Medium-term Outlook: Prospects for global production and trade in bananas and tropical fruits 2019 to 2028

02/03/2020

Medium-term Outlook: Prospects for global production and trade in bananas and tropical fruits 2019. Bananas and, particularly, tropical fruits constitute a significant source of economic growth, income, food security and nutrition for the rural areas of many developing countries.

Special Report – 2019 FAO Crop and Food Supply Assessment Mission to the Sudan

28/02/2020

Between 24 November and 14 December 2019, assisted by the Food and Agriculture Organization of the United Nations (FAO) and other partners, the Ministry of Agriculture and Natural Resources (MoANR) carried out its annual Assessment Mission to determine crop production and food supply situation throughout the 18 states of the country. The Mission consisted of six core teams comprising members from the MoANR, the Food Security Technical Secretariat (FSTS) of the MoANR, the Ministry of Animal Resources and Fisheries (MoARF), the Humanitarian Aid Commission (HAC), the Strategic Reserve Corporation (SRC), FAO, FEWS NET, WFP and USAID.

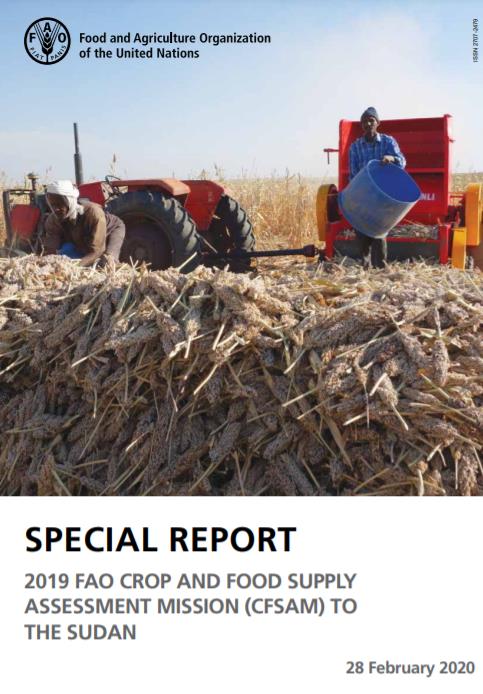

Oilseeds, Oils and Meals. Monthly Price and Policy Update No.127, February, 2020

12/02/2020

In January, FAO’s price indices tracking the oilcrops complex continued to rise. The oilseeds and oilmeals indices increased for the second consecutive month, gaining, respectively, 5.0 and 4.2 points (or 3.4 and 2.7 percent). While the oilseeds index climbed to the highest level since May 2018, the index for oilmeals remained below the value observed in the corresponding month of last year. As for vegetable oils, the price index rose for the seventh month in succession,posting a month-on-month gain of 11.6 points(or 7.0 percent) and marking a three-year high.

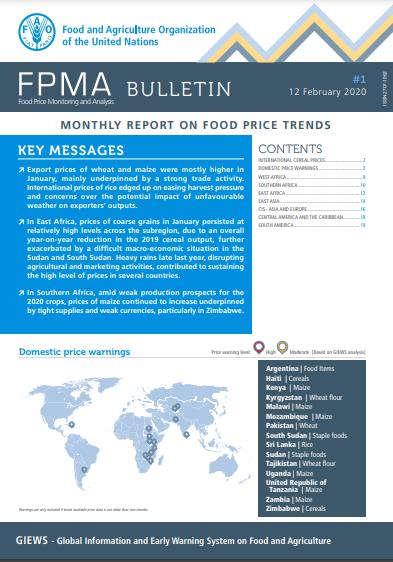

Food Price Monitoring and Analysis (FPMA) Bulletin # 1, 12 February 2020

12/02/2020

Export prices of wheat and maize were mostly higher in January, mainly underpinned by a strong trade activity. International prices of rice edged up on easing harvest pressure and concerns over the potential impact of unfavourable weather on exporters’ outputs. In East Africa, prices of coarse grains in January persisted at relatively high levels across the subregion, due to an overall year-on-year reduction in the 2019 cereal output, further exacerbated by a difficult macro-economic situation in the Sudan and South Sudan. Heavy rains late last year, disrupting agricultural and marketing activities, contributed to sustaining the high level of prices in several countries. In Southern Africa, amid weak production prospects for the 2020 crops, prices of maize continued to increase underpinned by tight supplies and weak currencies, particularly in Zimbabwe.

