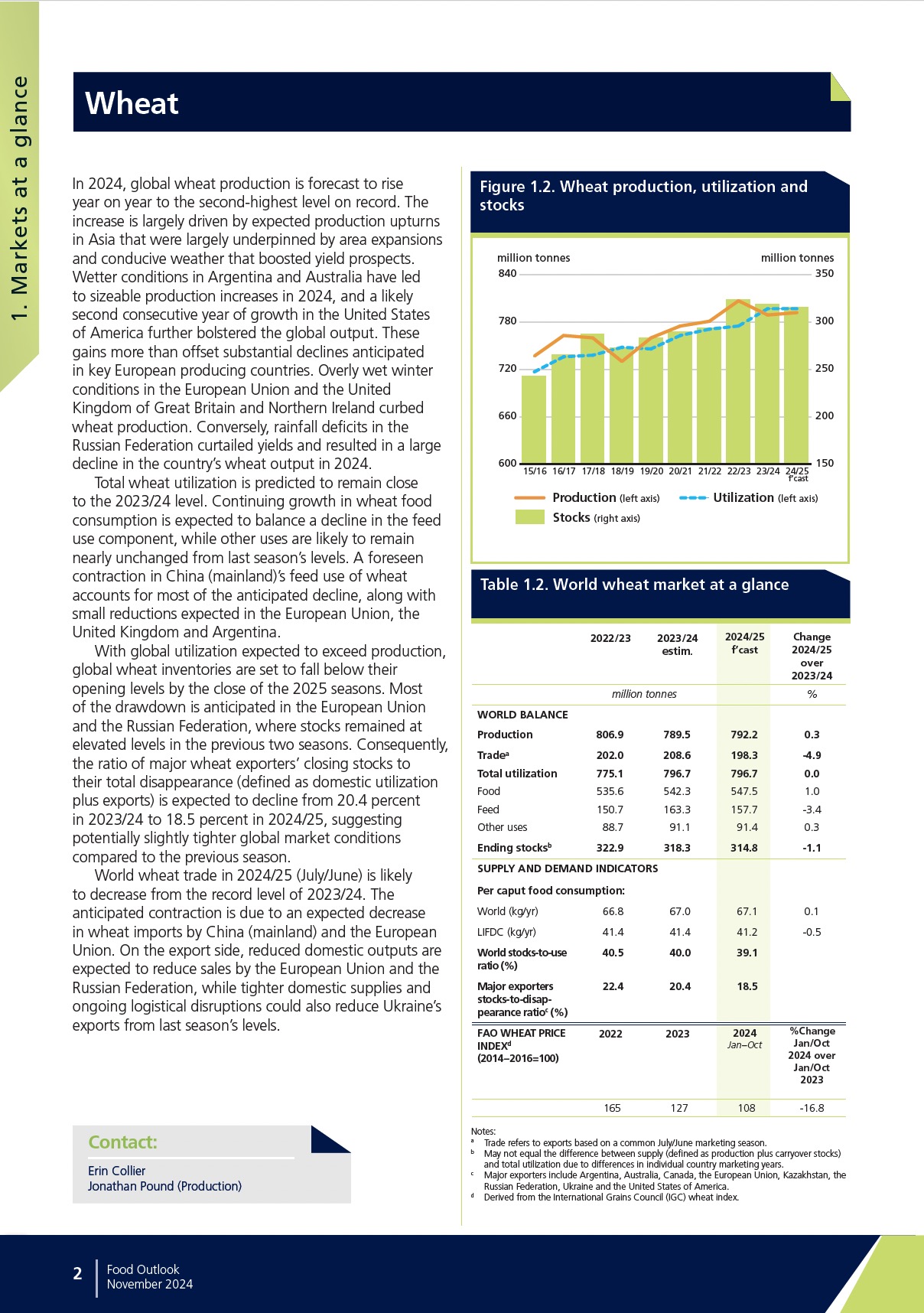

Wheat (Market summary)

14/11/2024

This report provides an analysis of the most recent developments in the global wheat market, including a short-term outlook.

Book (series)

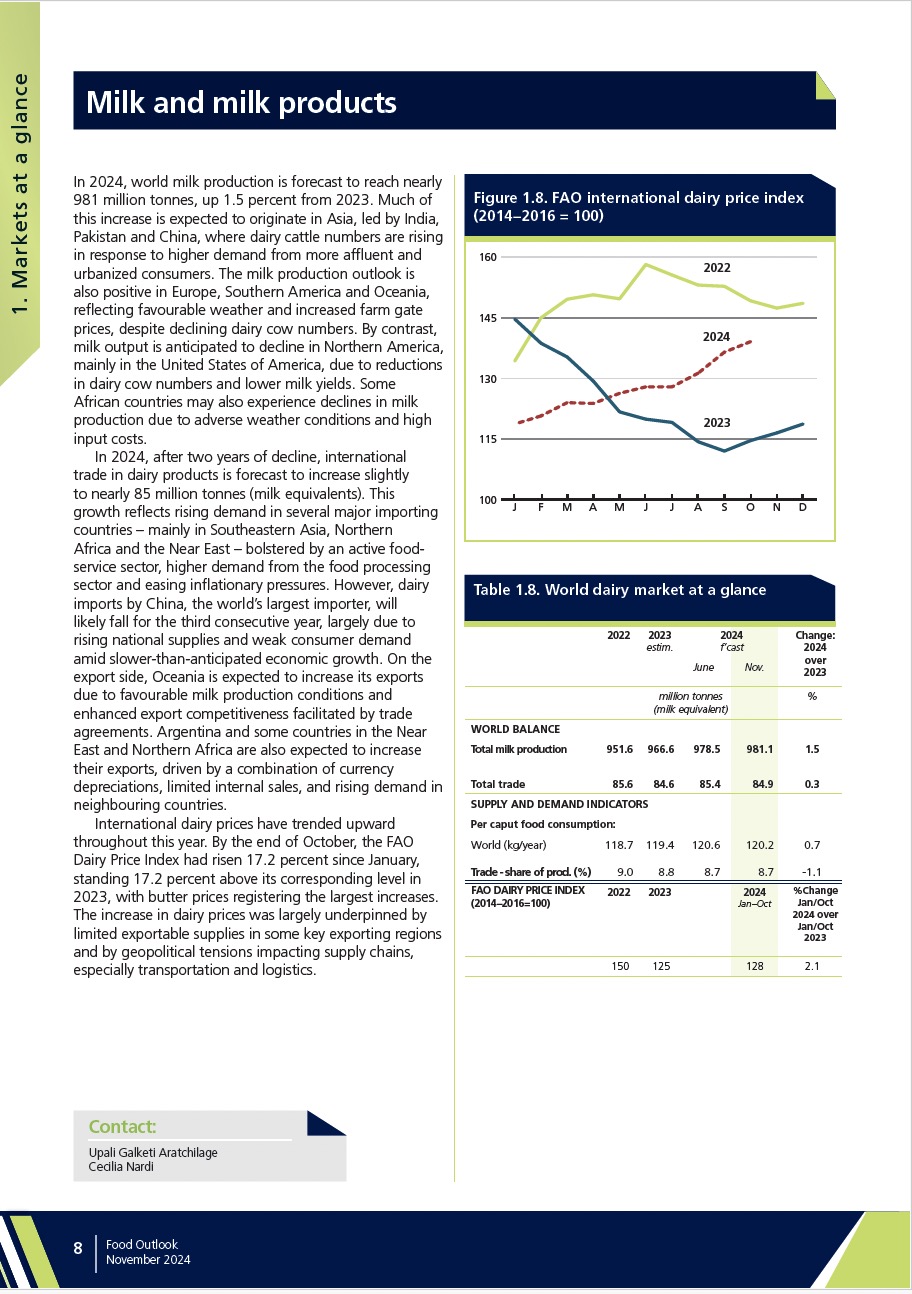

Milk and milk products (Market summary)

14/11/2024

This report provides an analysis of the most recent developments in the global milk market, including a short-term outlook