Medium-term Outlook

05/02/2020

Medium-term Outlook: Prospects for global production and trade in bananas and tropical fruits 2019. Bananas and, particularly, tropical fruits constitute a significant source of economic growth, income, food security and nutrition for the rural areas of many developing countries. The projections for bananas and tropical fruits presented in this medium-term outlook span a ten year horizon, from 2019 to 2028.

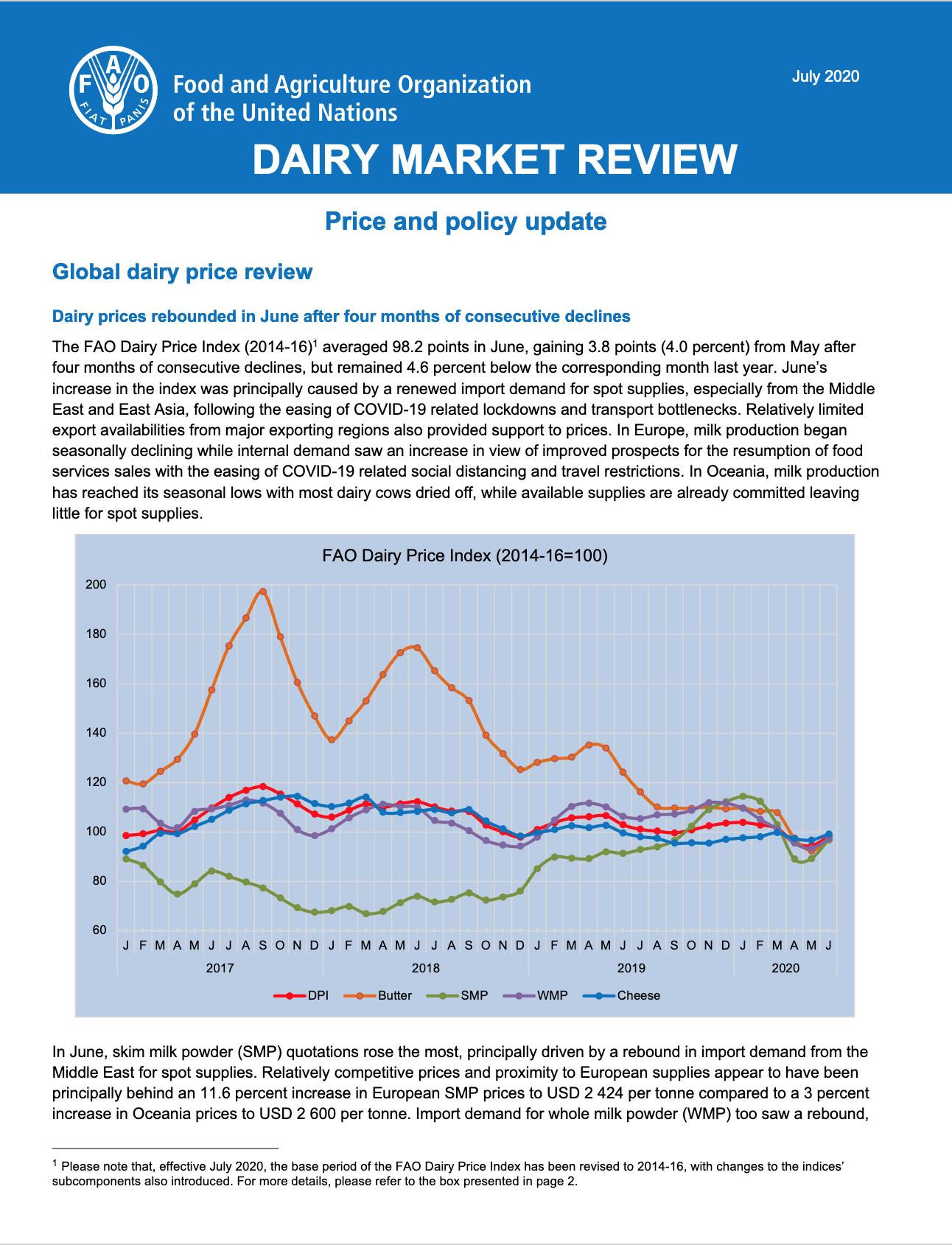

Dairy market review: Price and policy update - July 2020

03/02/2020

International dairy prices in June, measured by the FAO Dairy Price Index, were down by 5.7 points (5.4 percent) from January 2020, with skim milk powder (SMP) registering the sharpest fall (-15.3 percent), followed by butter (11.8 percent), whole milk powder (WMP) (-11.2 percent), while cheese prices rose (+1.6 percent).

Improved Post-Harvest Handling and Processing Techniques for Value Addition of Cashew Nuts and Coffee in the Chittagong Hill Tracts - TCP/BGD/3609

01/02/2020

Processing and value chain development of vegetables, fruits, fish and livestock products using appropriate technologies promoted through introduction of farmers group marketing practices.

GIEWS Special Alert No. 347 - East Africa, 29 January 2020

29/01/2020

The worst desert locust outbreak in 25 years has caused significant pasture losses across East Africa, mainly in agro-pastoral areas of eastern Ethiopia, central Somalia and northern Kenya. As sustained locust reproduction is expected until June 2020, the outbreak has a high probability to spread to southern Ethiopia, southern Somalia, northeastern Uganda and South Sudan. Immediate upscaling of aerial control measures is urgently needed to mitigate crop and pasture losses and to avoid a sharp deterioration of the food security situation.