Book (series)

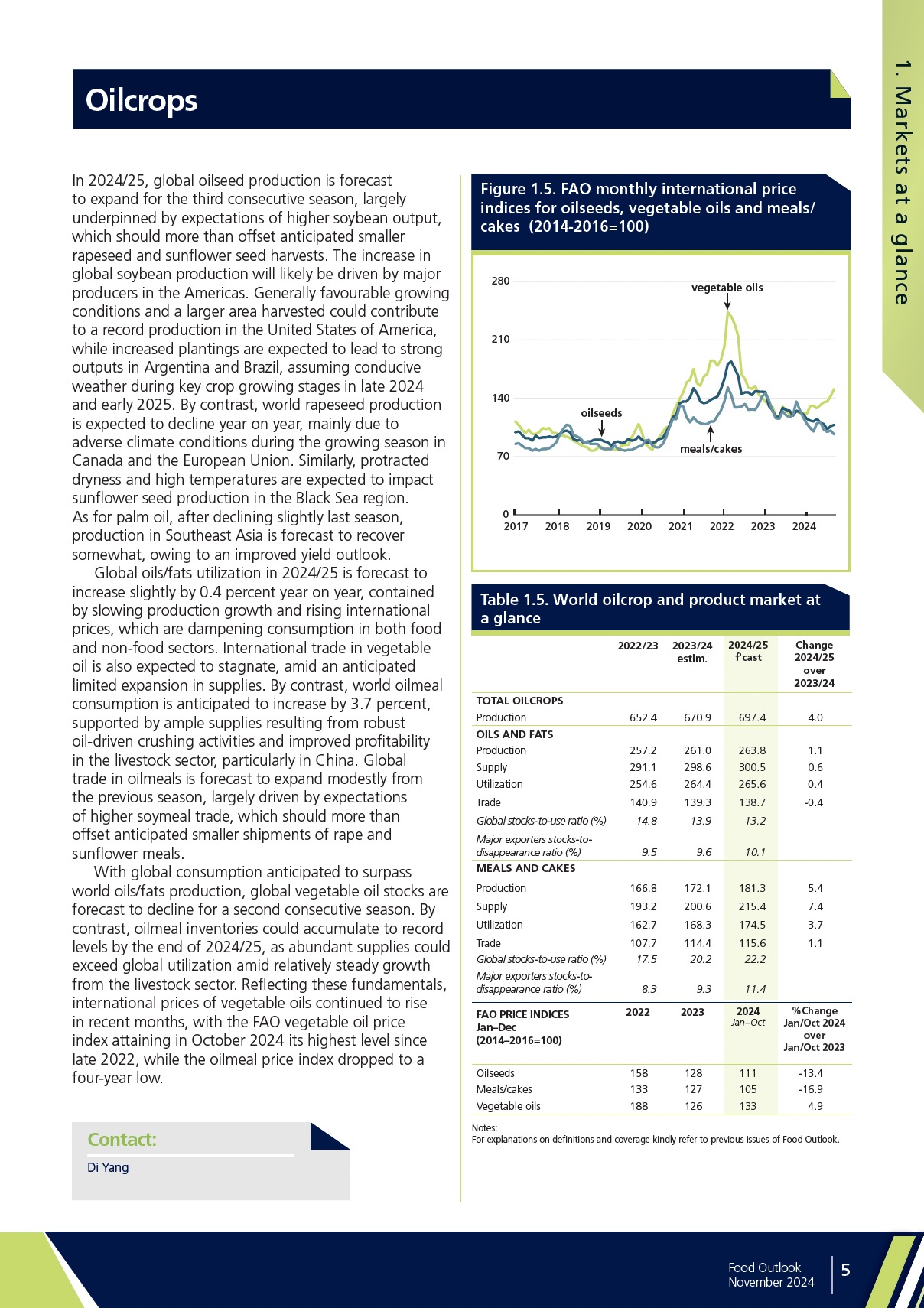

Oilcrops, oils and meals (Market summary)

14/11/2024

This report provides an analysis of the most recent developments in the global oilcrops market, including a short-term outlook.

Publications

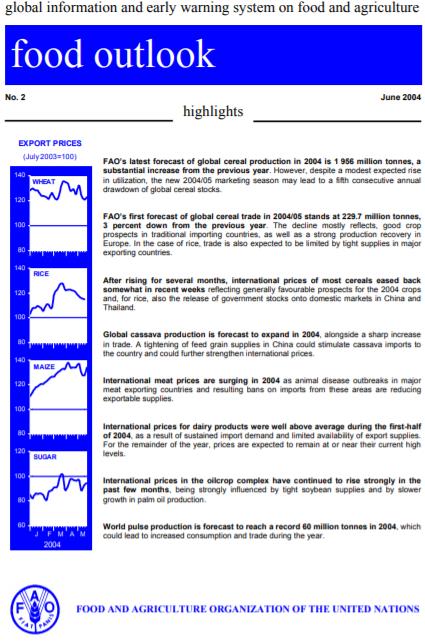

Food Outlook - June 2004

04/06/2004

FAO’s latest forecast of global cereal production in 2004 is 1 956 million tonnes, a substantial increase from the previous year. However, despite a modest expected rise in utilization, the new 2004/05 marketing season may lead to a fifth consecutive annual drawdown of global cereal stocks. FAO’s first forecast of global cereal trade in 2004/05 stands at 229.7 million tonnes, 3 percent down from the previous year. The decline mostly reflects, good crop prospects in traditional importing countries, as well as a strong production recovery in Europe. In the case of rice, trade is also expected to be limited by tight supplies in major exporting countries. After rising for several months, international prices of most cereals eased back somewhat in recent weeks reflecting generally favourable prospects for the 2004 crops and, for rice, also the release of government stocks onto domestic markets in China and Thailand. Global cassava production is forecast to expand in 2004, alongside a sharp increase in trade. A tightening of feed grain supplies in China could stimulate cassava imports to the country and could further strengthen international prices. International meat prices are surging in 2004 as animal disease outbreaks in major meat exporting countries and resulting bans on imports from these areas are reducing exportable supplies. International prices for dairy products were well above average during the first-half of 2004, as a result of sustained import demand and limited availability of export supplies. For the remainder of the year, prices are expected to remain at or near their current high levels. International prices in the oilcrop complex have continued to rise strongly in the past few months, being strongly influenced by tight soybean supplies and by slower growth in palm oil production. World pulse production is forecast to reach a record 60 million tonnes in 2004, which could lead to increased consumption and trade during the year.

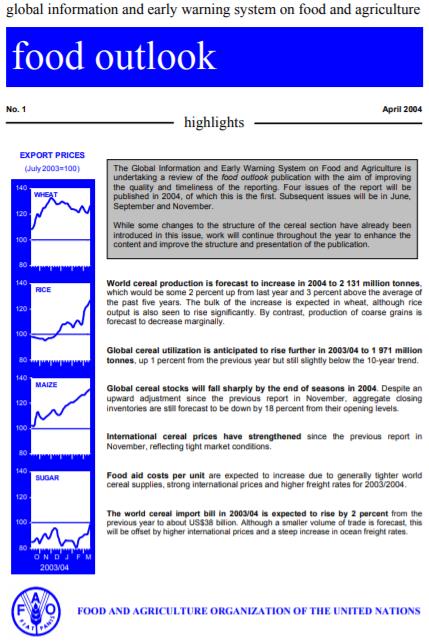

Food Outlook - April 2004

05/04/2004

World cereal production is forecast to increase in 2004 to 2 131 million tonnes, which would be some 2 percent up from last year and 3 percent above the average of the past five years. The bulk of the increase is expected in wheat, although rice output is also seen to rise significantly. By contrast, production of coarse grains is forecast to decrease marginally. Global cereal utilization is anticipated to rise further in 2003/04 to 1 971 million tonnes, up 1 percent from the previous year but still slightly below the 10-year trend. Global cereal stocks will fall sharply by the end of seasons in 2004. Despite an upward adjustment since the previous report in November, aggregate closing inventories are still forecast to be down by 18 percent from their opening levels. International cereal prices have strengthened since the previous report in November, reflecting tight market conditions. Food aid costs per unit are expected to increase due to generally tighter world cereal supplies, strong international prices and higher freight rates for 2003/2004. The world cereal import bill in 2003/04 is expected to rise by 2 percent from the previous year to about US$38 billion. Although a smaller volume of trade is forecast, this will be offset by higher international prices and a steep increase in ocean freight rates.

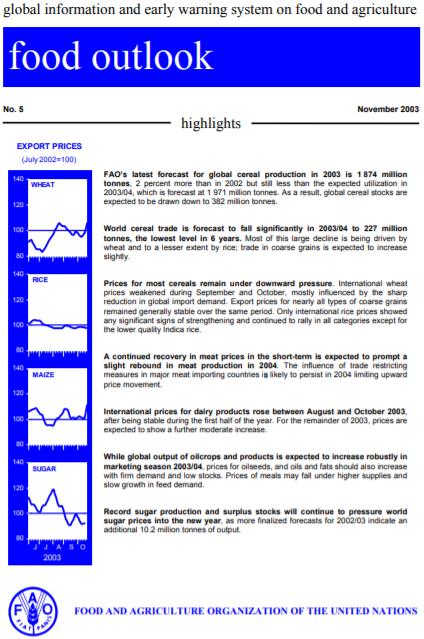

Food Outlook - November 2003

03/11/2003

FAO’s latest forecast for global cereal production in 2003 is 1 874 million tonnes, 2 percent more than in 2002 but still less than the expected utilization in 2003/04, which is forecast at 1 971 million tonnes. As a result, global cereal stocks are expected to be drawn down to 382 million tonnes. World cereal trade is forecast to fall significantly in 2003/04 to 227 million tonnes, the lowest level in 6 years. Most of this large decline is being driven by wheat and to a lesser extent by rice; trade in coarse grains is expected to increase slightly. Prices for most cereals remain under downward pressure. International wheat prices weakened during September and October, mostly influenced by the sharp reduction in global import demand. Export prices for nearly all types of coarse grains remained generally stable over the same period. Only international rice prices showed any significant signs of strengthening and continued to rally in all categories except for the lower quality Indica rice. A continued recovery in meat prices in the short-term is expected to prompt a slight rebound in meat production in 2004. The influence of trade restricting measures in major meat importing countries is likely to persist in 2004 limiting upward price movement. International prices for dairy products rose between August and October 2003, after being stable during the first half of the year. For the remainder of 2003, prices are expected to show a further moderate increase. While global output of oilcrops and products is expected to increase robustly in marketing season 2003/04, prices for oilseeds, and oils and fats should also increase with firm demand and low stocks. Prices of meals may fall under higher supplies and slow growth in feed demand. Record sugar production and surplus stocks will continue to pressure world sugar prices into the new year, as more finalized forecasts for 2002/03 indicate an additional 10.2 million tonnes of output.

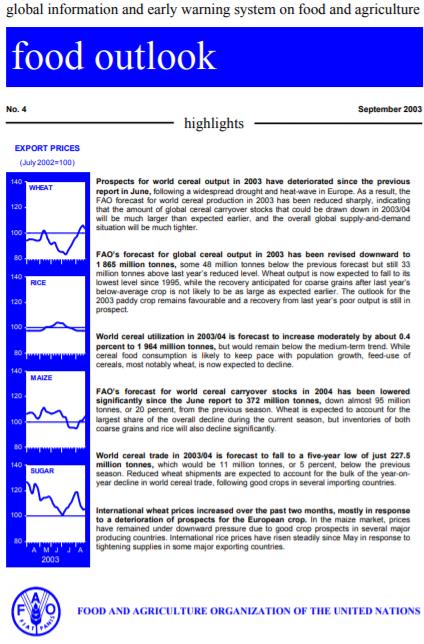

Food Outlook - September 2003

05/09/2003

Prospects for world cereal output in 2003 have deteriorated since the previous report in June, following a widespread drought and heat-wave in Europe. As a result, the FAO forecast for world cereal production in 2003 has been reduced sharply, indicating that the amount of global cereal carryover stocks that could be drawn down in 2003/04 will be much larger than expected earlier, and the overall global supply-and-demand situation will be much tighter. FAO’s forecast for global cereal output in 2003 has been revised downward to 1 865 million tonnes, some 48 million tonnes below the previous forecast but still 33 million tonnes above last year’s reduced level. Wheat output is now expected to fall to its lowest level since 1995, while the recovery anticipated for coarse grains after last year’s below-average crop is not likely to be as large as expected earlier. The outlook for the 2003 paddy crop remains favourable and a recovery from last year’s poor output is still in prospect. World cereal utilization in 2003/04 is forecast to increase moderately by about 0.4 percent to 1 964 million tonnes, but would remain below the medium-term trend. While cereal food consumption is likely to keep pace with population growth, feed-use of cereals, most notably wheat, is now expected to decline. FAO’s forecast for world cereal carryover stocks in 2004 has been lowered significantly since the June report to 372 million tonnes, down almost 95 million tonnes, or 20 percent, from the previous season. Wheat is expected to account for the largest share of the overall decline during the current season, but inventories of both coarse grains and rice will also decline significantly. World cereal trade in 2003/04 is forecast to fall to a five-year low of just 227.5 million tonnes, which would be 11 million tonnes, or 5 percent, below the previous season. Reduced wheat shipments are expected to account for the bulk of the year-onyear decline in world cereal trade, following good crops in several importing countries. International wheat prices increased over the past two months, mostly in response to a deterioration of prospects for the European crop. In the maize market, prices have remained under downward pressure due to good crop prospects in several major producing countries. International rice prices have risen steadily since May in response to tightening supplies in some major exporting countries.

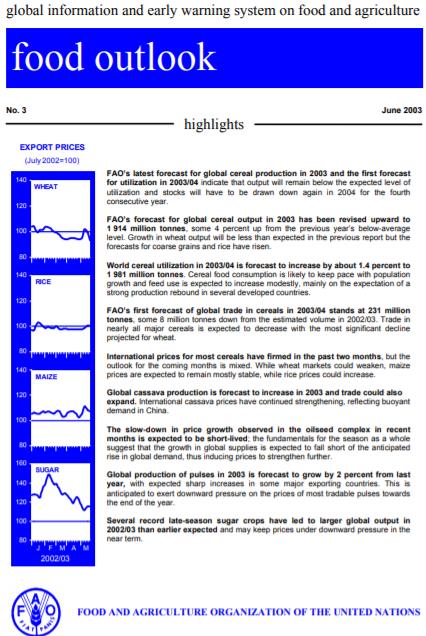

Food Outlook - June 2003

04/06/2003

FAO’s latest forecast for global cereal production in 2003 and the first forecast for utilization in 2003/04 indicate that output will remain below the expected level of utilization and stocks will have to be drawn down again in 2004 for the fourth consecutive year. FAO’s forecast for global cereal output in 2003 has been revised upward to 1 914 million tonnes, some 4 percent up from the previous year’s below-average level. Growth in wheat output will be less than expected in the previous report but the forecasts for coarse grains and rice have risen. World cereal utilization in 2003/04 is forecast to increase by about 1.4 percent to 1 981 million tonnes. Cereal food consumption is likely to keep pace with population growth and feed use is expected to increase modestly, mainly on the expectation of a strong production rebound in several developed countries. FAO’s first forecast of global trade in cereals in 2003/04 stands at 231 million tonnes, some 8 million tonnes down from the estimated volume in 2002/03. Trade in nearly all major cereals is expected to decrease with the most significant decline projected for wheat. International prices for most cereals have firmed in the past two months, but the outlook for the coming months is mixed. While wheat markets could weaken, maize prices are expected to remain mostly stable, while rice prices could increase. Global cassava production is forecast to increase in 2003 and trade could also expand. International cassava prices have continued strengthening, reflecting buoyant demand in China. The slow-down in price growth observed in the oilseed complex in recent months is expected to be short-lived; the fundamentals for the season as a whole suggest that the growth in global supplies is expected to fall short of the anticipated rise in global demand, thus inducing prices to strengthen further. Global production of pulses in 2003 is forecast to grow by 2 percent from last year, with expected sharp increases in some major exporting countries. This is anticipated to exert downward pressure on the prices of most tradable pulses towards the end of the year. Several record late-season sugar crops have led to larger global output in 2002/03 than earlier expected and may keep prices under downward pressure in the near term.