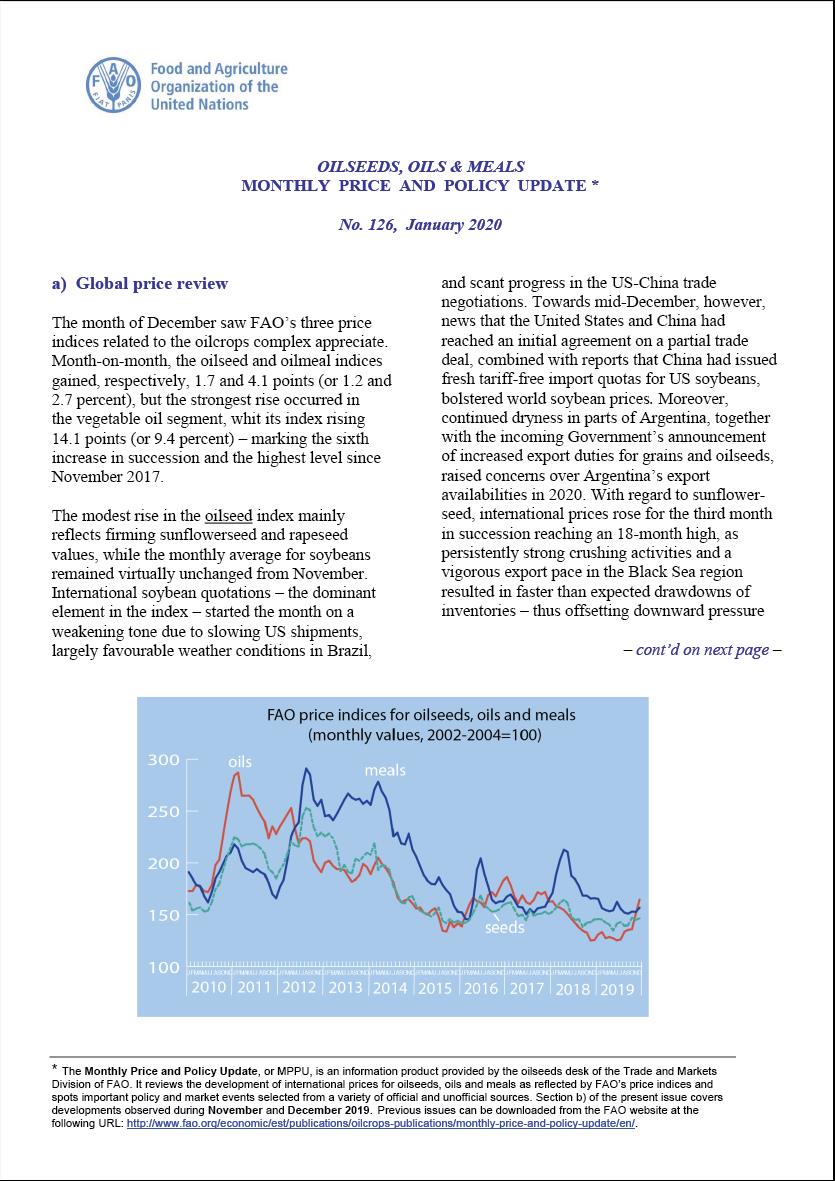

Oilseeds, Oils and Meals. Monthly Price and Policy Update No.126, January, 2020

15/01/2020

The month of December saw FAO’s three price indices related to the oilcrops complex appreciate. Month-on-month, the oilseed and oilmeal indices gained, respectively, 1.7 and 4.1 points (or 1.2 and 2.7 percent), but the strongest rise occurred in the vegetable oil segment, whit its index rising 14.1 points (or 9.4 percent) –marking the sixth increase in succession and the highest level since November 2017.

Banana Market Review 2019

09/01/2020

A comprehensive analysis of production, trade, and prices of bananas.

Banana Statistical Compendium 2019

07/01/2020

The Banana Statistical compendium, issued once a year, contains information on global banana trade. Its sources include information provided by FAO member nations, traders, news bulletins and the opinions of commodity specialists and represents the most authoritative and up-to-date source of information on the world banana economy.