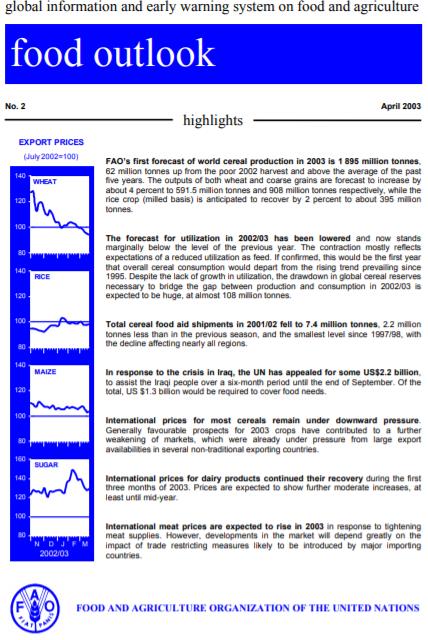

Food Outlook - April 2003

04/04/2003

FAO’s first forecast of world cereal production in 2003 is 1 895 million tonnes, 62 million tonnes up from the poor 2002 harvest and above the average of the past five years. The outputs of both wheat and coarse grains are forecast to increase by about 4 percent to 591.5 million tonnes and 908 million tonnes respectively, while the rice crop (milled basis) is anticipated to recover by 2 percent to about 395 million tonnes. The forecast for utilization in 2002/03 has been lowered and now stands marginally below the level of the previous year. The contraction mostly reflects expectations of a reduced utilization as feed. If confirmed, this would be the first year that overall cereal consumption would depart from the rising trend prevailing since 1995. Despite the lack of growth in utilization, the drawdown in global cereal reserves necessary to bridge the gap between production and consumption in 2002/03 is expected to be huge, at almost 108 million tonnes. Total cereal food aid shipments in 2001/02 fell to 7.4 million tonnes, 2.2 million tonnes less than in the previous season, and the smallest level since 1997/98, with the decline affecting nearly all regions. In response to the crisis in Iraq, the UN has appealed for some US$2.2 billion, to assist the Iraqi people over a six-month period until the end of September. Of the total, US $1.3 billion would be required to cover food needs. International prices for most cereals remain under downward pressure. Generally favourable prospects for 2003 crops have contributed to a further weakening of markets, which were already under pressure from large export availabilities in several non-traditional exporting countries. International prices for dairy products continued their recovery during the first three months of 2003. Prices are expected to show further moderate increases, at least until mid-year. International meat prices are expected to rise in 2003 in response to tightening meat supplies. However, developments in the market will depend greatly on the impact of trade restricting measures likely to be introduced by major importing countries.

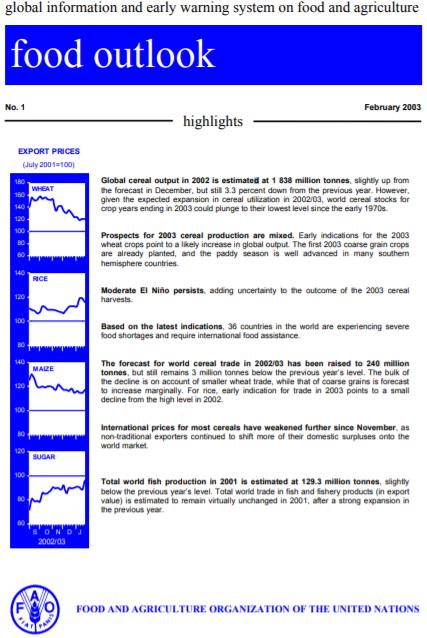

Food Outlook - February 2003

03/02/2003

Global cereal output in 2002 is estimated at 1 838 million tonnes, slightly up from the forecast in December, but still 3.3 percent down from the previous year. However, given the expected expansion in cereal utilization in 2002/03, world cereal stocks for crop years ending in 2003 could plunge to their lowest level since the early 1970s. Prospects for 2003 cereal production are mixed. Early indications for the 2003 wheat crops point to a likely increase in global output. The first 2003 coarse grain crops are already planted, and the paddy season is well advanced in many southern hemisphere countries. Moderate El Niño persists, adding uncertainty to the outcome of the 2003 cereal harvests. Based on the latest indications, 36 countries in the world are experiencing severe food shortages and require international food assistance. The forecast for world cereal trade in 2002/03 has been raised to 240 million tonnes, but still remains 3 million tonnes below the previous year’s level. The bulk of the decline is on account of smaller wheat trade, while that of coarse grains is forecast to increase marginally. For rice, early indication for trade in 2003 points to a small decline from the high level in 2002. International prices for most cereals have weakened further since November, as non-traditional exporters continued to shift more of their domestic surpluses onto the world market. Total world fish production in 2001 is estimated at 129.3 million tonnes, slightly below the previous year’s level. Total world trade in fish and fishery products (in export value) is estimated to remain virtually unchanged in 2001, after a strong expansion in the previous year.

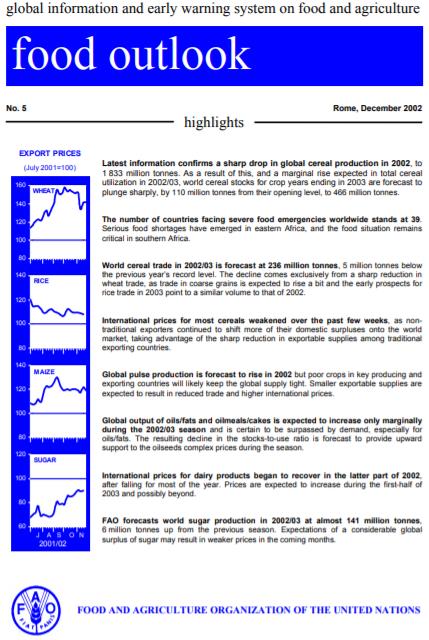

Food Outlook - December 2002

02/12/2002

Latest information confirms a sharp drop in global cereal production in 2002, to 1 833 million tonnes. As a result of this, and a marginal rise expected in total cereal utilization in 2002/03, world cereal stocks for crop years ending in 2003 are forecast to plunge sharply, by 110 million tonnes from their opening level, to 466 million tonnes. The number of countries facing severe food emergencies worldwide stands at 39. Serious food shortages have emerged in eastern Africa, and the food situation remains critical in southern Africa. World cereal trade in 2002/03 is forecast at 236 million tonnes, 5 million tonnes below the previous year’s record level. The decline comes exclusively from a sharp reduction in wheat trade, as trade in coarse grains is expected to rise a bit and the early prospects for rice trade in 2003 point to a similar volume to that of 2002. International prices for most cereals weakened over the past few weeks, as nontraditional exporters continued to shift more of their domestic surpluses onto the world market, taking advantage of the sharp reduction in exportable supplies among traditional exporting countries. Global pulse production is forecast to rise in 2002 but poor crops in key producing and exporting countries will likely keep the global supply tight. Smaller exportable supplies are expected to result in reduced trade and higher international prices. Global output of oils/fats and oilmeals/cakes is expected to increase only marginally during the 2002/03 season and is certain to be surpassed by demand, especially for oils/fats. The resulting decline in the stocks-to-use ratio is forecast to provide upward support to the oilseeds complex prices during the season. International prices for dairy products began to recover in the latter part of 2002, after falling for most of the year. Prices are expected to increase during the first-half of 2003 and possibly beyond. FAO forecasts world sugar production in 2002/03 at almost 141 million tonnes, 6 million tonnes up from the previous season. Expectations of a considerable global surplus of sugar may result in weaker prices in the coming months.

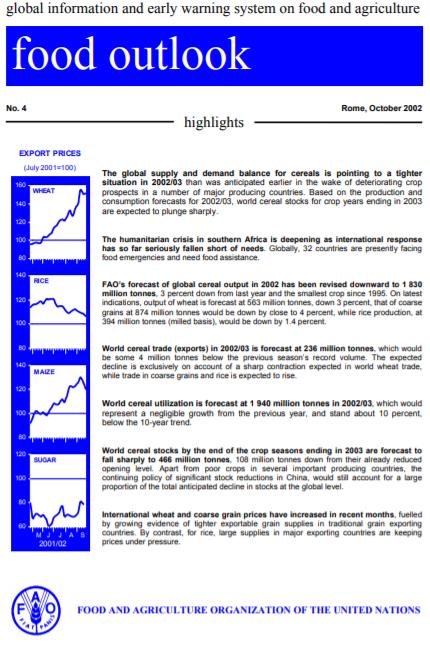

Food Outlook - October 2002

02/10/2002

The global supply and demand balance for cereals is pointing to a tighter situation in 2002/03 than was anticipated earlier in the wake of deteriorating crop prospects in a number of major producing countries. Based on the production and consumption forecasts for 2002/03, world cereal stocks for crop years ending in 2003 are expected to plunge sharply. The humanitarian crisis in southern Africa is deepening as international response has so far seriously fallen short of needs. Globally, 32 countries are presently facing food emergencies and need food assistance. FAO’s forecast of global cereal output in 2002 has been revised downward to 1 830 million tonnes, 3 percent down from last year and the smallest crop since 1995. On latest indications, output of wheat is forecast at 563 million tonnes, down 3 percent, that of coarse grains at 874 million tonnes would be down by close to 4 percent, while rice production, at 394 million tonnes (milled basis), would be down by 1.4 percent. World cereal trade (exports) in 2002/03 is forecast at 236 million tonnes, which would be some 4 million tonnes below the previous season’s record volume. The expected decline is exclusively on account of a sharp contraction expected in world wheat trade, while trade in coarse grains and rice is expected to rise. World cereal utilization is forecast at 1 940 million tonnes in 2002/03, which would represent a negligible growth from the previous year, and stand about 10 percent, below the 10-year trend. World cereal stocks by the end of the crop seasons ending in 2003 are forecast to fall sharply to 466 million tonnes, 108 million tonnes down from their already reduced opening level. Apart from poor crops in several important producing countries, the continuing policy of significant stock reductions in China, would still account for a large proportion of the total anticipated decline in stocks at the global level. International wheat and coarse grain prices have increased in recent months, fuelled by growing evidence of tighter exportable grain supplies in traditional grain exporting countries. By contrast, for rice, large supplies in major exporting countries are keeping prices under pressure. FOOD AND AGRICULTUR

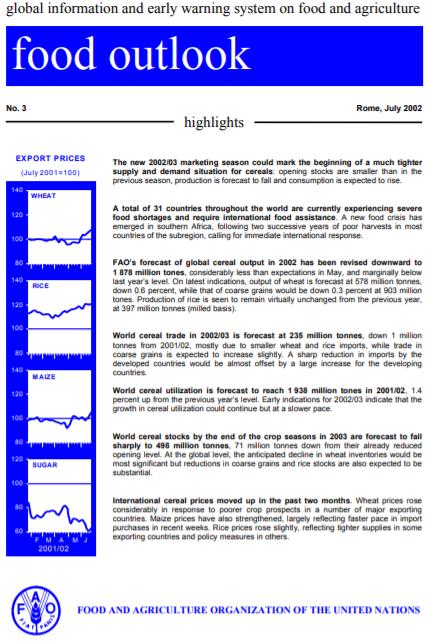

Food Outlook - July 2002

02/07/2002

The new 2002/03 marketing season could mark the beginning of a much tighter supply and demand situation for cereals: opening stocks are smaller than in the previous season, production is forecast to fall and consumption is expected to rise. A total of 31 countries throughout the world are currently experiencing severe food shortages and require international food assistance. A new food crisis has emerged in southern Africa, following two successive years of poor harvests in most countries of the subregion, calling for immediate international response. FAO’s forecast of global cereal output in 2002 has been revised downward to 1 878 million tones, considerably less than expectations in May, and marginally below last year’s level. On latest indications, output of wheat is forecast at 578 million tonnes, down 0.6 percent, while that of coarse grains would be down 0.3 percent at 903 million tones. Production of rice is seen to remain virtually unchanged from the previous year, at 397 million tonnes (milled basis). World cereal trade in 2002/03 is forecast at 235 million tonnes, down 1 million tonnes from 2001/02, mostly due to smaller wheat and rice imports, while trade in coarse grains is expected to increase slightly. A sharp reduction in imports by the developed countries would be almost offset by a large increase for the developing countries. World cereal utilization is forecast to reach 1 938 million tones in 2001/02, 1.4 percent up from the previous year’s level. Early indications for 2002/03 indicate that the growth in cereal utilization could continue but at a slower pace. World cereal stocks by the end of the crop seasons in 2003 are forecast to fall sharply to 498 million tonnes, 71 million tonnes down from their already reduced opening level. At the global level, the anticipated decline in wheat inventories would be most significant but reductions in coarse grains and rice stocks are also expected to be substantial. International cereal prices moved up in the past two months. Wheat prices rose considerably in response to poorer crop prospects in a number of major exporting countries. Maize prices have also strengthened, largely reflecting faster pace in import purchases in recent weeks. Rice prices rose slightly, reflecting tighter supplies in some exporting countries and policy measures in others.

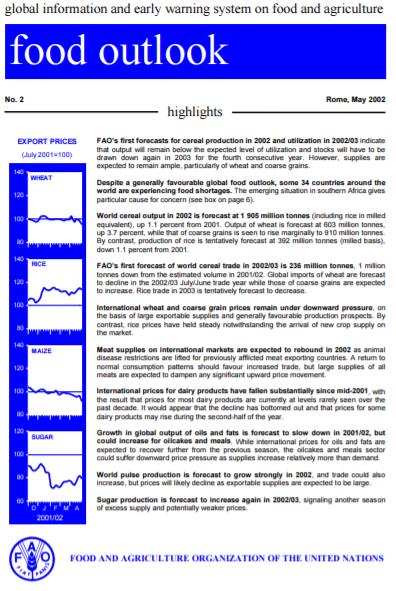

Food Outlook - May 2002

03/05/2002

FAO’s first forecasts for cereal production in 2002 and utilization in 2002/03 indicate that output will remain below the expected level of utilization and stocks will have to be drawn down again in 2003 for the fourth consecutive year. However, supplies are expected to remain ample, particularly of wheat and coarse grains. Despite a generally favourable global food outlook, some 34 countries around the world are experiencing food shortages. The emerging situation in southern Africa gives particular cause for concern. World cereal output in 2002 is forecast at 1 905 million tonnes (including rice in milled equivalent), up 1.1 percent from 2001. Output of wheat is forecast at 603 million tonnes, up 3.7 percent, while that of coarse grains is seen to rise marginally to 910 million tonnes. By contrast, production of rice is tentatively forecast at 392 million tonnes (milled basis), down 1.1 percent from 2001. FAO’s first forecast of world cereal trade in 2002/03 is 236 million tonnes, 1 million tonnes down from the estimated volume in 2001/02. Global imports of wheat are forecast to decline in the 2002/03 July/June trade year while those of coarse grains are expected to increase. Rice trade in 2003 is tentatively forecast to decrease. International wheat and coarse grain prices remain under downward pressure, on the basis of large exportable supplies and generally favourable production prospects. By contrast, rice prices have held steady notwithstanding the arrival of new crop supply on the market. Meat supplies on international markets are expected to rebound in 2002 as animal disease restrictions are lifted for previously afflicted meat exporting countries. A return to normal consumption patterns should favour increased trade, but large supplies of all meats are expected to dampen any significant upward price movement. International prices for dairy products have fallen substantially since mid-2001, with the result that prices for most dairy products are currently at levels rarely seen over the past decade. It would appear that the decline has bottomed out and that prices for some dairy products may rise during the second-half of the year. Growth in global output of oils and fats is forecast to slow down in 2001/02, but could increase for oilcakes and meals. While international prices for oils and fats are expected to recover further from the previous season, the oilcakes and meals sector could suffer downward price pressure as supplies increase relatively more than demand. World pulse production is forecast to grow strongly in 2002, and trade could also increase, but prices will likely decline as exportable supplies are expected to be large. Sugar production is forecast to increase again in 2002/03, signaling another season of excess supply and potentially weaker prices.