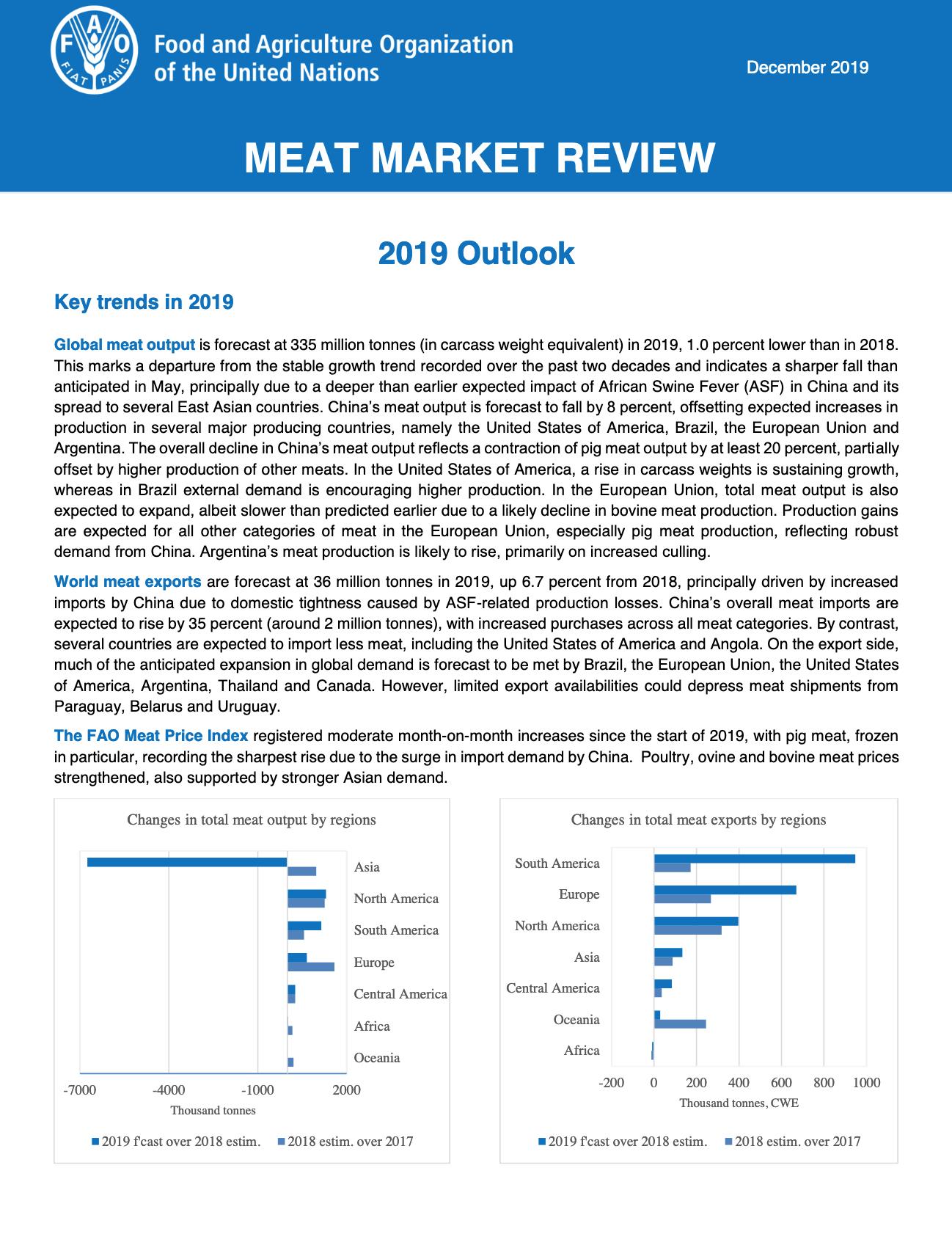

Meat Market Review: 2019 Outlook, December 2019

20/12/2019

Global meat output is forecast at 335 million tonnes (in carcass weight equivalent) in 2019, 1 percent lower than in 2018. This marks a departure from the stable growth trend recorded over the past two decades and indicates a sharper fall than anticipated in May, principally due to a deeper than earlier expected impact of African Swine Fever (ASF) in China and its spread to several East Asian countries. World meat exports is forecast at 36 million tonnes in 2019, up 6.7 percent from 2018, principally driven by increased imports by China due to domestic tightness caused by ASF-related production losses. The FAO Meat Price Index measured by the FAO Meat Price Index, have continued to register moderate month-on-month increases since the start of 2019, with pig meat, frozen in particular, recording the sharpest rise due to the surge in import demand by China. Poultry, ovine and bovine meat prices strengthened, also supported by stronger Asian demand.

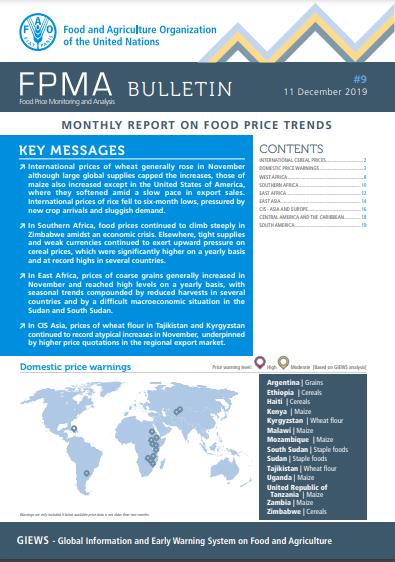

Food Price Monitoring and Analysis (FPMA) Bulletin #9, 11 December 2019

11/12/2019

International prices of wheat generally rose in November although large global supplies capped the increases, those of maize also increased except in the United States of America, where they softened amid a slow pace in export sales. International prices of rice fell to six-month lows, pressured by new crop arrivals and sluggish demand. In Southern Africa, food prices continued to climb steeply in Zimbabwe amidst an economic crisis. Elsewhere, tight supplies and weak currencies continued to exert upward pressure on cereal prices, which were significantly higher on a yearly basis and at record highs in several countries. In East Africa, prices of coarse grains generally increased in November and reached high levels on a yearly basis, with seasonal trends compounded by reduced harvests in several countries and by a difficult macroeconomic situation in the Sudan and South Sudan. In CIS Asia, prices of wheat flour in Tajikistan and Kyrgyzstan continued to record atypical increases in November, underpinned by higher price quotations in the regional export market.

Oilcrops complex: policy changes and industry measures - Annual compendium - 2018

09/12/2019

The 2018 compendium offers an overview of salient government policies and related private sector measures concerning global and national markets for oilcrops and derived products. Its purpose is to facilitate the work of policy makers, market experts, analysts and other interested stakeholders by providing a short, concise, overview of policy developments relevant to the sector. Detailed news items are presented in tabular form (in English only), preceeded by a breief discussion of teh key policy trends observed in the year under review.

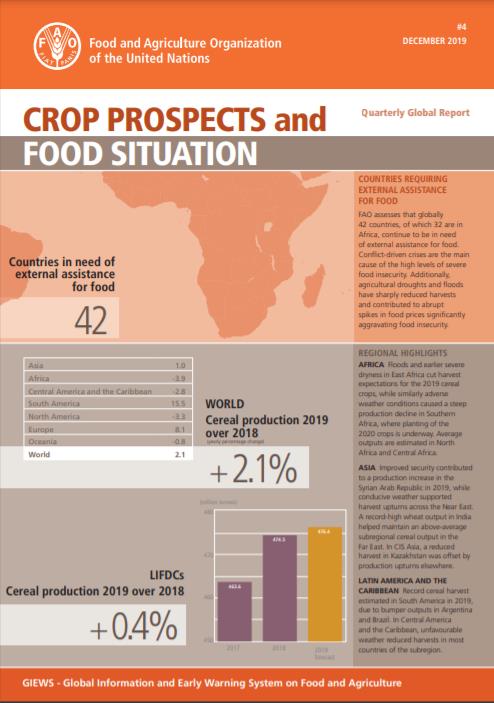

Crop Prospects and Food Situation - Quarterly Global Report, No. 4, December 2019

05/12/2019

FAO assesses that globally 42 countries, of which 32 are in Africa, continue to be in need of external assistance for food. Conflict‑driven crises are the main cause of the high levels of severe food insecurity. Additionally, agricultural droughts and floods have sharply reduced harvests and contributed to abrupt spikes in food prices significantly aggravating food insecurity.

Food Outlook - November 2019

12/11/2019

From a global perspective, food commodity markets in 2019/20 should continue to be generally well supplied, with international prices remaining below their recent peaks. However, a fast changing trade environment along with the outbreaks of important animal and plant diseases could pose challenges for global market stability.

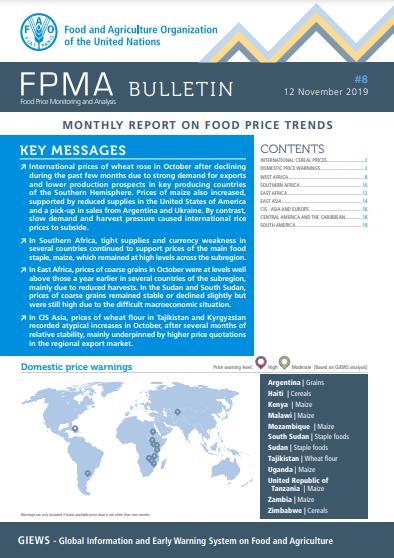

Food Price Monitoring and Analysis (FPMA) Bulletin #8, 12 November 2019

12/11/2019

International prices of wheat rose in October after declining during the past few months due to strong demand for exports and lower production prospects in key producing countries of the Southern Hemisphere. Prices of maize also increased, supported by reduced supplies in the United States of America and a pick-up in sales from Argentina and Ukraine. By contrast, slow demand and harvest pressure caused international rice prices to subside. In Southern Africa, tight supplies and currency weakness in several countries continued to support prices of the main food staple, maize, which remained at high levels across the subregion. In East Africa, prices of coarse grains in October were at levels well above those a year earlier in several countries of the subregion, mainly due to reduced harvests. In the Sudan and South Sudan, prices of coarse grains remained stable or declined slightly but were still high due to the difficult macroeconomic situation. In CIS Asia, prices of wheat flour in Tajikistan and Kyrgyzstan recorded atypical increases in October, after several months of relative stability, mainly underpinned by higher price quotations in the regional export market.

GIEWS Update - Argentina, 24 October 2019

24/10/2019

The Government declares the food emergency law until 2022, as the upsurge of food prices is severely constraining access to food. Despite the expected record cereal production in 2019, prices continue to increase mainly due to the sharp weakening of the local currency and soaring inflation rate.