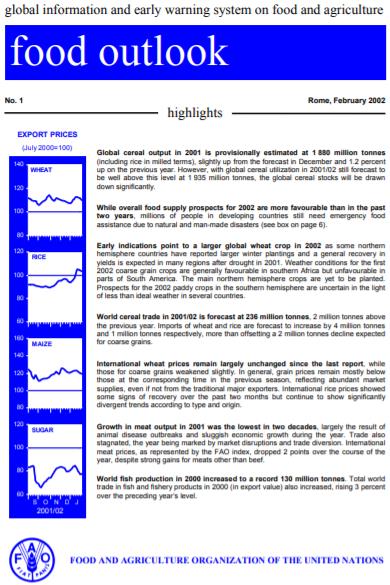

Food Outlook - February 2002

04/02/2002

Global cereal output in 2001 is provisionally estimated at 1 880 million tonnes (including rice in milled terms), slightly up from the forecast in December and 1.2 percent up on the previous year. However, with global cereal utilization in 2001/02 still forecast to be well above this level at 1 935 million tonnes, the global cereal stocks will be drawn down significantly.

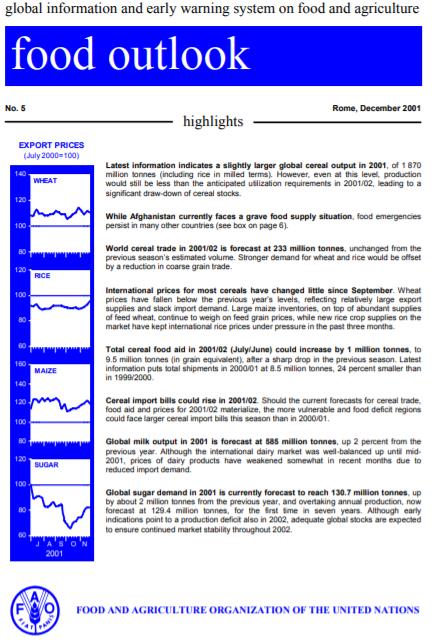

Food Outlook - December 2001

03/12/2001

Latest information indicates a slightly larger global cereal output in 2001, of 1 870 million tonnes (including rice in milled terms). However, even at this level, production would still be less than the anticipated utilization requirements in 2001/02, leading to a significant draw-down of cereal stocks. While Afghanistan currently faces a grave food supply situation, food emergencies persist in many other countries. World cereal trade in 2001/02 is forecast at 233 million tonnes, unchanged from the previous season’s estimated volume. Stronger demand for wheat and rice would be offset by a reduction in coarse grain trade. International prices for most cereals have changed little since September. Wheat prices have fallen below the previous year’s levels, reflecting relatively large export supplies and slack import demand. Large maize inventories, on top of abundant supplies of feed wheat, continue to weigh on feed grain prices, while new rice crop supplies on the market have kept international rice prices under pressure in the past three months. Total cereal food aid in 2001/02 (July/June) could increase by 1 million tonnes, to 9.5 million tonnes (in grain equivalent), after a sharp drop in the previous season. Latest information puts total shipments in 2000/01 at 8.5 million tonnes, 24 percent smaller than in 1999/2000. Cereal import bills could rise in 2001/02. Should the current forecasts for cereal trade, food aid and prices for 2001/02 materialize, the more vulnerable and food deficit regions could face larger cereal import bills this season than in 2000/01. Global milk output in 2001 is forecast at 585 million tonnes, up 2 percent from the previous year. Although the international dairy market was well-balanced up until mid2001, prices of dairy products have weakened somewhat in recent months due to reduced import demand. Global sugar demand in 2001 is currently forecast to reach 130.7 million tonnes, up by about 2 million tonnes from the previous year, and overtaking annual production, now forecast at 129.4 million tonnes, for the first time in seven years. Although early indications point to a production deficit also in 2002, adequate global stocks are expected to ensure continued market stability throughout 2002.

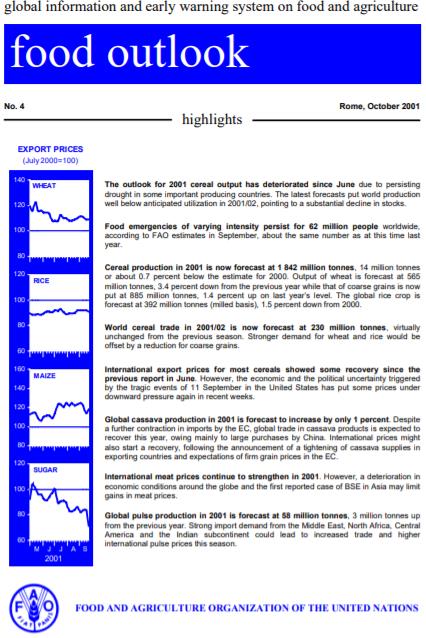

Food Outlook - October 2001

03/10/2001

The outlook for 2001 cereal output has deteriorated since June due to persisting drought in some important producing countries. The latest forecasts put world production well below anticipated utilization in 2001/02, pointing to a substantial decline in stocks. Food emergencies of varying intensity persist for 62 million people worldwide, according to FAO estimates in September, about the same number as at this time last year. Cereal production in 2001 is now forecast at 1 842 million tonnes, 14 million tonnes or about 0.7 percent below the estimate for 2000. Output of wheat is forecast at 565 million tonnes, 3.4 percent down from the previous year while that of coarse grains is now put at 885 million tonnes, 1.4 percent up on last year’s level. The global rice crop is forecast at 392 million tonnes (milled basis), 1.5 percent down from 2000. World cereal trade in 2001/02 is now forecast at 230 million tonnes, virtually unchanged from the previous season. Stronger demand for wheat and rice would be offset by a reduction for coarse grains. International export prices for most cereals showed some recovery since the previous report in June. However, the economic and the political uncertainty triggered by the tragic events of 11 September in the United States has put some prices under downward pressure again in recent weeks. Global cassava production in 2001 is forecast to increase by only 1 percent. Despite a further contraction in imports by the EC, global trade in cassava products is expected to recover this year, owing mainly to large purchases by China. International prices might also start a recovery, following the announcement of a tightening of cassava supplies in exporting countries and expectations of firm grain prices in the EC. International meat prices continue to strengthen in 2001. However, a deterioration in economic conditions around the globe and the first reported case of BSE in Asia may limit gains in meat prices. Global pulse production in 2001 is forecast at 58 million tonnes, 3 million tonnes up from the previous year. Strong import demand from the Middle East, North Africa, Central America and the Indian subcontinent could lead to increased trade and higher international pulse prices this season.

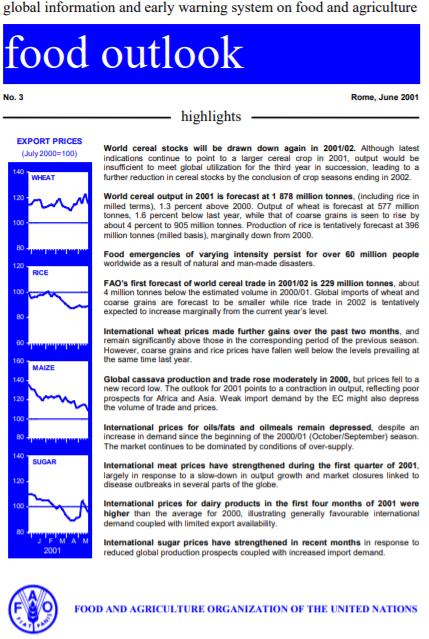

Food Outlook - June 2001

04/06/2001

World cereal stocks will be drawn down again in 2001/02. Although latest indications continue to point to a larger cereal crop in 2001, output would be insufficient to meet global utilization for the third year in succession, leading to a further reduction in cereal stocks by the conclusion of crop seasons ending in 2002. World cereal output in 2001 is forecast at 1 878 million tonnes, (including rice in milled terms), 1.3 percent above 2000. Output of wheat is forecast at 577 million tonnes, 1.6 percent below last year, while that of coarse grains is seen to rise by about 4 percent to 905 million tonnes. Production of rice is tentatively forecast at 396 million tonnes (milled basis), marginally down from 2000. Food emergencies of varying intensity persist for over 60 million people worldwide as a result of natural and man-made disasters. FAO’s first forecast of world cereal trade in 2001/02 is 229 million tonnes, about 4 million tonnes below the estimated volume in 2000/01. Global imports of wheat and coarse grains are forecast to be smaller while rice trade in 2002 is tentatively expected to increase marginally from the current year’s level. International wheat prices made further gains over the past two months, and remain significantly above those in the corresponding period of the previous season. However, coarse grains and rice prices have fallen well below the levels prevailing at the same time last year. Global cassava production and trade rose moderately in 2000, but prices fell to a new record low. The outlook for 2001 points to a contraction in output, reflecting poor prospects for Africa and Asia. Weak import demand by the EC might also depress the volume of trade and prices. International prices for oils/fats and oilmeals remain depressed, despite an increase in demand since the beginning of the 2000/01 (October/September) season. The market continues to be dominated by conditions of over-supply. International meat prices have strengthened during the first quarter of 2001, largely in response to a slow-down in output growth and market closures linked to disease outbreaks in several parts of the globe. International prices for dairy products in the first four months of 2001 were higher than the average for 2000, illustrating generally favourable international demand coupled with limited export availability. International sugar prices have strengthened in recent months in response to reduced global production prospects coupled with increased import demand.

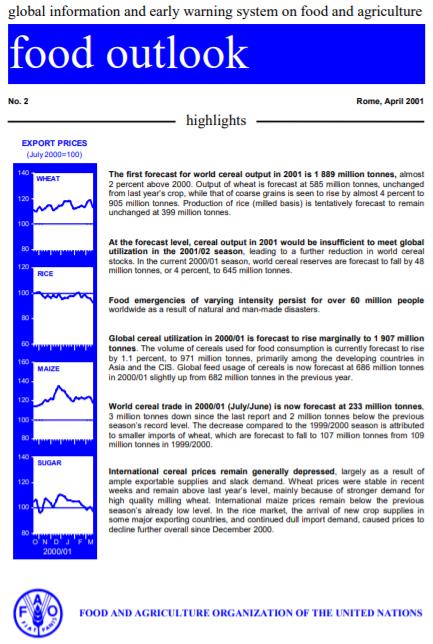

Food Outlook - April 2001

02/04/2001

The first forecast for world cereal output in 2001 is 1 889 million tonnes, almost 2 percent above 2000. Output of wheat is forecast at 585 million tonnes, unchanged from last year’s crop, while that of coarse grains is seen to rise by almost 4 percent to 905 million tonnes. Production of rice (milled basis) is tentatively forecast to remain unchanged at 399 million tonnes. At the forecast level, cereal output in 2001 would be insufficient to meet global utilization in the 2001/02 season, leading to a further reduction in world cereal stocks. In the current 2000/01 season, world cereal reserves are forecast to fall by 48 million tonnes, or 4 percent, to 645 million tonnes. Food emergencies of varying intensity persist for over 60 million people worldwide as a result of natural and man-made disasters. Global cereal utilization in 2000/01 is forecast to rise marginally to 1 907 million tonnes. The volume of cereals used for food consumption is currently forecast to rise by 1.1 percent, to 971 million tonnes, primarily among the developing countries in Asia and the CIS. Global feed usage of cereals is now forecast at 686 million tonnes in 2000/01 slightly up from 682 million tonnes in the previous year. World cereal trade in 2000/01 (July/June) is now forecast at 233 million tonnes, 3 million tonnes down since the last report and 2 million tonnes below the previous season’s record level. The decrease compared to the 1999/2000 season is attributed to smaller imports of wheat, which are forecast to fall to 107 million tonnes from 109 million tonnes in 1999/2000. International cereal prices remain generally depressed, largely as a result of ample exportable supplies and slack demand. Wheat prices were stable in recent weeks and remain above last year’s level, mainly because of stronger demand for high quality milling wheat. International maize prices remain below the previous season’s already low level. In the rice market, the arrival of new crop supplies in some major exporting countries, and continued dull import demand, caused prices to decline further overall since December 2000.

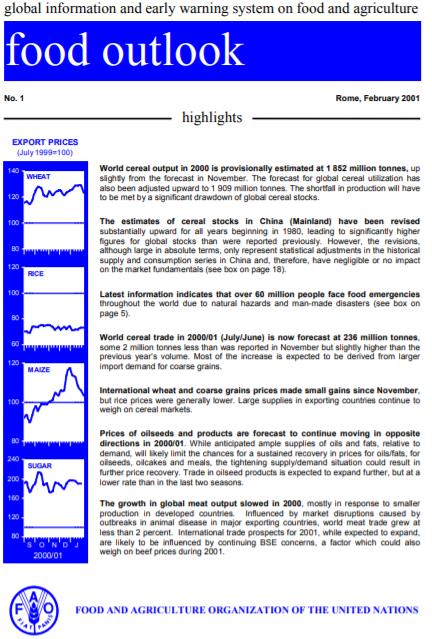

Food Outlook - February 2001

05/02/2001

World cereal output in 2000 is provisionally estimated at 1 852 million tonnes, up slightly from the forecast in November. The forecast for global cereal utilization has also been adjusted upward to 1 909 million tonnes. The shortfall in production will have to be met by a significant drawdown of global cereal stocks. The estimates of cereal stocks in China (Mainland) have been revised substantially upward for all years beginning in 1980, leading to significantly higher figures for global stocks than were reported previously. However, the revisions, although large in absolute terms, only represent statistical adjustments in the historical supply and consumption series in China and, therefore, have negligible or no impact on the market fundamentals. Latest information indicates that over 60 million people face food emergencies throughout the world due to natural hazards and man-made disasters. World cereal trade in 2000/01 (July/June) is now forecast at 236 million tonnes, some 2 million tonnes less than was reported in November but slightly higher than the previous year’s volume. Most of the increase is expected to be derived from larger import demand for coarse grains. International wheat and coarse grains prices made small gains since November, but rice prices were generally lower. Large supplies in exporting countries continue to weigh on cereal markets. Prices of oilseeds and products are forecast to continue moving in opposite directions in 2000/01. While anticipated ample supplies of oils and fats, relative to demand, will likely limit the chances for a sustained recovery in prices for oils/fats, for oilseeds, oilcakes and meals, the tightening supply/demand situation could result in further price recovery. Trade in oilseed products is expected to expand further, but at a lower rate than in the last two seasons. The growth in global meat output slowed in 2000, mostly in response to smaller production in developed countries. Influenced by market disruptions caused by outbreaks in animal disease in major exporting countries, world meat trade grew at less than 2 percent. International trade prospects for 2001, while expected to expand, are likely to be influenced by continuing BSE concerns, a factor which could also weigh on beef prices during 2001.

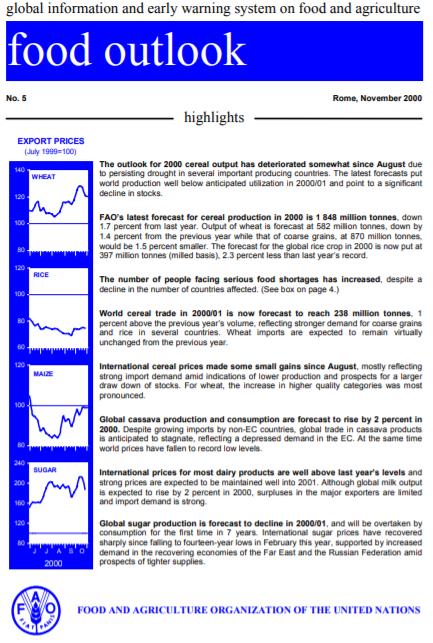

Food Outlook - November 2000

03/11/2000

The outlook for 2000 cereal output has deteriorated somewhat since August due to persisting drought in several important producing countries. The latest forecasts put world production well below anticipated utilization in 2000/01 and point to a significant decline in stocks. FAO’s latest forecast for cereal production in 2000 is 1 848 million tonnes, down 1.7 percent from last year. Output of wheat is forecast at 582 million tonnes, down by 1.4 percent from the previous year while that of coarse grains, at 870 million tonnes, would be 1.5 percent smaller. The forecast for the global rice crop in 2000 is now put at 397 million tonnes (milled basis), 2.3 percent less than last year’s record. The number of people facing serious food shortages has increased, despite a decline in the number of countries affected. World cereal trade in 2000/01 is now forecast to reach 238 million tonnes, 1 percent above the previous year’s volume, reflecting stronger demand for coarse grains and rice in several countries. Wheat imports are expected to remain virtually unchanged from the previous year. International cereal prices made some small gains since August, mostly reflecting strong import demand amid indications of lower production and prospects for a larger draw down of stocks. For wheat, the increase in higher quality categories was most pronounced. Global cassava production and consumption are forecast to rise by 2 percent in 2000. Despite growing imports by non-EC countries, global trade in cassava products is anticipated to stagnate, reflecting a depressed demand in the EC. At the same time world prices have fallen to record low levels. International prices for most dairy products are well above last year’s levels and strong prices are expected to be maintained well into 2001. Although global milk output is expected to rise by 2 percent in 2000, surpluses in the major exporters are limited and import demand is strong. Global sugar production is forecast to decline in 2000/01, and will be overtaken by consumption for the first time in 7 years. International sugar prices have recovered sharply since falling to fourteen-year lows in February this year, supported by increased demand in the recovering economies of the Far East and the Russian Federation amid prospects of tighter supplies.

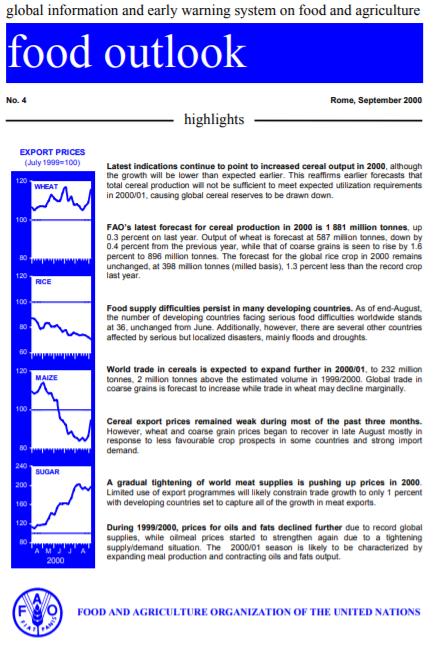

Food Outlook - September 2000

04/09/2000

Latest indications continue to point to increased cereal output in 2000, although the growth will be lower than expected earlier. This reaffirms earlier forecasts that total cereal production will not be sufficient to meet expected utilization requirements in 2000/01, causing global cereal reserves to be drawn down. FAO’s latest forecast for cereal production in 2000 is 1 881 million tonnes, up 0.3 percent on last year. Output of wheat is forecast at 587 million tonnes, down by 0.4 percent from the previous year, while that of coarse grains is seen to rise by 1.6 percent to 896 million tonnes. The forecast for the global rice crop in 2000 remains unchanged, at 398 million tonnes (milled basis), 1.3 percent less than the record crop last year. Food supply difficulties persist in many developing countries. As of end-August, the number of developing countries facing serious food difficulties worldwide stands at 36, unchanged from June. Additionally, however, there are several other countries affected by serious but localized disasters, mainly floods and droughts. World trade in cereals is expected to expand further in 2000/01, to 232 million tonnes, 2 million tonnes above the estimated volume in 1999/2000. Global trade in coarse grains is forecast to increase while trade in wheat may decline marginally. Cereal export prices remained weak during most of the past three months. However, wheat and coarse grain prices began to recover in late August mostly in response to less favourable crop prospects in some countries and strong import demand. A gradual tightening of world meat supplies is pushing up prices in 2000. Limited use of export programmes will likely constrain trade growth to only 1 percent with developing countries set to capture all of the growth in meat exports. During 1999/2000, prices for oils and fats declined further due to record global supplies, while oilmeal prices started to strengthen again due to a tightening supply/demand situation. The 2000/01 season is likely to be characterized by expanding meal production and contracting oils and fats output.

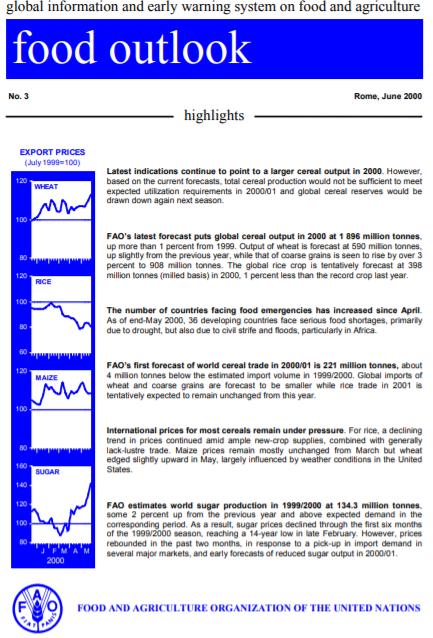

Food Outlook - June 2000

05/06/2000

Latest indications continue to point to a larger cereal output in 2000. However, based on the current forecasts, total cereal production would not be sufficient to meet expected utilization requirements in 2000/01 and global cereal reserves would be drawn down again next season. FAO’s latest forecast puts global cereal output in 2000 at 1 896 million tonnes, up more than 1 percent from 1999. Output of wheat is forecast at 590 million tonnes, up slightly from the previous year, while that of coarse grains is seen to rise by over 3 percent to 908 million tonnes. The global rice crop is tentatively forecast at 398 million tonnes (milled basis) in 2000, 1 percent less than the record crop last year. The number of countries facing food emergencies has increased since April. As of end-May 2000, 36 developing countries face serious food shortages, primarily due to drought, but also due to civil strife and floods, particularly in Africa. FAO’s first forecast of world cereal trade in 2000/01 is 221 million tonnes, about 4 million tonnes below the estimated import volume in 1999/2000. Global imports of wheat and coarse grains are forecast to be smaller while rice trade in 2001 is tentatively expected to remain unchanged from this year. International prices for most cereals remain under pressure. For rice, a declining trend in prices continued amid ample new-crop supplies, combined with generally lack-lustre trade. Maize prices remain mostly unchanged from March but wheat edged slightly upward in May, largely influenced by weather conditions in the United States. FAO estimates world sugar production in 1999/2000 at 134.3 million tonnes, some 2 percent up from the previous year and above expected demand in the corresponding period. As a result, sugar prices declined through the first six months of the 1999/2000 season, reaching a 14-year low in late February. However, prices rebounded in the past two months, in response to a pick-up in import demand in several major markets, and early forecasts of reduced sugar output in 2000/01.